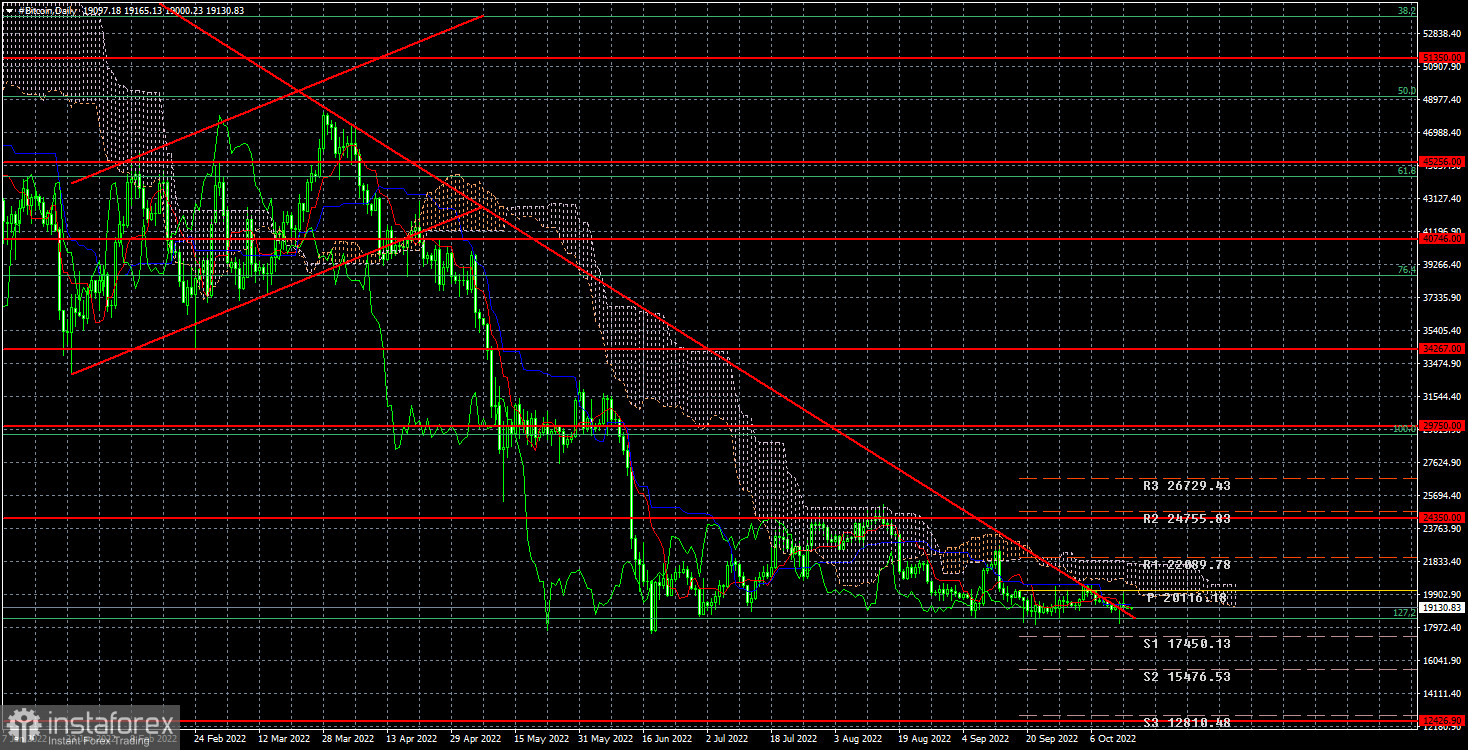

Bitcoin continues to trade almost flat, just above the $18,500 level. Earlier, it at least "jumped" along the entire side channel of $18,500–$24,350; now, for almost a month, it has been moving only along the level of $18,500. As we warned earlier, the price collided with the trend line and overcame it. As you can see, there were no changes like the movement because this signal was formed in a flat and cannot be considered strong. Therefore, at the moment, we have a canceled trend line and a persisting side channel. We still believe that sooner or later, the decline of bitcoin will resume. This is supported by the fact that cryptocurrency has been around its annual lows for a long time, from time to time, trying to overcome them. And the longer the price tries to overcome any level, the higher the probability it will eventually overcome it. We still expect a drop to the level of $12,426.

With the fundamental background, everything was quite modest this week and bad for bitcoin. Several members of the Fed's monetary committee have once again stated that the rate would continue to rise until inflation begins to show a significant slowdown. And inflation in the US is not even considered a significant slowdown. The latest report for September showed that the consumer price index decreased by only 0.1% compared to the previous month, and core inflation increased altogether. Therefore, the Fed has no other option but to raise the key rate by another 0.75% at the next meeting. Moreover, we believe that even this measure may not achieve the desired result.

Is it worth reminding everyone again that any tightening monetary policy is bad for all risky assets? The stock market remains near its lows, and risky currencies – too. The more the Fed tightens monetary policy, the more likely these markets will fall further. And even when the Fed stops raising the rate, a "period of high rates" will begin, during which the rate will remain unchanged. That is, bitcoin will not receive a favorable fundamental background even now. Thus, we believe that the period of cheap bitcoin can last quite a long time.

In the 24-hour timeframe, the quotes of "bitcoin" could not overcome the $ 24,350, but they also could not overcome the $18,500 (127.2% Fibonacci). Thus, we have a side channel, and it is unclear how much time Bitcoin will spend on it. We recommend not rushing to open positions. It is better to wait for the price to exit this channel and only then open the corresponding transactions. Overcoming the $18,500 level will take you to the $12,426 level.