The British authorities are trying in all known and unknown ways to save the pound from the mistakes of the euro. The specter of parity is still circling around sterling, nevertheless, there are also good chances of salvation.

At the start of the new week, the markets gave their initial verdict to the speech of the new Chancellor Jeremy Hunt. He has made increased commitments to restore market confidence in the UK's finances and largely reversed the tax cuts announced earlier by his predecessor, Kwasi Kwarteng.

During the weekend, he reported on the difficult decisions to be made in the near future. Hunt made it clear that spending cuts and further tax increases may be required.

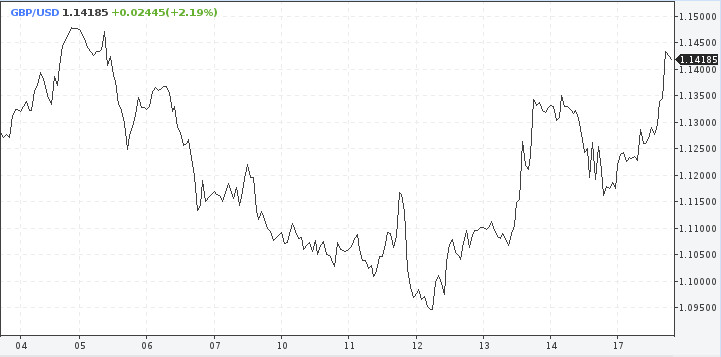

The pound started the week with a strengthening, during the hours of the US session its growth accelerated. First, it took the bar at 1.1300 against the dollar, then crossed the threshold of 1.1400, gaining more than 2% growth.

Meanwhile, investors remain cautious about the effectiveness and credibility of the new fiscal measures that will be announced after the policy reversal. Therefore, there may be interest in selling, UniCredit Bank strategists comment.

It is quite possible for GBP/USD quotes to go down, since it is now subject to any incoming information and reacts quite vividly to what is happening in the country in the field of finance. Sterling was falling over the weekend, and on Monday it rebounded significantly from the lows.

The sell-off of the pound was due to the fact that investors felt that Prime Minister Liz Truss had not done enough to restore confidence in British assets.

Truss previously announced that the government would continue raising corporate tax in 2023, reversing an important political promise to reverse the increase that was made during her campaign to be elected leader of the Conservative Party.

But apparently, this was not enough for market players. A series of important statements over the weekend, followed by a speech by the Treasury, confirms that the Brits are still nervous about the negative reaction of the market.

All eyes are on the UK fixed income bond markets, where the securities were bought at the beginning of trading as the first sign of confidence. Taking into account the reaction of the bond market, Hunt has already had a conversation with the head of the Bank of England and the head of the Debt Management Office to inform them about the new plans.

As it became known, the government abandoned the plan to abolish the maximum income tax rate, saving 2 billion pounds a year. Now the authorities are returning to previous plans to raise the corporate tax rate from 19% to 25% from April 2023, which will amount to about 18 billion pounds a year.

Thus, the government is on the way to abolishing more than half of the unsecured measures to reduce taxes from the mini-budget, analysts say.

In recent days, the British central bank has been active in the country's bond markets, keeping them from a more serious sell-off. However, the intervention ended last week and the bond markets faced a serious test this week.

The markets will continue to evaluate the steps of the authorities, if they decide again that what has been done is not enough, further pressure from sellers may arise, as a result, profitability will increase. This, in turn, increases the cost of domestic finance, including corporate loans and mortgages. The pound, in particular, will be under pressure.

Sterling's growth will continue with the recovery of sentiment. Anyway, the week promises to be volatile for the pound.

"We continue to see risks more skewed to the downside for the pound, especially against the dollar, later in the year. The pound has already fully recovered all losses after the adoption of the mini-budget, which should limit further growth amid further government measures to restore market confidence in the gold market," commented the MUFG.

Rabobank economists have been holding a bearish position on the pound for a single month. There are still too many uncertainties in Britain to change their minds, they say. This applies to both the economic and political spheres.

The forecast at 1.0600 for the GBP/USD pair seems overly pessimistic, but anything can happen.

Hawkish statements by BoE Governor Andrew Bailey during the weekend confirm that the central bank is preparing for an aggressive rate hike. This should support the pound somewhat, along with the repeal of Truss' tax promises.

Standard Chartered is betting on a weak pound, but abandoning the idea of parity. In their opinion, the pound will decline, but will remain above the 1.0500-1.0700 area.

In the short term, the GBP/USD pair may retest 1.1400 and even 1.1600.

At the same time, disappointment over potential rollback or budget proposals may increase the risk of a parity test. However, it will not be as easy for bears to break through to it as it was possible earlier.