Inflationary expectations, which disappointed not only the markets, but also the Federal Reserve, helped put everything in its place, restoring justice. The dollar is rising again, while the euro and the pound went down after an artificial recovery.

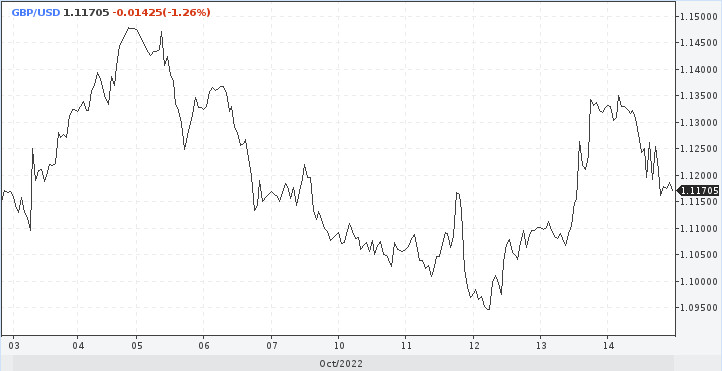

Earlier, the pound rose to its highest level in a week against the dollar amid reports that the British government plans to cancel part or all of its mini-budget. The happiness of the pound traders did not last long. In principle, such an outcome was clear from the outset.

The conductor of the markets is the dollar. A short-term correction amid an illogical surge in risk appetite amid accelerating inflation in the US is no reason for a market reversal. Investors once again had to concentrate on the main problem. If the market does its best to ignore the existence of any problems, they will not disappear on their own.

Therefore, market players once again had to convince themselves that the Fed will continue to raise rates at an accelerated pace until the end of the year. Without additional help, of course, it was not possible. Another portion of the data was a cold shower and returned investors from heaven to earth.

Inflation expectations for the current month have risen in both the short and medium term this month. This is likely to disappoint the Fed, which is working hard to combat inflationary pressures.

"The average expected inflation rate for the year ahead has risen to 5.1%," the University of Michigan said in a report.

"Long-term inflation expectations fell below a narrow range of 2.9-3.1% for the first time since July 2021. However, expectations have since returned to that range at 2.9%. After three months of waiting for a slight increase in gas prices next year, both short-term and long-term expectations have recovered.

Inflationary expectations are closely monitored by the Fed and the central bank has repeatedly emphasized this, calling them the key factors influencing the interest rate forecast. Many politicians believe that expectations of price changes can be self-fulfilling.

Thus, the dollar has regained its status and upward trend. The GBP/USD pair came under pressure again.

The growth of inflationary expectations is most likely a reaction to the increase in gas prices. If this is true, then the growth of these expectations will continue in the future, economists say.

However, a preliminary value was released on Friday, which can be adjusted by as much as plus or minus 0.2 percentage points. There is hope, but doubts do not leave.

"Following the September inflation data, this rebound, reversing last month's fall, doesn't look very good given how closely policymakers seem to be tracking the figure," Pantheon Macroeconomics said.

Now almost all economists are waiting for the members of the Federal Open Market Committee to vote for a 75 bps rate hike for the fourth time. The central bank has no choice but to continue following the rate path outlined by the September forecasts.

"We are now more confident that the Fed will continue to raise rates faster through the end of this year," MUFG said in a statement.

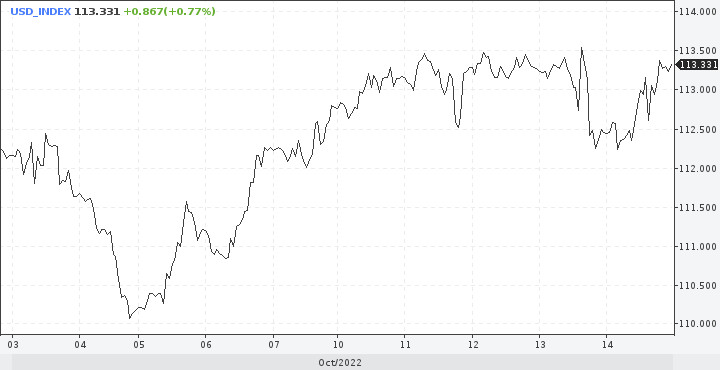

US monetary policy has been a significant driver of the dollar's rise against other major currencies, including the pound. Now a hawkish revaluation of rates and increased fears of a hard landing in the global economy will support the outlook for an even stronger dollar.

By the end of the trading week, the greenback has noticeably moved forward. Judging by its movement dynamics, it intends to regain the area beyond 113.00.

If bulls manage to cleanly work out this scenario, then the index will most likely overcome 114.00. The next target will be the 2002 high at 114.78 and then the round 115.00.

As for the pound, its hard times did not come today or yesterday, but much earlier. But the sterling is trying in every possible way to be stubborn and does not recognize a completely obvious reality. And the reality is that the GBP/USD pair will have to go to around 1.0600. Expectations of a more cautious fiscal stance by the British authorities inspired some optimists this week, but the outlook for the pound remains fragile.