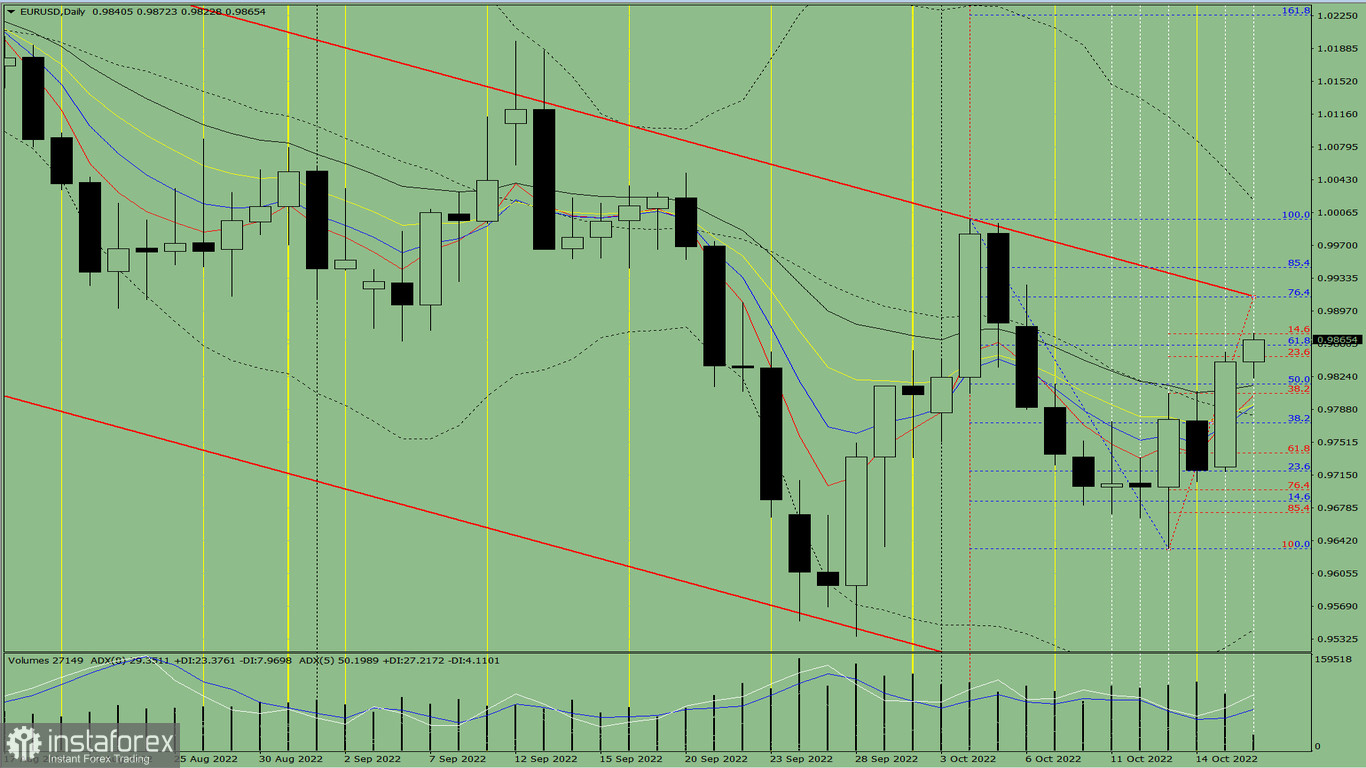

Trend analysis (Fig. 1).

The euro-dollar pair may move upward from the level of 0.9841 (closing of yesterday's daily candle) to 0.9913, the 76.4% retracement level (blue dotted line). When testing this level, a downward movement is possible to 0.9872, the 14.6% retracement level (red dotted line). The price may move upward from this level with the target of 0.9913, the 76.6% retracement level (blue dotted line).

Fig. 1 (daily chart).

Comprehensive analysis:

- indicator analysis – up;

- Fibonacci levels – up;

- volumes – up;

- candlestick analysis – up;

- trend analysis – up;

- Bollinger bands – up;

- weekly chart – up.

General conclusion:

Today the price may move upward from the level of 0.9841 (closing of yesterday's daily candle) to 0.9913, the 76.4% retracement level (blue dotted line). When testing this level, a downward movement is possible to 0.9872, the 14.6% retracement level (red dotted line). The price may move upward from this level with the target of 0.9913, the 76.6% retracement level (blue dotted line).

Alternatively, the price may move upward from the level of 0.9841 (closing of yesterday's daily candle) to 0.9859, the 61.8% retracement level (blue dotted line). When testing this level, a downward movement is possible to 0.9805, the 38.2% retracement level (red dotted line). The price may move upward from this level with the target of 0.9913, the 76.4% retracement level (blue dotted line).