The EUR/USD currency pair started the new week quite calmly. On the first trading day of the week, no important events were planned that could force the market to trade actively. Therefore, the pair spent most of the day near the moving average, but it still increased in the afternoon. If we look at the 4-hour TF (or 24-hour), the downward trend still does not cause any doubts. Even taking into account the latest correction of the euro by 450 points, by and large, this does not change anything for it. The euro still needs serious, compelling reasons to turn up against the dollar. As we have repeatedly said, there are no such reasons now.

Previously, we assumed that the potential completion of the Fed's key rate hike cycle could positively impact risky currencies. The fact is that, usually, the market considers certain monetary policy changes in advance, especially if they are known in advance. Since the beginning of 2022, it has been known that the Fed will raise the rate until inflation shows a significant slowdown. Then a period of high rates will begin, during which it is planned to return to 2%. However, at the beginning of this year, it was about a total rate increase of 3.5%. Now it seems that even 4.5% may not be enough for inflation to begin to show a serious slowdown. Therefore, the market cannot account for all the rate increases since no one understands to what level the Fed will tighten monetary policy. At the beginning of the year, it seemed that a 0.75% increase was an emergency measure that the Fed might not dare to take. The rate may increase by exactly this value for the fourth meeting in a row.

The ECB cannot raise the rate as much as the Fed.

With a great delay, the European Central Bank started raising the key rate a few months ago. However, this did not help the European currency in any way, as it continues to be located near its 20-year low. It is clear what the market is guided by when it refuses to buy euros. Geopolitics, first of all, harms the European economy. The US dollar is stable and is the world's reserve currency. No matter how it grows, the ECB rate remains below the Fed rate. As you can see, there are plenty of reasons to buy the dollar. However, economists have recently noted that there may be another reason for the current and future weakness of the euro currency.

No one doubts that the Fed will raise the rate "to the bitter end." It will be done if it is necessary to raise it to 5%. But economists very much doubt that the ECB will be capable of the same scenario. According to analysts from Natixis, the ECB will not be able to raise its rate to 5% if necessary. The problem lies in the high public debt of many European countries and its maintenance. If the rate goes up, it means that the economic growth of these countries (in many cases, zero already) will fall even more, and the national debt will grow. After the COVID pandemic, many EU countries are experiencing serious problems with public debt (Greece, Italy). And for such countries, raising rates to a level that can bring inflation back to 2% can be deadly.

Natixis analysts believe that the ECB will take a neutral position, but this position may be the worst possible. They believe that the ECB will raise the rate to 3–3.5%, which will not be enough to return inflation to 2% in the foreseeable future. Still, the burden on countries with high public debt will increase significantly, creating new solvency problems for many countries. However, we need to understand that the ECB may not be aimed at the maximum possible level of the key rate. If this is the case, the Fed rate will remain higher for a long time, and the US economy will attract investors much more strongly than the EU. Thus, for the euro not to fall further, the ECB needs to strive for the Fed rate. But whether this is possible, only time will tell.

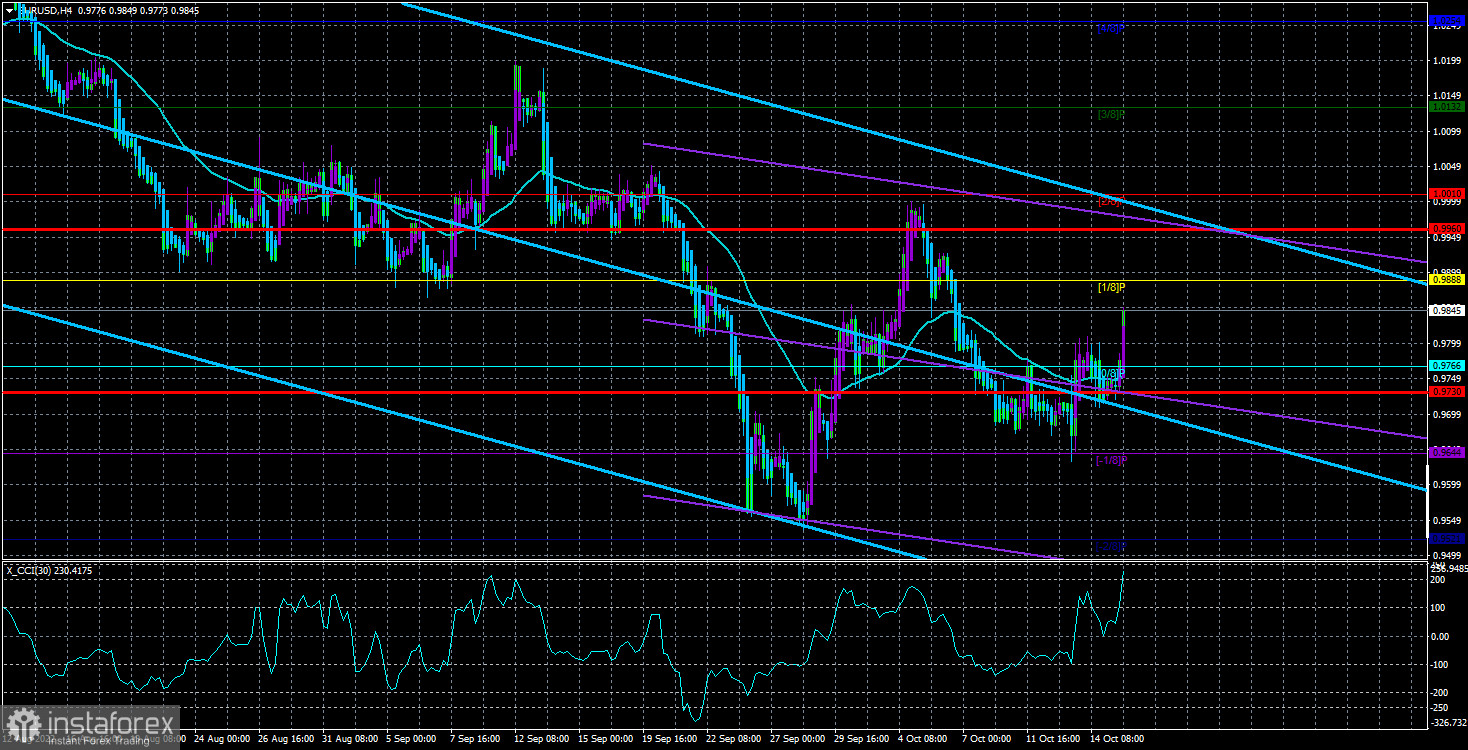

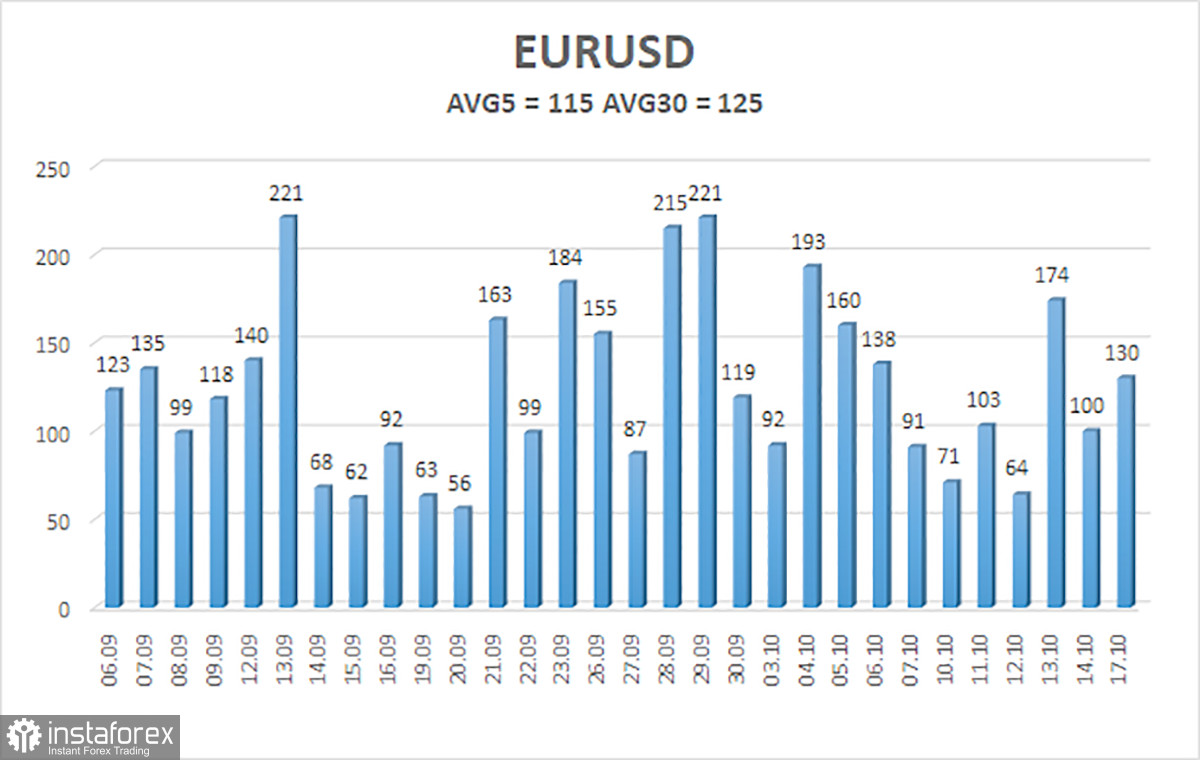

The average volatility of the euro/dollar currency pair over the last five trading days as of October 18 is 115 points and is characterized as "high." Thus, on Tuesday, we expect the pair to move between the levels of 0.9730 and 0.9960. A reversal of the Heiken Ashi indicator downwards will signal a new round of downward movement.

The nearest support levels:

S1 – 0.9766

S2 – 0.9644

S3 – 0.9521

The nearest resistance levels:

R1 – 0.9888

R2 – 1.0010

R3 – 1.0132

Trading Recommendations:

The EUR/USD pair has made a new upward leap. Thus, now you should stay in long positions with targets of 0.9888 and 0.9960 (if you managed to open them) until the Heiken Ashi indicator turns down. Sales will become relevant again no earlier than fixing the price below the moving average with goals of 0.9644 and 0.9521.

Explanations of the illustrations:

Linear regression channels help to determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.