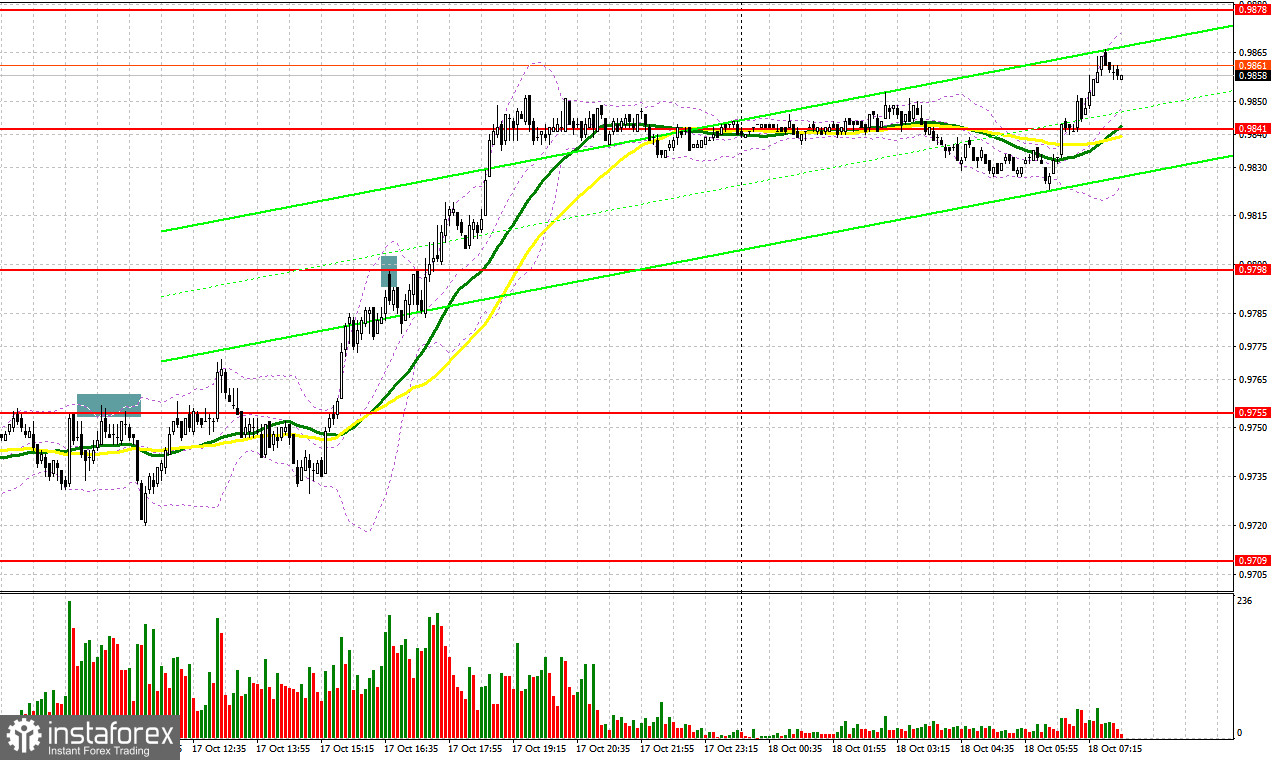

Yesterday, traders received several signals to enter the market. Let us take a look at the 5-minute chart to clear up the market situation. Earlier, I asked you to pay attention to the level of 0.9755 to decide when to enter the market. Bulls tried to go above the area, thus forming a sell signal. As a result, the pair lost more than 30 pips. In the second part of the day, demand for the euro recovered and the pair climbed above the sideways channel. Bears managed to protect 0.9798. However, the pair did not show a considerable decline.

Conditions for opening long positions on EUR/USD:

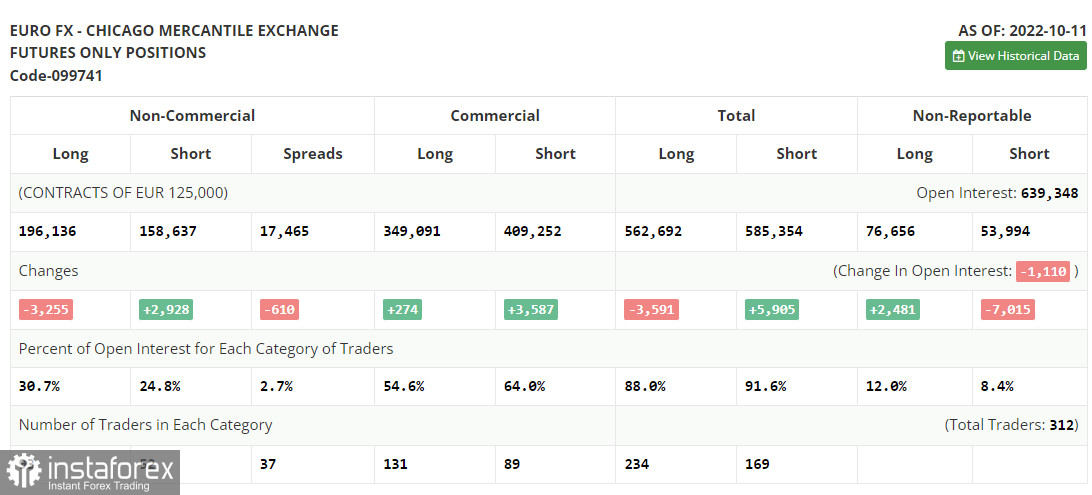

First of all, let us focus on the futures market and a fresh COT report. According to the COT report from October 11, the number of long positions tumbled, whereas the number of short positions increased. The fact is that traders were getting ready for the US inflation and retail sales reports. It is obvious that the Fed finds it difficult to cap inflation, which is reflected in the report for September. The US inflation slackened just by 0.1% compared to the previous reading. It means that the Fed's approach will remain the same or become even more aggressive. Notably, we haven't seen the euro sell-off below the parity level for a long time already. What is more, even the geopolitical situation and the key interest rate hike by the Fed will hardly push the price lower. That is why it is a good reason to start buying the euro in the middle term. The COT report unveiled that the number of long non-commercial positions slumped by 3,255 to 196,136, whereas the number of short non-commercial positions increased by 2,928 to 158,637. At the end of the week, the total non-commercial net position remained positive and amounted to 37,499 against 43,682. This indicates that investors are benefiting from the situation and continue to buy the cheap euro below parity. They are also accumulating long positions, expecting the end of the crisis and the pair's recovery in the long term. The weekly closing price decreased to 0.9757 from 1.0053.

Today, in the first part of the day, the eurozone will not publish any important macroeconomic report. That is why bulls will have a chance to boost the price above the resistance level of 0.9878. However, it is unknown whether the pair will be able to consolidate and close the day at this level. The euro's upward potential could be capped by the ZEW economic sentiment reports for Germany and the eurozone. If traders ignore the negative data, the euro may jump and even hit a fresh parity level. ECB Schnabel's speech is unlikely to attract traders' attention. In case of a negative reaction to the data, only a false breakout of the nearest support level of .9828 will give a long signal. This will allow the pair to reach a new resistance level of 0.9878. Only a breakout and an upward test of the area will allow the pair to climb to a new high of 0.9917, providing hope for a further rise to 0.9948. The farthest target is located at 0.9990, where it is recommended to lock in profits. If the euro/dollar pair declines and buyers fail to protect 0.9828, it will hardly influence the overall market situation. A false breakout of the next support level of 0.9786, where there are bullish MAs, will give a buy signal. It is also possible to go long just after a bounce off the support level of 0.9734 or even lower – from the low of 0.9682, expecting a rise of 30-35 pips.

Conditions for opening short positions

Sellers lost the market and allowed the pair to leave the sideways channel, where it was trading during the previous week. Today, bears should primarily return the euro to this range. It will be wise to go short after a false breakout of the nearest resistance level of 0.9878. The pair may jump to this level after speeches that will be provided by the ECB's representatives. A failure to settle at 0.9878 will push the price to 0.9828. A breakout and settlement in this range as well as an upward test will give an additional sell signal that will affect buyers' stop orders and cause a drop to 0.9786, where it is recommended to lock in profits. Only strong data from the US is able to push the price lower. If the euro/dollar pair increases during the European session and bears fail to protect 0.9878, the pair will show noticeable growth. In this case, it will be wise to avoid selling until the price touches 1.9917. A false breakout of this level will give a new sell signal. Traders may also go short just after a rebound from 0.9948 or higher – from 0.9990, expecting a decline of 30-35 pips.

Signals of indicators:

Moving Averages

Trading is performed above the 30- and 50-day moving averages, which points to a further rise in the euro.

Note: The period and prices of moving averages are considered by the author on the one-hour chart, which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the euro/dollar pair declines, the lower limit of the indicator located at 0.9780 will act as support. A breakout of the upper limit of the indicator located at 0.9895 will lead to a rise in the pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.