Unlike the Fed, which is completely satisfied with the strengthening of the US dollar to a 20-year peak, as this allows to contain inflation, quite different sentiments prevail in the ranks of ECB officials. The weakness of the euro, on the contrary, fuels the growth of consumer prices in the eurozone and gives grounds for the "hawks" of the Governing Council to dictate their will at meetings starting in June. So far, their activity has not allowed EURUSD to go for a serious correction, but sooner or later this time will come.

Pierre Wunsch, governor of the National Bank of Belgium, says fiscal stimulus measures by the governments of the currency bloc countries aimed at supporting households affected by the energy crisis increase the likelihood of a more aggressive tightening of the ECB's monetary policy. Germany and other countries are spending hundreds of billions of euros, which accelerates inflation and forces the central bank to actively raise the deposit rate. Wunsch believes that market expectations of its growth from the current 0.75% to 3% are fully justified.

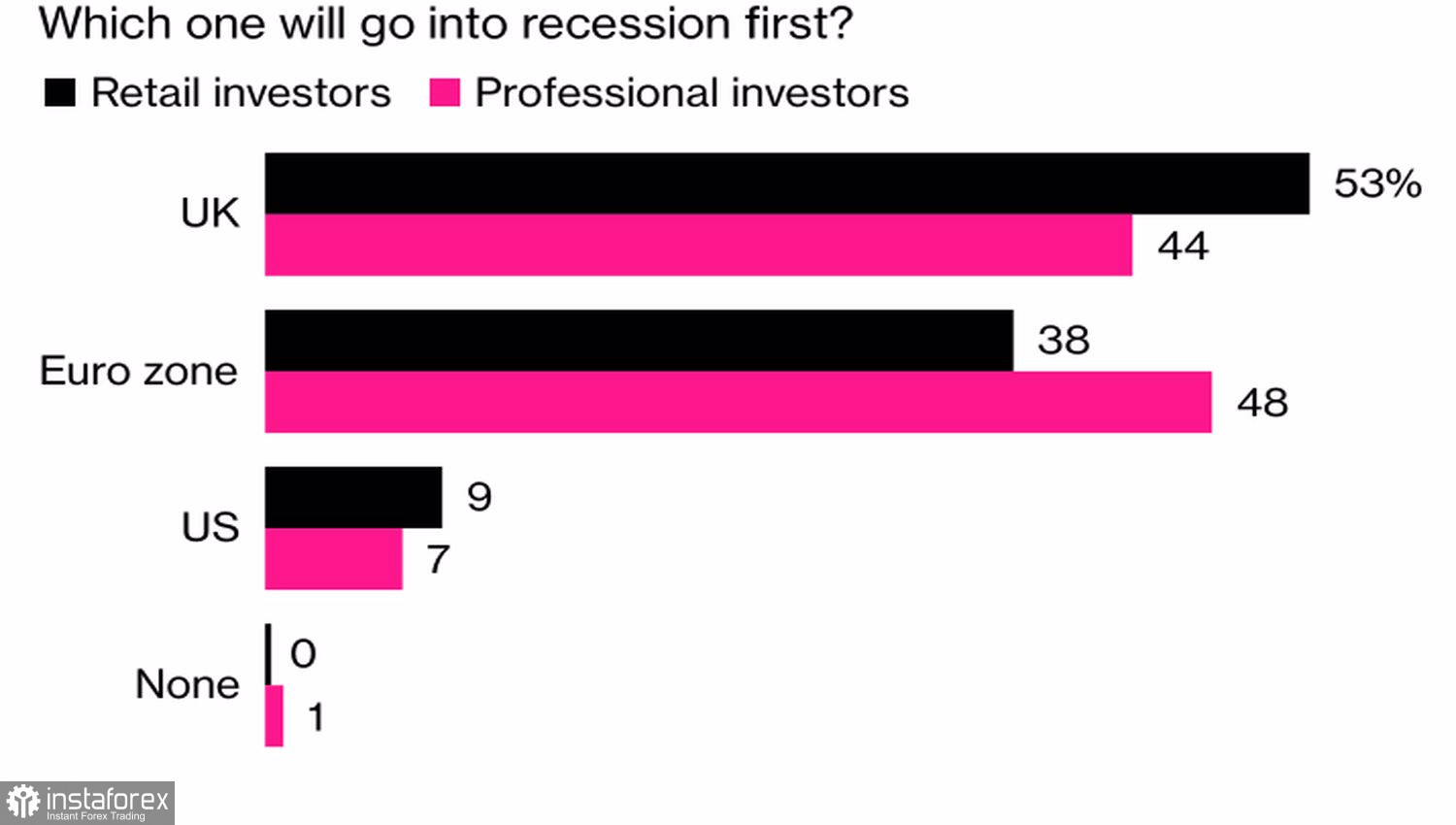

The bad example of Britain, where divergences in monetary and tax policy provoked turmoil in financial markets, is unlikely to be repeated in the eurozone. Here, fiscal incentives are targeted. Their scale, high occupancy of gas storage facilities, and increased LNG revenues reduce the degree of energy crisis and the likelihood of a serious recession. At the same time, 45% of investors surveyed by MLIV Pulse believe that the currency bloc will be the first to face a downturn in the economy.

Which region will be the first to face a recession?

However, the European Central Bank is not particularly embarrassed by this. Following the example of the Fed, it is ready to sacrifice the economy for the sake of defeating high inflation. According to the head of the Bank of Latvia, Martin Kazaks, the ECB will raise the deposit rate by 75 bps in November, and in December it will choose between 50 and 75 bps depending on incoming data. In addition, discussions have already begun on how to reduce the balance by €5.1 trillion. The process is going to be launched at the beginning of 2023, and expectations of the start may support the "bulls" on EURUSD.

Thus, the EU's preparedness for winter, the dominance of the "hawks" in the Governing Council, and the ECB's dissatisfaction with the serious weakening of the euro suggest that the regional currency has its trump cards. While the strong US dollar does not allow them to take advantage of them, however, as soon as the American monetary unit allows itself to relax, the situation on EURUSD may seriously change. According to St. Louis Fed President James Bullard, this will happen at the moment when the federal funds rate reaches the ceiling. That is, in 2023. In the meantime, the "bears" on the main currency pair continue to control the situation.

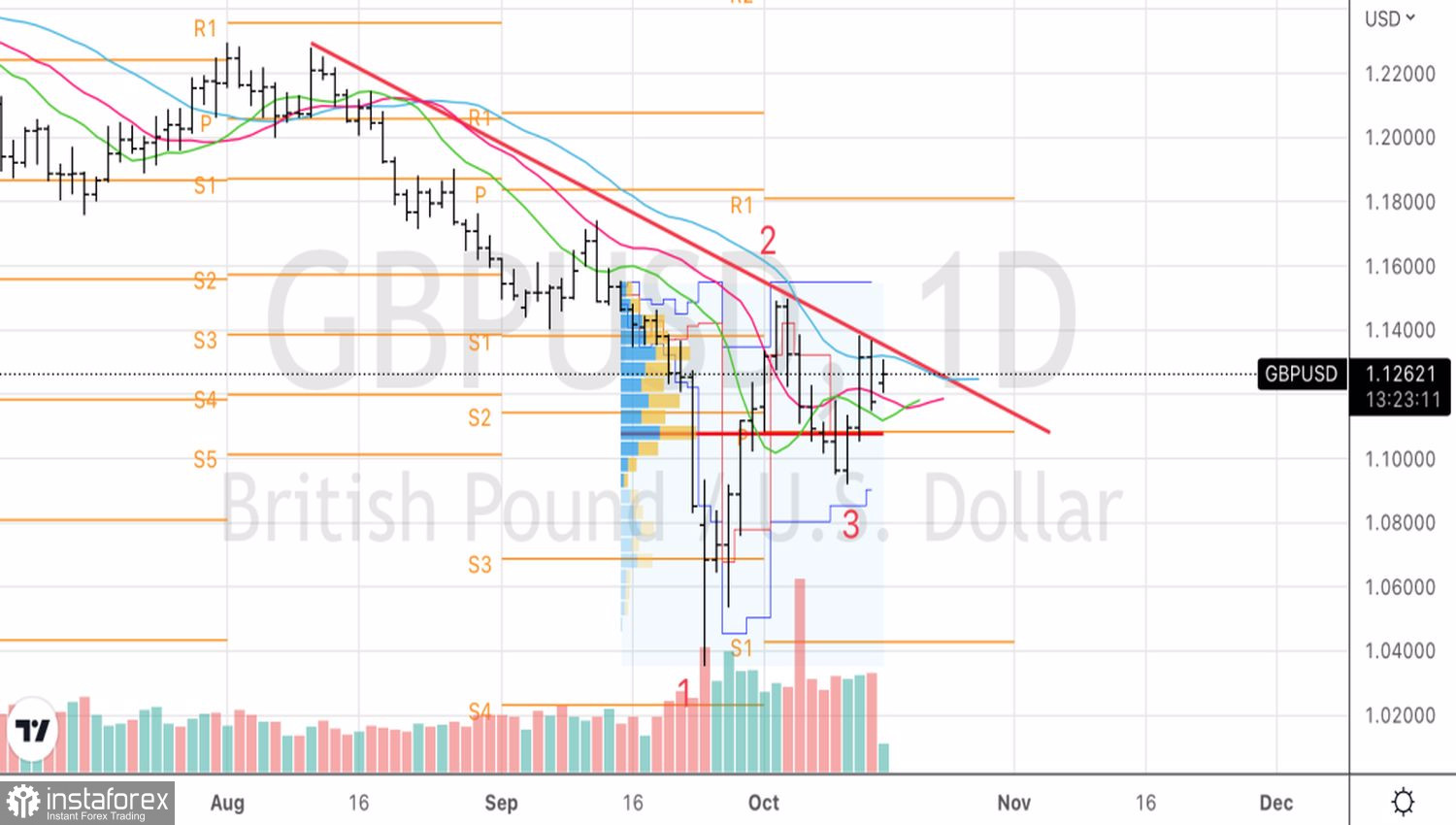

Technically, on the EURUSD daily chart, the rebound from dynamic resistance in the form of the moving average included in the Bill Williams Alligator allows us to talk about the growing risks of restoring the downward trend and gives grounds for selling the euro against the US dollar on a breakout of the fair value 0.97.