EUR/USD

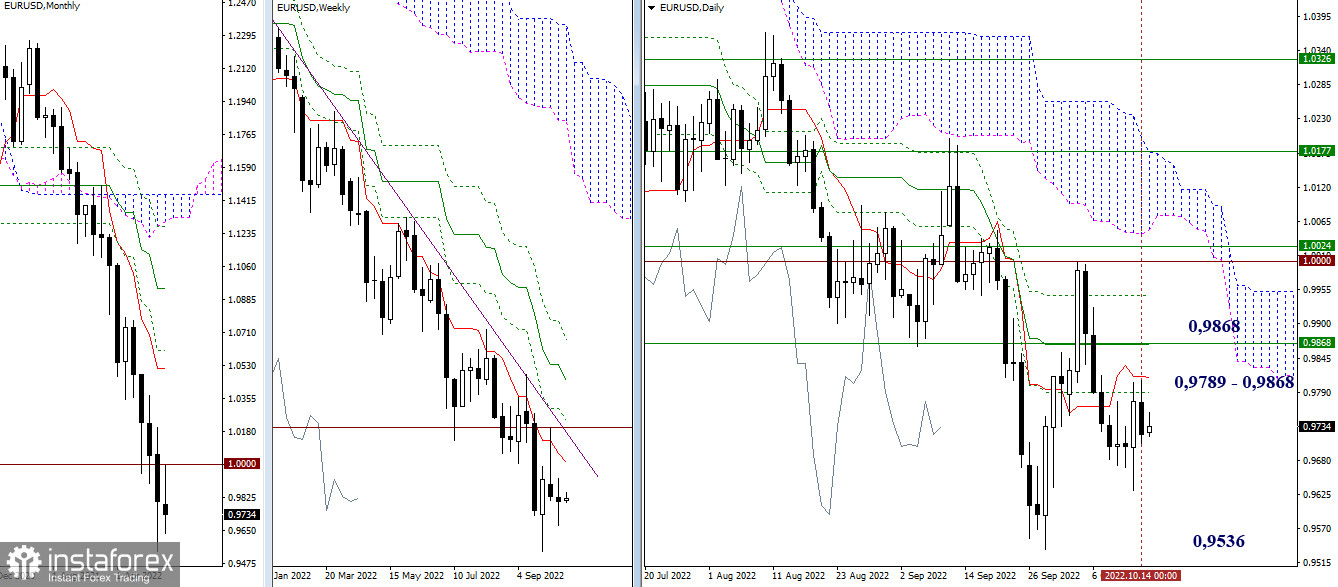

Higher timeframes

There was a slowdown and consolidation in the movement of the pair last week. As a result, there is uncertainty in the weekly candle formed. The nearest benchmarks for bulls today can be noted at 0.9813 – 0.9789 (daily levels) and 0.9868 (daily medium-term trend + weekly short-term trend). For bears, the main focus is still on updating the low (0.9536) and restoring the downward trend.

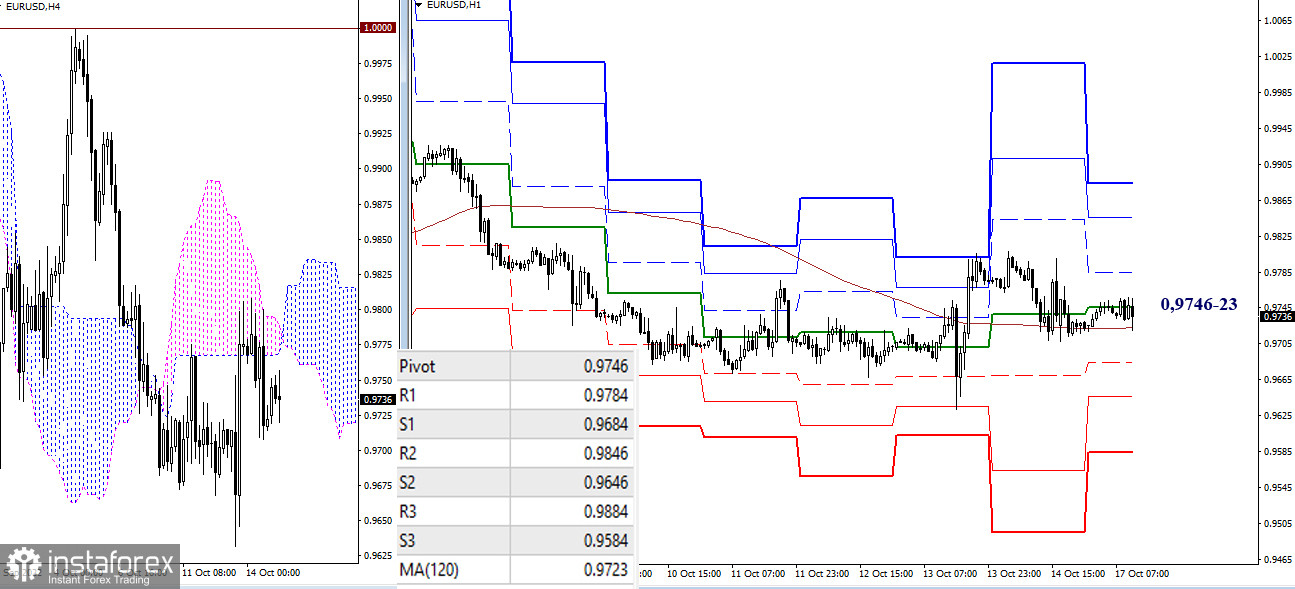

H4 – H1

Uncertainty also prevails in the lower timeframes. The pair is in the zone of attraction and influence of the key levels 0.9746–23, which are horizontal. A move above 0.9746–23 (central pivot + weekly long-term trend) will increase the chances that bulls will be able to realize a recovery and begin to strengthen their sentiment. Upward targets within the day today are located at 0.9784 - 0.9846 - 0.9884 (classic pivot points). If the pair manages to consolidate below 0.9746–23, then the initiative and the balance of power will shift to the bears. The support of classic pivot points (0.9684 – 0.9646 – 0.9584 ) can serve as benchmarks for the decline today.

***

GBP/USD

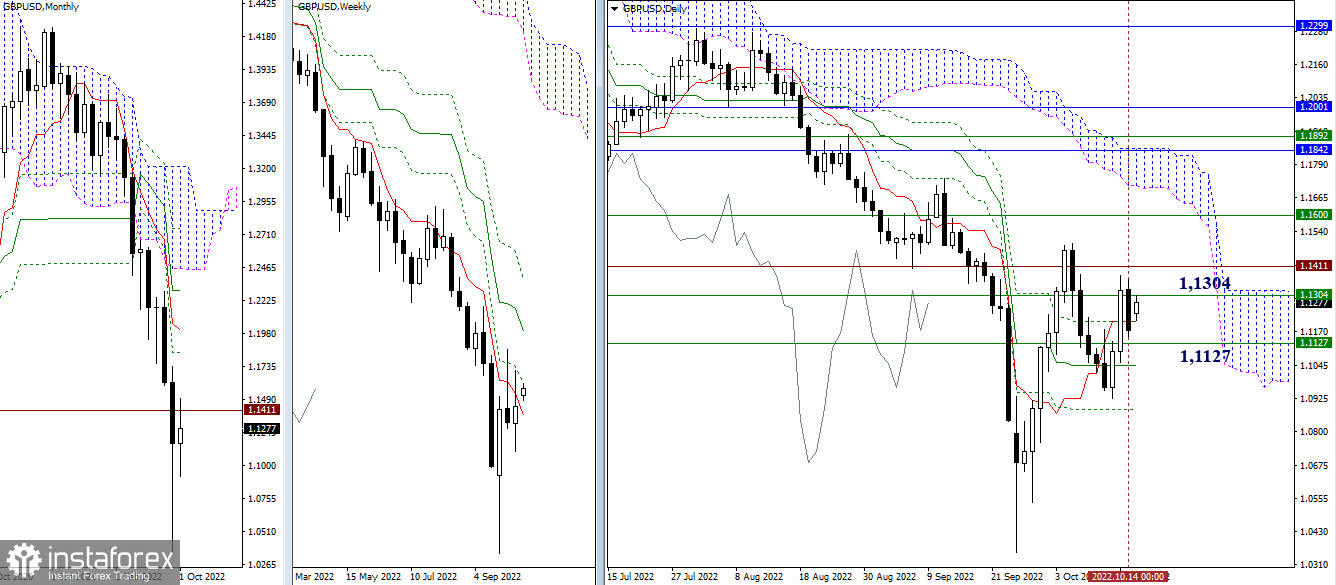

Higher timeframes

At the moment, there is a fairly wide zone on the chart of the pair, which exerts its attraction and influence on the development of events. The main boundaries of this zone can be noted at the weekly levels 1.1127 and 1.1304. The resistance levels of 1.1411 and 1.1600 are located just above, and support levels of 1.1046 and 1.0883 may meet the movement just below.

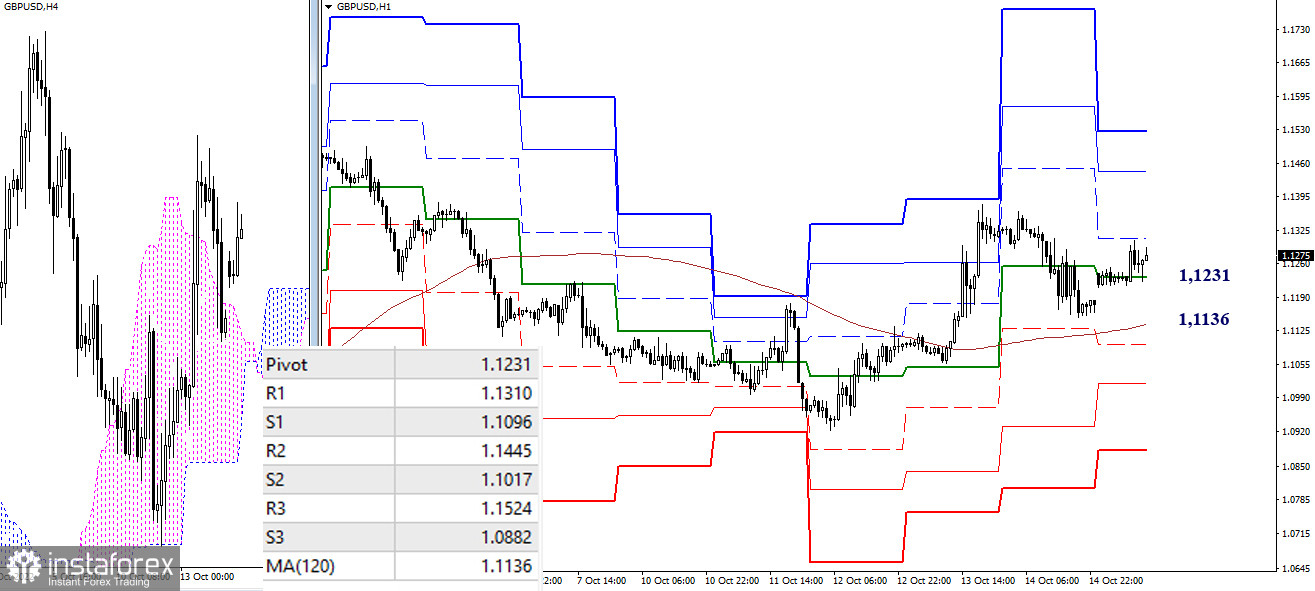

H4 – H1

The main advantage on the lower timeframes now belongs to the bulls. Nevertheless, the pair has been in the downward correction zone for a long time, the key supports of which are the levels of 1.1231 (central pivot point) and 1.1136 (weekly long-term trend). Working above the levels provides a preponderance of forces on the side of the bulls. The reference points for the continuation of the rise within the day today are located at 1.1310 - 1.1445 - 1.1524 (classic pivot points). The breakdown of key supports 1.1231 – 1.1136 can change the current balance of power in favor of the bears. The next bearish targets today are at 1.1096 - 1.1017 - 1.0882 (support of the classic pivot points).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)