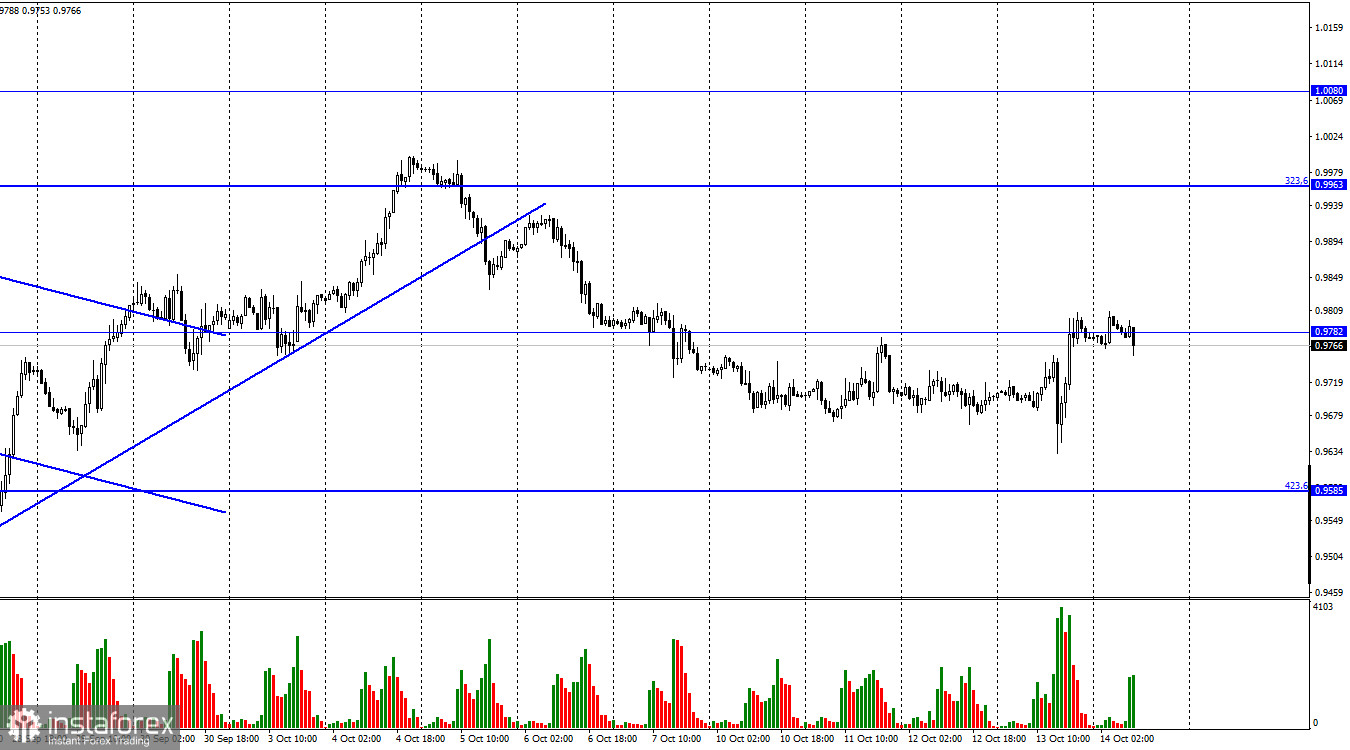

The EUR/USD pair traded horizontally again on Thursday for most of the day. However, by the end of the day, it still performed a reversal in favor of the European currency and rose to the level of 0.9782. The rebound of quotes from this level will favor the US dollar and the resumption of the fall toward the corrective level of 423.6% (0.9585). The consolidation of quotes above 0.9782 will increase the chances of further growth of the euro in the direction of the Fibo level of 323.6% (0.9963).

Yesterday was interesting to traders only because of one event—inflation in the United States. As it turned out, the consumer price index fell from 8.3% to 8.2% y/y, but at the same time, core inflation (which, according to rumors, is of priority importance for the Fed) increased from 6.3% to 6.6% y/y. Thus, we get a lot of food for thought. Let's try to figure it out.

If the main inflation has fallen, this is positive for the US economy and negative for the dollar because the Fed may move earlier to curtail the rate hike program. But inflation fell very slightly, by only 0.1% in September, so such a decline can be called a "margin of error." The Fed will not react to such a slowdown and will continue to raise the rate as planned.

The main inflation has decreased, but the basic one has increased. As a result, the Fed now has even more reasons to raise interest rates aggressively. It turns out that both CPI indicators can be considered negative for the American economy and positive for the dollar. If these reports came out right now, I would be waiting for a new fall in the euro/dollar pair. However, the pair grew, although it fell in the first hour after the report's release. This may mean that traders are no longer ready to sell at the current values of the pair, but at the same time, these values are low enough that traders do not doubt that the "bearish" market persists. I believe that yesterday's growth of the euro was an accident.

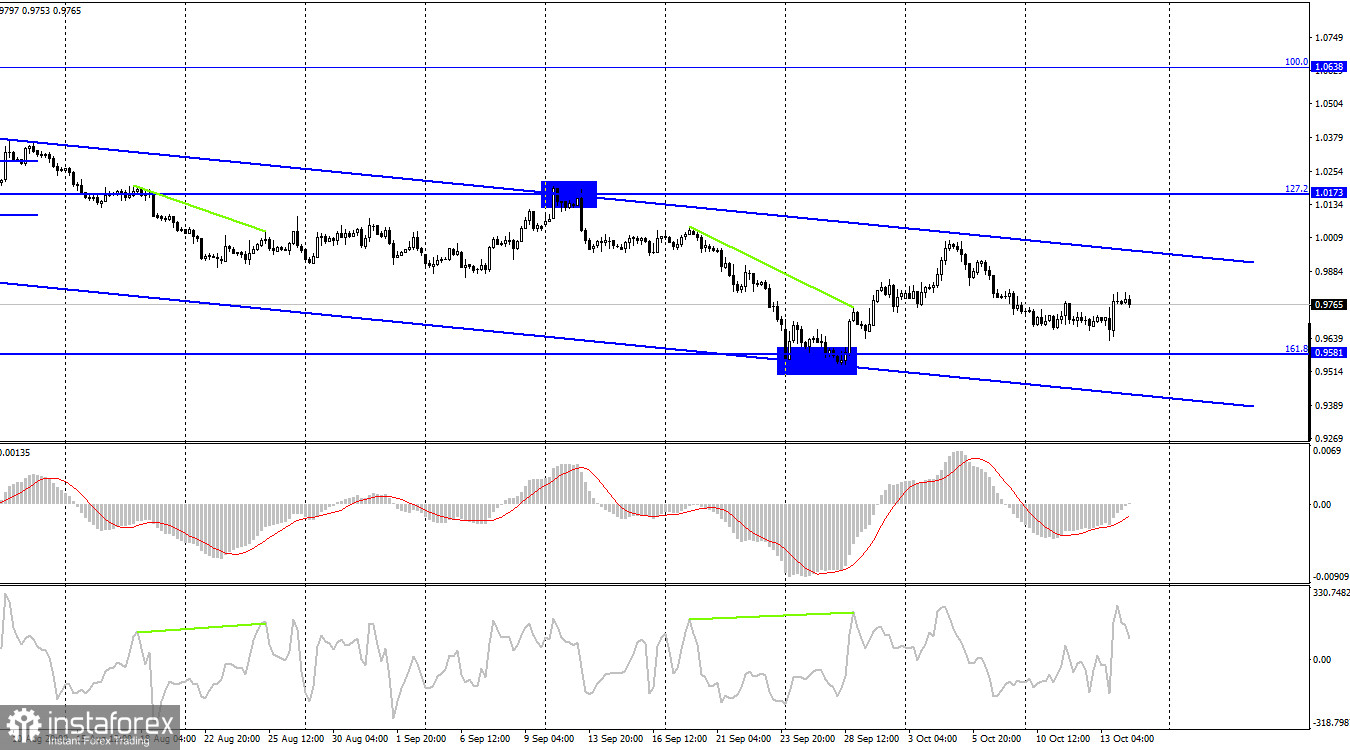

On the 4-hour chart, the pair continues to fall toward the Fibo level of 161.8% (0.9581) and within the descending trend corridor. Thus, the mood of traders on this chart remains "bearish" without any questions. Only consolidation above the descending corridor will allow us to count on a tangible growth of the euro currency in the direction of the corrective level of 127.2% (1.0173).

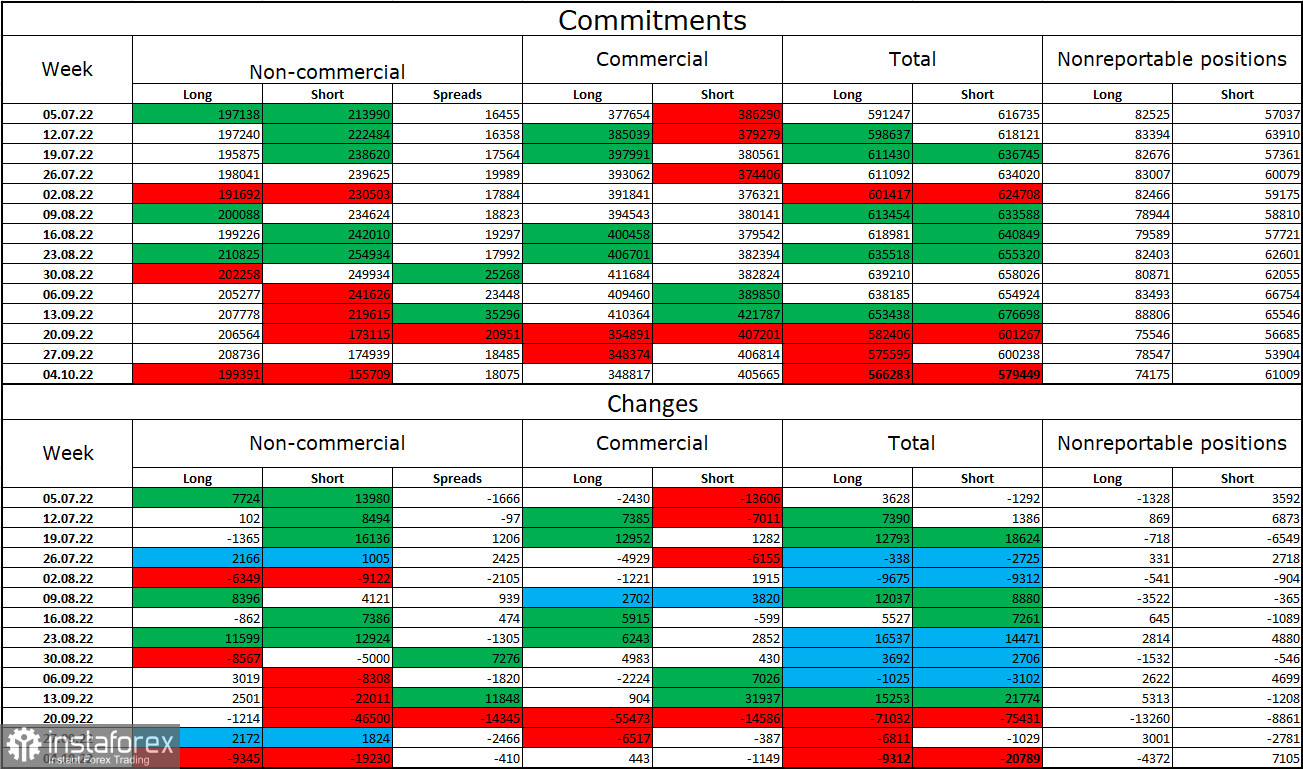

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 9,345 long contracts and 19,230 short contracts. This means that the mood of large traders has become even more "bullish" than before. The total number of long contracts concentrated in the hands of speculators is now 199 thousand, and short contracts – 155 thousand. However, the euro currency is still experiencing serious problems with growth. In the last few weeks, the chances of the euro's growth have been increasing, but traders are more actively buying up the dollar than the euro. Therefore, I would now bet on an important descending corridor on the 4-hour chart, over which it was impossible to close. I also recommend that you carefully monitor the news of geopolitics, as it greatly affects the mood of traders.

News calendar for the USA and the European Union:

USA - retail sales volume (12:30 UTC).

USA - consumer sentiment index from the University of Michigan (14:00 UTC).

On October 14, the calendar of economic events in the European Union is empty, and not the most important data will be released in the USA. The influence of the information background on the mood of traders today may be quite weak.

EUR/USD forecast and recommendations to traders:

I recommend new sales of the pair when rebounding from the upper line of the corridor on the 4-hour chart or rebounding from the 0.9782 level on the hourly chart with a target of 0.9585. I recommend buying the euro currency when fixing quotes above the upper line of the corridor on a 4-hour chart with a target of 1.0638.