Long-term perspective.

The GBP/USD currency pair showed an increase of 100 points during the current week, but it still ended two days out of five in a serious minus. A few weeks ago, the price was fixed above the critical line, and this week – first lower, and then higher again. As a result, it continues to be located just above Kijun-sen, which preserves certain chances for a new upward trend. However, at the same time, after the turn of the upward movement by 1100 points, which happened immediately after the next drop of 1000 points, the pound did not show anything special. Recall that the last "flights" of the pound were associated with the tax initiatives of Liz Truss and Kwasi Kwarteng, the latter of whom has already been dismissed. Clouds are also "gathering" over Liz Truss herself. She is accused of a large-scale depreciation of the British currency as well as a sharp drop in demand for Treasury bonds. Some of the tax initiatives have already been removed from the current "plan", but the market is still in a state of shock. The Bank of England has tried to stabilize the debt market, but we cannot say that it has succeeded well. Thus, the fundamental background for the British pound is now expressed not only by the process of tightening the Fed's monetary policy (traders still pay much less attention to the Bank of England) but also by problems with the financial market in the UK and another political crisis, which may end with a vote of no confidence. Therefore, the pound might be happy to grow, but most factors, including geopolitics, remain on the side of the US dollar. On Thursday, the US inflation report also had a bombshell effect on the market. The US dollar first rose sharply, then fell heavily, and on Friday it rose again. Traders have been working out a slowdown in inflation by 0.1% in annual terms for more than a day. And the 0.1% decline itself means that the Fed is simply obliged to raise the rate very aggressively because inflation has already shown that it will not slow down without support in the form of tightening monetary policy.

COT analysis.

The latest COT report on the British pound showed a new weakening of the "bearish" mood. During the week, the non-commercial group opened 6,900 buy contracts and closed 3,400 sell contracts. Thus, the net position of non-commercial traders increased by 10.3 thousand, which is quite a lot for the pound. It could be assumed that the actions of major players and the movement of the pound have finally begun to coincide since the pound has grown over the last period of net position growth. However, we are worried that this may once again be a "false alarm." The net position indicator has been growing slightly in recent weeks, but this is not the first time it has been growing, the mood of major players remains "pronounced bearish," and the pound sterling continues to fall in the medium term. And, if we recall the situation with the euro, there are serious doubts that, based on COT reports, we can expect the pair to grow significantly. How can you count on it if the market buys the dollar more than the pound? The non-commercial group has now opened a total of 88 thousand sales contracts and 49 thousand purchase contracts. The difference, as we can see, is still very big. The euro cannot show growth in the "bullish" mood of major players, and the pound will suddenly be able to grow in a "bearish" mood. We remain skeptical about the long-term growth of the British currency, although there are certain technical reasons for this.

Analysis of fundamental events.

During the current week, quite a lot of different statistical information has been published in the UK, but at the same time, we cannot conclude that it somehow helped the pound. The unemployment rate dropped to 3.5%, which is good, but at the same time, GDP fell by 0.3% in August, and industrial production lost 1.8%. Well, at the end of the week it became known about the dismissal of British Finance Minister Kwasi Kwarteng, who had spent a little more than a month in his position. Thus, Britain continues to be in a fever, and we believe that the overall fundamental background remains negative for the pound. The American statistics were not much better this week. Retail sales showed zero growth in September, and the consumer sentiment index from the University of Michigan rose slightly. Inflation has decreased by only 0.1%, but this factor just works in favor of the US currency.

Trading plan for the week of October 17–21:

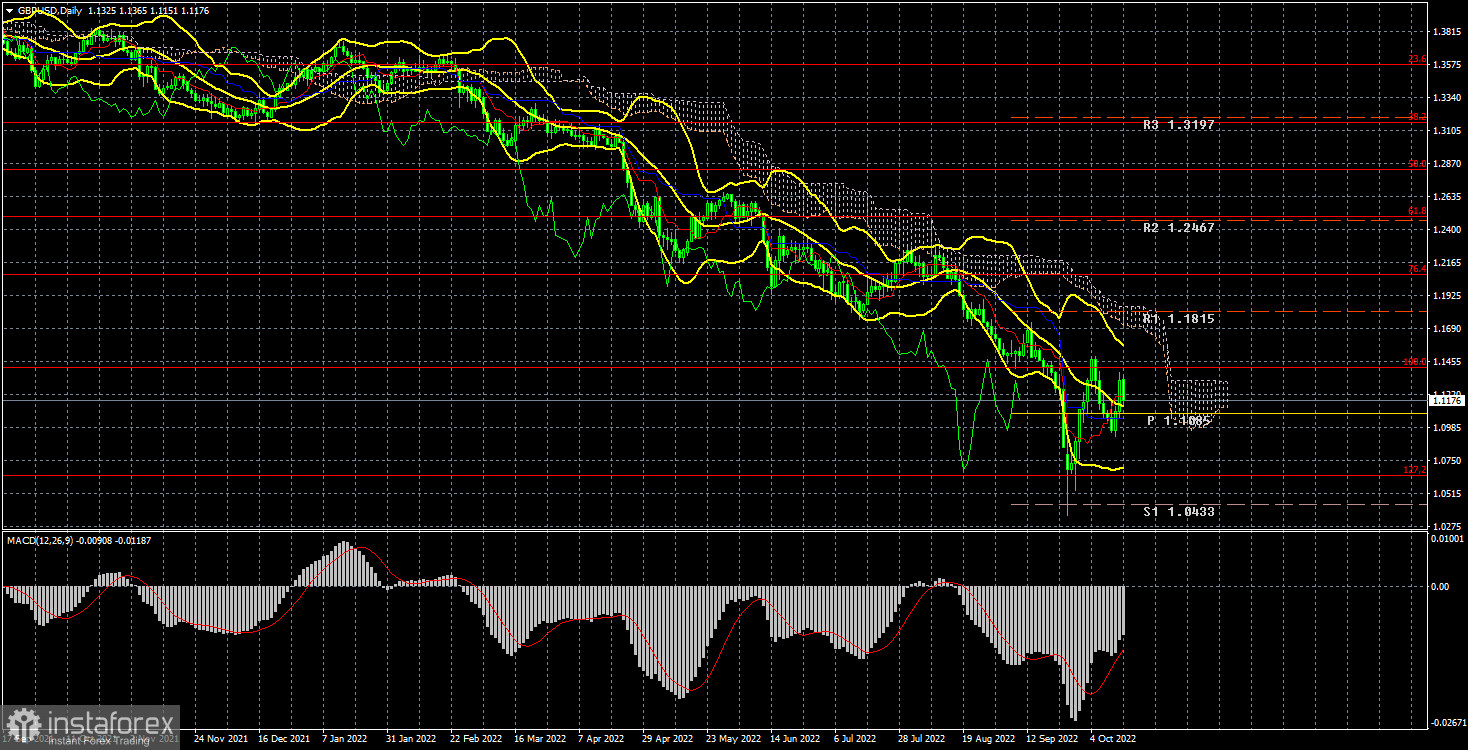

1) The pound/dollar pair as a whole maintains a long-term downward trend but is already located above the critical line. Therefore, small purchases can now be considered as long as the pair is located above the Kijun-sen. The target is the Senkou Span B line, which runs at 1.1843. There are some reasons for the pair's growth, but there are still a lot of reasons for a new fall. Be careful with your purchases.

2) The pound sterling has made a significant step forward but remains in a position where it is quite difficult to wait for strong growth. If the price fixes back below the Kijun-sen line, then the pair's fall can quickly and cheerfully resume with targets in the area of 1.0632–1.0357.

Explanations of the illustrations:

Price levels of support and resistance (resistance/support), Fibonacci levels – target levels when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators(standard settings), Bollinger Bands(standard settings), MACD(5, 34, 5).

Indicator 1 on the COT charts is the net position size of each category of traders.

Indicator 2 on the COT charts is the net position size for the "Non-commercial" group.