US stock index futures surged upwards on Monday after investors reconsidered their approach to the earnings season. Market players are now betting on positive income and losses reports by the world's major companies. The Dow Jones added 500 points or 1.7%, while the S&P 500 and the Nasdaq Composite increased by 2.1% and 2.6% respectively.

Currently, the S&P 500 has recouped its losses after another week of losses. Last week, the index lost 1.6% with five straight week of losses. Higher than expected inflation data caused sharp price fluctuations. However, it did not harm the market significantly, as investors shifted their expectations regarding the upcoming interest rate hike by the Federal Reserve.

These large fluctuations have only led to the market hitting new yearly lows. Some experts are sure that it did not worsen the overall technical situation and believe that the market would recover in the short term. The 200-week SMA is a serious support level and would remain so until investors fully accept the fact that a recession is unavoidable, until it is officially announced. It may take a few more months before an upward rally can be expected.

Pressure in the FX market has fallen slightly after the UK government has adjusted its policy slightly. Jeremy Hunt, the new UK finance minister, has announced that most planned tax cuts will be cancelled.

In regards to the earning season, the events on the economic calendar are now particularly important. Investors are paying close attention to reports from US corporations and watch out for US companies potentially revising their outlooks downwards amid stubbornly high inflation and the economic downturn.

This week, Netflix, Tesla, and IBM will release their earnings reports, followed by Johnson & Johnson, United Airlines, AT&T, Verizon, and Procter & Gamble.

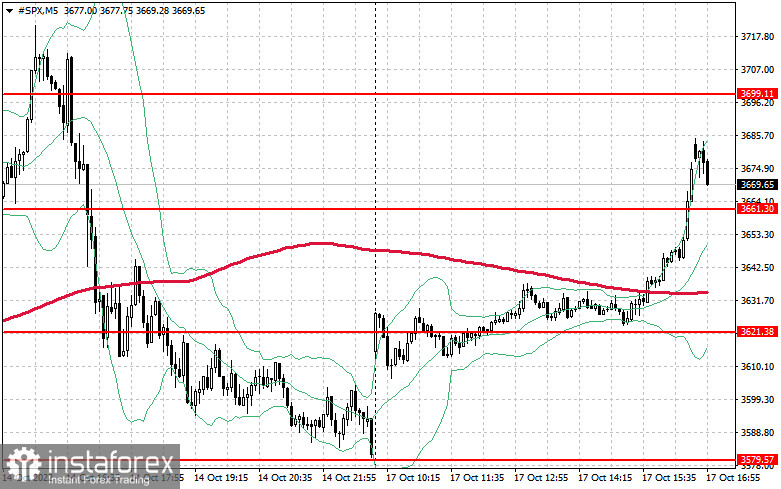

On the technical side, investors are now ful of optimism regarding the S&P 500 after its slump on Friday, which was caused to weak retail sales data. Going long on the index at its current lows is very advantageous. The index is currently trading above $3,661, which opens the possibility for the S&P 500 rising towards $3,699. Bulls would definitely try to break through this level at the beginning of the trading session. A breakout above this level could lead to an upward correction towards the resistance at $3,735, as well as $3,773 further ahead. If the index moves down, bullish traders must take action at $3,661. A breakout below this level would send the index towards $3,621, allowing it to test the support at $3,579, its new yearly low.