The political crisis in the UK is gaining momentum, which cannot but put pressure on the British pound. After the instrument has moved away from its low by more than 1000 basis points, the British pound is in danger again. But this time, political problems have also been added to the economic problems. On Friday, it became known that British Finance Minister Kwasi Kwarteng was dismissed. He spent only 38 days in his position. The reason for the resignation was the shock in the UK's financial markets caused by tax amendments to the legislation. These amendments have not even been adopted yet, and it is unknown whether they will be adopted. They concerned several tax rates, which, according to the British government, should be lowered to reduce the pressure from rising energy prices on households and businesses. However, the tax reduction plan was criticized by economists, and it immediately became known that its implementation would lead to a huge budget deficit.

Even the conservatives themselves spoke out against this plan, so the Liz Truss government had to urgently make a statement that the plan was still "raw" and needed improvements. It has already become known that the maximum tax rate of 45% will not be canceled, and the proposed changes may also be canceled for other taxes. Since someone had to "take over" responsibility for the shock in the financial and currency markets, most likely, this role was performed by Kwasi Kwarteng, who personally developed this plan. The media noted the importance of this event because Kwarteng was not just the Minister of Finance but also a close friend and colleague of Truss. Former Foreign Minister Jeremy Hunt may become the new finance minister.

However, this is not all the upheaval in Parliament. Yesterday, it became known that Defense Secretary Ben Wallace may resign if Liz Truss reneges on her promise to increase defense spending. Earlier, during the election campaign, Truss promised to increase defense spending to 2.5% of GDP by 2026 and 3% of GDP by 2030. It is reported that this promise prompted Wallace to support the candidacy of Truss and not Rishi Sunak, who refrained from such statements. Jeremy Hunt, who may now take up his new position, has already stated that spending on many items will have to be cut amid the developing recession and the energy crisis in Europe. At this time, there was talk about the possible departure of Wallace, who believed that the defense budget needed to be increased.

It is also reported that NATO recommended that all member countries of the union increase their defense budgets to 2.5% of GDP, and the UK was supposed to be one of the first to do so. The Bank of England somehow restored stability in the financial markets through an emergency program of buying bonds for 65 billion pounds. Still, political problems remain very serious, and the recession and the energy crisis may continue to pressure the pound and the UK economy.

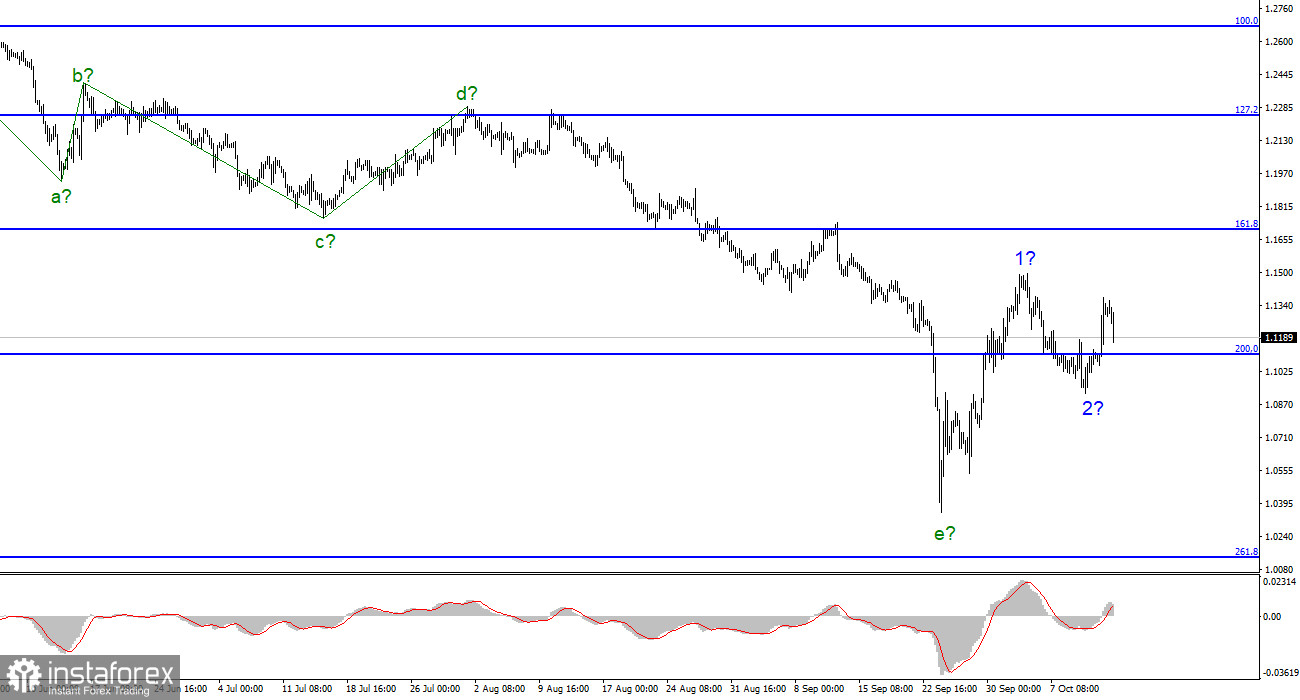

The wave pattern of the pound/dollar instrument implies the construction of a new upward trend segment. Thus, now I advise buying a tool for MACD reversals "up" with targets located above the peak of wave 1. Buy and sell should be careful since it is unclear which wave markings (euro or pound) will require adjustments, and the news background may negatively affect both the euro and the pound. Corrective wave 2 may already be completed.