Stocks rose on Monday, primarily due to the start of the corporate reporting season. Clearly, investors are no longer focusing only on increasing interest rates, high inflation and deteriorating world economy, but also on the performance of companies. This inspires optimism in the market, which decreases negative sentiment and brings back demand for shares. Thus, the stock markets in Europe and the US showed a noticeable increase, while US treasury yields have stalled and are not going anywhere after their recent growth. For example, the yield of 10-year bonds hit 4% and so far could not consolidate above it. This, in turn, puts pressure on the dollar, prompting a rise in other currencies paired with it.

Considering that there is a two-week time lag until the Fed's meeting in November, investors have more time to win back losses. This may start today, during the European session, and may extend amid positive dynamics of US stock indices. Of course, the dollar will be affected negatively, but there is still the need to buy it because there are too many factors that do not allow it to decline fully. Most likely, further aggressive rate hikes by the Fed and the presence of high demand will keep it afloat for a long time.

Forecasts for today:

AUD/USD

The pair failed to overcome 0.6330, which reinforces the existing downward trend. If this continues, the quote will fall to 0.6220.

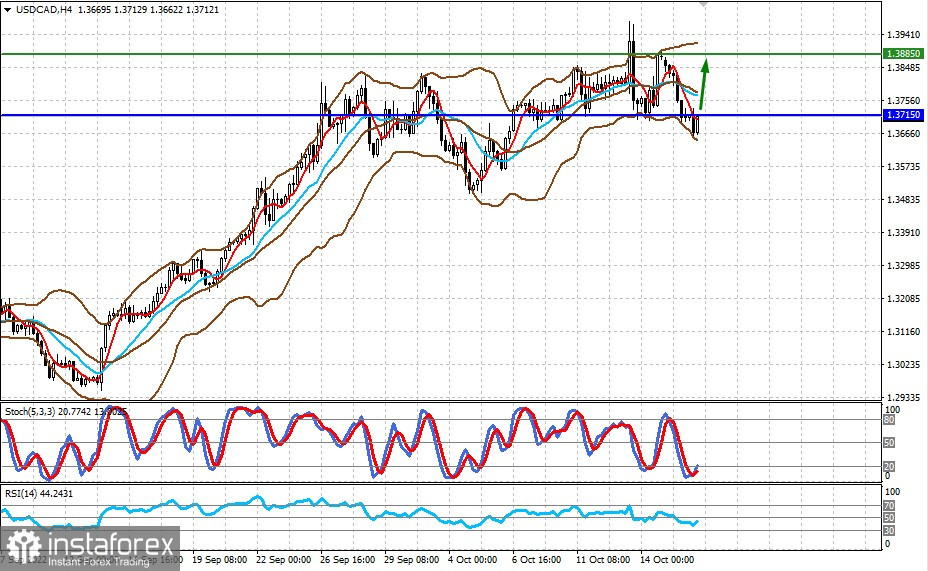

USD/CAD

The pair is testing the level of 1.3715. A rise above it could lead to a further increase to 1.3885.