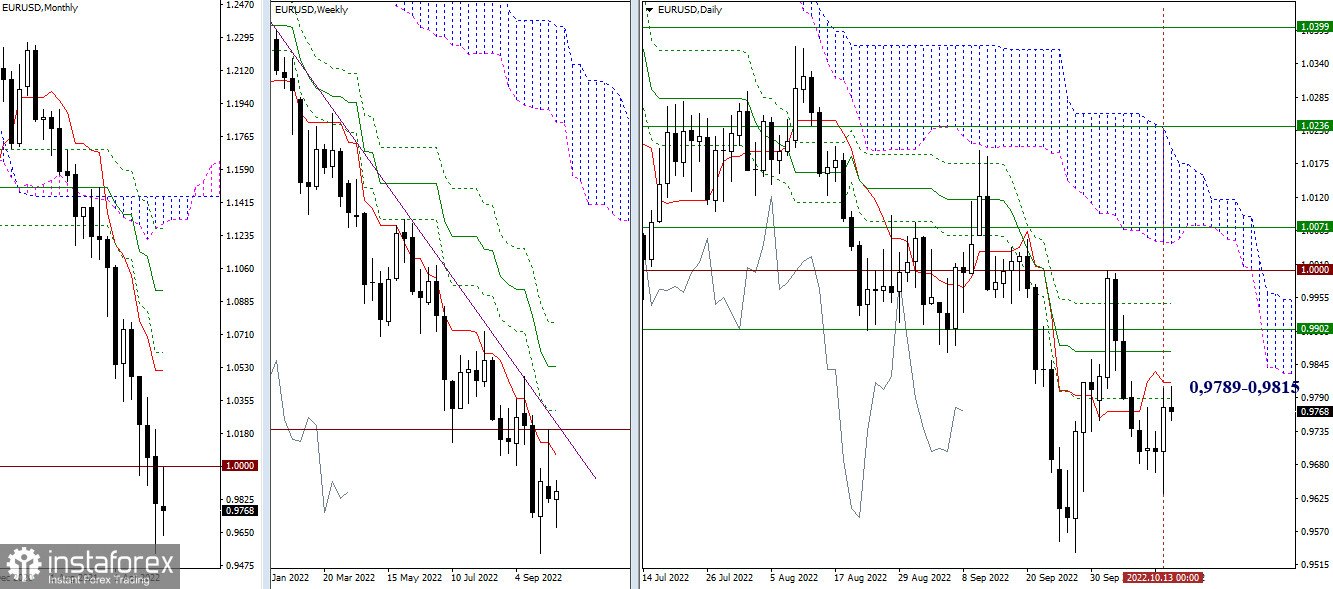

EUR/USD

Higher timeframes

The bulls tried to seize the initiative yesterday. As of writing, resistance is provided by the levels of the daily cross 0.9789 - 0.9815. In the case of further rise, daily and weekly boundaries of 0.9867 - 0.9902 - 0.9945, as well as the 1.0000 psychological level, may matter. The main bearish benchmark in this area remains important today, located at 0.9536 (low).

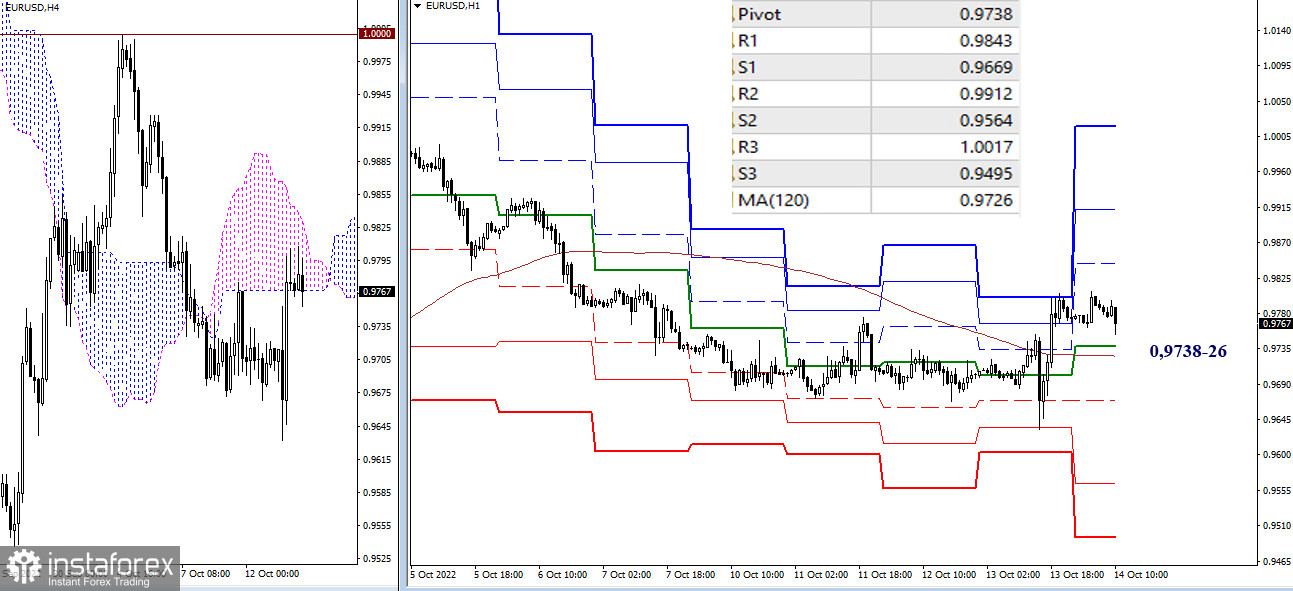

H4 – H1

By now, bulls have already managed to consolidate above the key levels that form support today, consolidating their efforts in the area of 0.9738–26 (central pivot point + weekly long-term trend). The classic pivot points (0.9843 – 0.9912 – 1.0017) are the next upward benchmarks within the day. In case of a new change of priorities, the relevance will return to the support of the classic pivot points (0.9669 – 0.9564 – 0.9495).

***

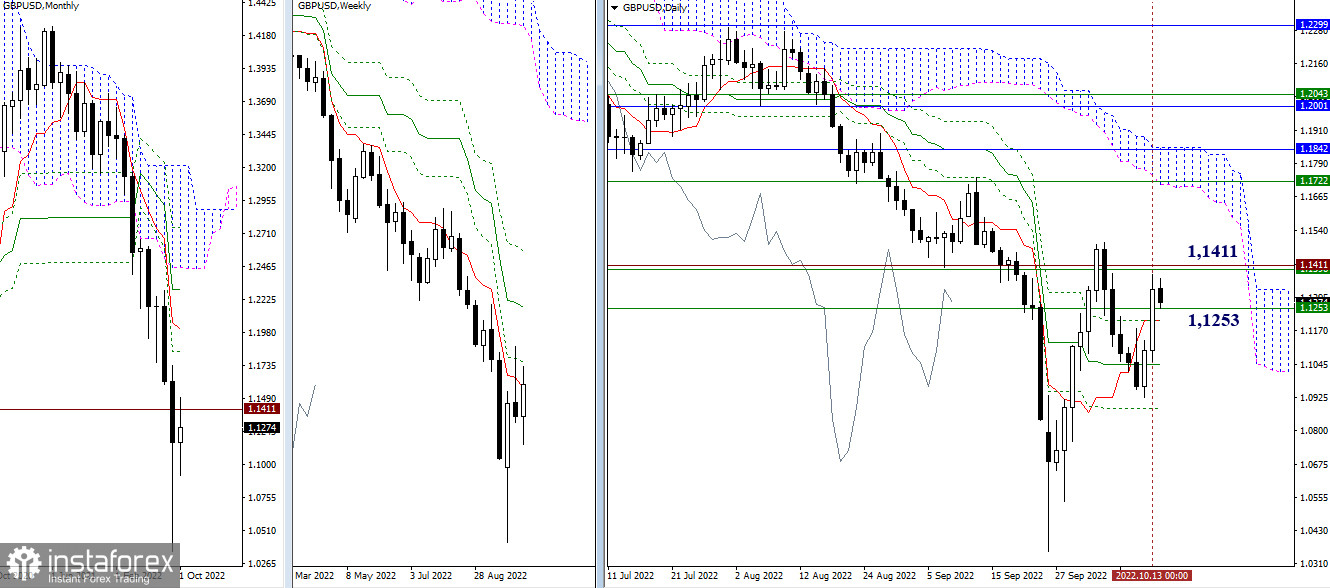

GBP/USD

Higher timeframes

Bulls returned to the zone of the main resistances of this section and started testing them again. Based on the result of interaction with the encountered resistance zone 1.1253 - 1.1411 (weekly short-term trend + weekly Fibo Kijun + historical level), further development of the situation will be determined. If the bulls win, their next benchmarks will be the daily cloud and the levels of higher timeframes that reinforce it (1.1722 – 1.1842). If the initiative returns to the bears and they manage to go beyond the supports of the daily cross (1.1209 – 1.1046 – 1.0883), then attention will be directed to the high at 1.0355.

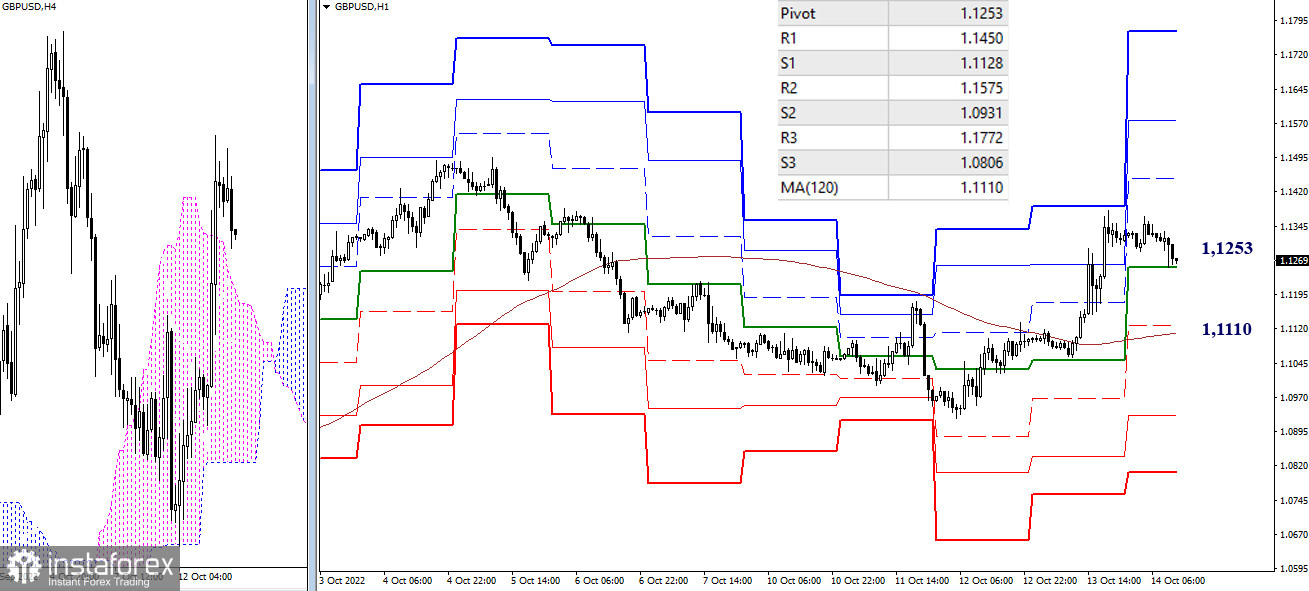

H4 – H1

In the lower timeframes, the bulls have taken over the support of key levels. As of writing, 1.1253 (central pivot point) is being tested, and then 1.1110 (weekly long-term trend) will have the greatest value for maintaining the bullish advantage. Additional downward benchmarks, in case of a bearish scenario, are 1.0931 - 1.0806 (support for the classic pivot points). If the bulls end the decline and work out the upward trend, then they will face such important milestones as the resistance of the classic pivot points, which today are located at 1.1450 - 1.1575 - 1.1772.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)