Global risk appetite dominated trading floors on Tuesday morning. The S&P 500 rose 2.6%, while NASDAQ added 3.4%. Asian and European indices also traded in the green zone.

The main reason for growth was the decision of the new UK finance minister to scrap off the controversial mini-budget presented by the Liz Truss government earlier. This has led to the increase of pound, as well as other risky assets.

Accordingly, the dollar weakened against most major currencies, except for yen. USD/JPY set a new 32-year high amid the rhetoric of the Bank of Japan on interest rates.

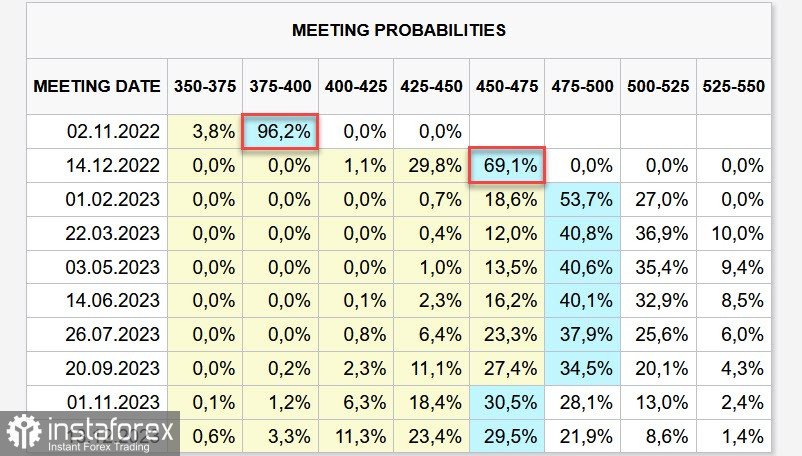

As for the Fed, there is a huge chance that it will raise rates by 75 basis points in November and December, making it reach 4.50% - 4.75% by the end of the year. This increases the chances of seeing a rate above 5% next year.

This means that the dollar will win back its losses, especially since the recent risk appetite is only caused by political motives. There is also the rapidly approaching recession, which will come no matter how aggressive central banks raise rates.

NZD/USD

Hopes that inflationary pressures in New Zealand are easing have not materialized. Prices have reportedly increased in Q3, by 2.2% instead of 1.6%. Gas prices have stabilized, but there is a strong increase in prices for food, housing and transport.

In terms of the labor market, it is likely that unemployment has decreased, but if this is added to the current high inflation, pressure on the RBNZ will increase, which will prevent it from softening its hawkish attitude. This means that rates may climb by atleast 50 to 75 basis points in November.

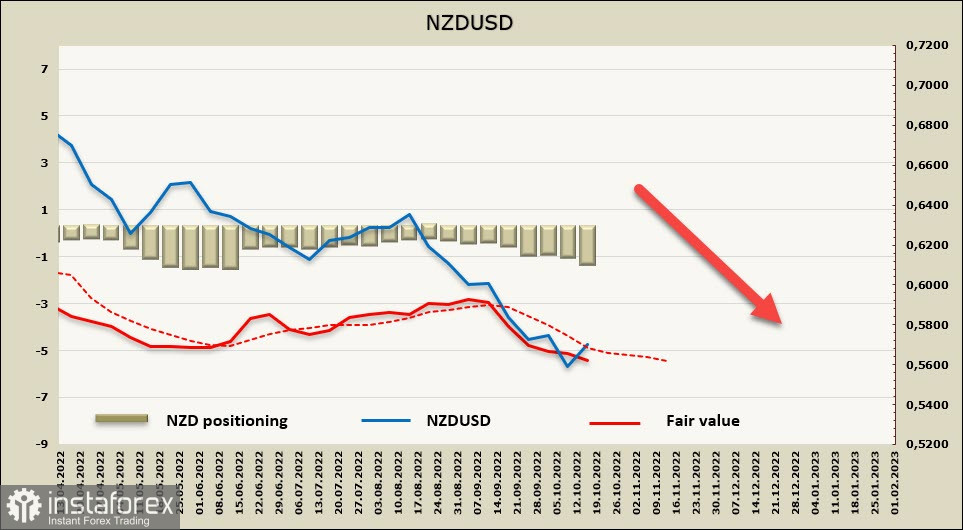

So far, the net short position in NZD, according to the CFTC report, rose by 262 million to -1.06 billion. The positioning is still bearish, and the settlement price is below the long-term average and is directed downwards.

NZD/USD updated the low, but did not reach the support level of 0.5464. And even though there was some growth, bearish pressure remains, which indicates that the recent price increase is just a correction, and sometime later the downward movement will resume. A lot will depend on the resistance zone of 0.5760/5805 as trading within it will prompt sell-offs to 0.5810 and 0.5464.

AUD/USD

The minutes of the RBA meeting published this morning did not give an unequivocal answer to the key question - what caused the bank to increase their rate by 0.25% instead of the expected 0.50%?

The RBA appears to have just taken a short pause, with two more increases of 0.25% expected before the end of the year. A 0.50% increase could also happen if the updated inflation data shows that price growth is not slowing down.

In any case, it must be assumed that the RBA rate will lag behind the Fed rate, and the inevitable global recession will put strong pressure on commodity currencies. This is why AUD/USD will not bounce up yet.

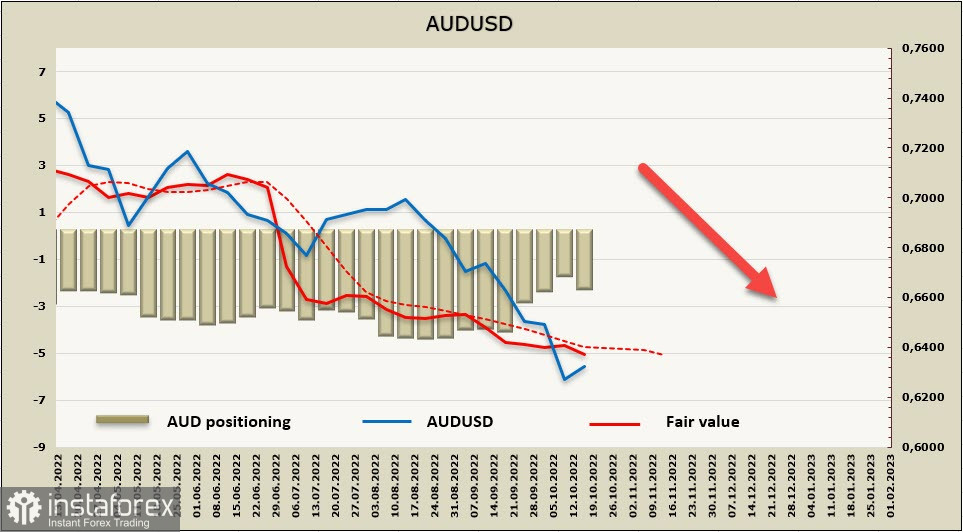

Also, the net short position increased by 156 million to -1.96 billion during the reporting week, with the positioning bearish. The settlement price is below the long-term average and is directed downwards.

Corrective growth is unlikely to be long, so the downward movement will continue soon. The nearest resistance zone is 0.6340/60, where sales may resume. If risk appetite persists for some time, which is unlikely, then the next zone favorable for sales is 0.6550/70. The long-term target is still 0.5513.