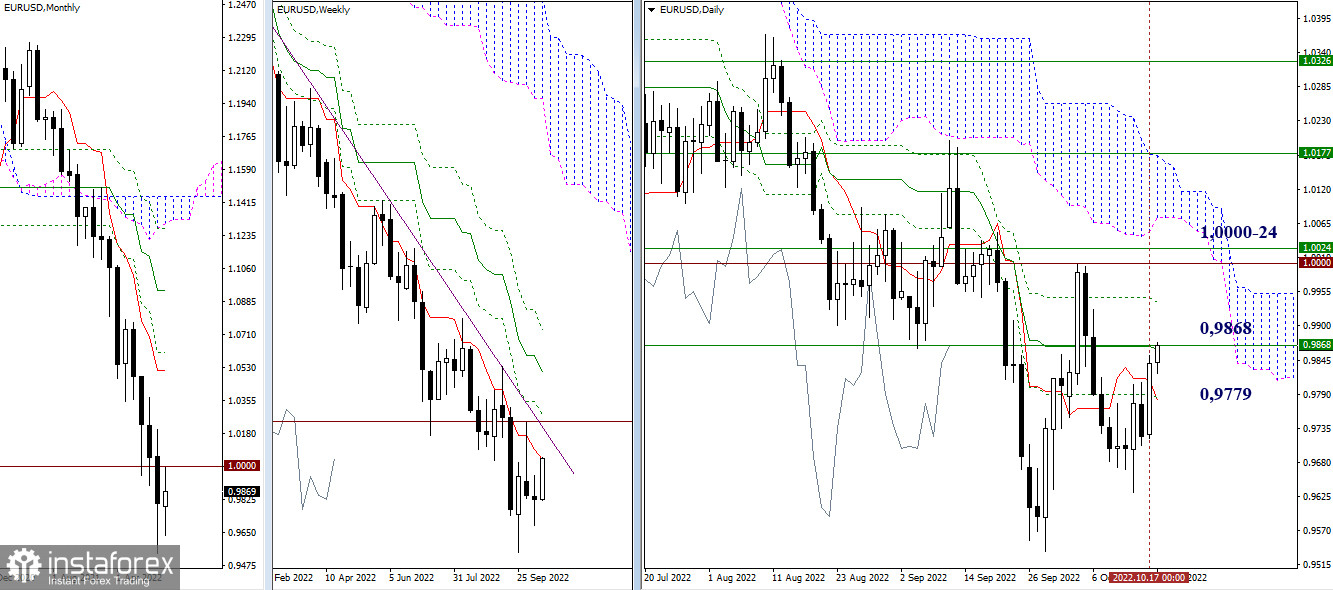

EUR/USD

Higher timeframes

Yesterday, the bulls took the initiative. They organized a rise and are now testing the 0.9868 milestone, where the daily medium-term trend and the weekly short-term trend have combined their efforts. In the event of a breakdown of this resistance, the main task will be the elimination of the daily Ichimoku death cross (0.9945), a breakdown of the trend line, which was formed for a very long period over several months. Further attention will be directed to resistance at 1.0000 - 1.0024 (psychological level + weekly Fibo Kijun). If it is not possible to pass the level of 0.9868, then 0.9779 (daily levels) - 0.9632 - 0.9536 (lows) can be noted as supports.

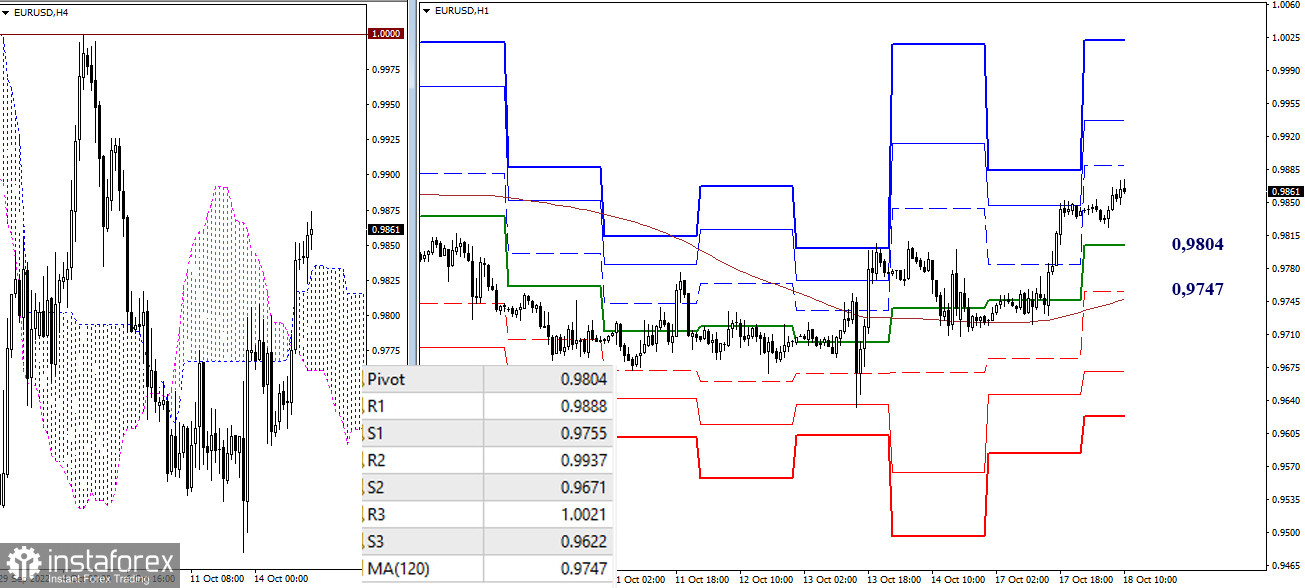

H4 – H1

The lower timeframes are now supporting the upside advantage. Further benchmarks for the upward movement are the classic pivot points (0.9888 – 0.9937 – 1.0021). Key levels are forming support today, so in case of a corrective decline, they will defend bullish interests at 0.9804 (central pivot point) and 0.9747 (weekly long-term trend). The breakdown of key levels will change the current balance of power and contribute to the formation of a rebound from the resistance encountered in the higher timeframes. Additional downside targets today can be noted at 0.9671 - 0.9622 (classic pivot points).

***

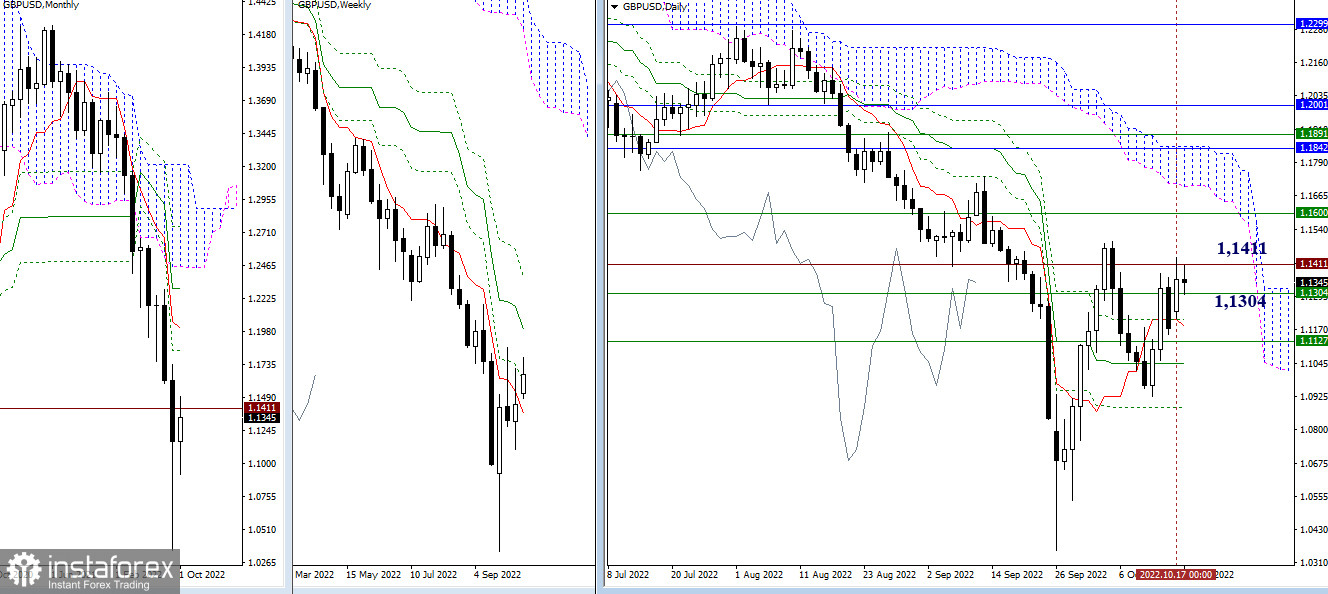

GBP/USD

Higher timeframes

As of writing, the pair is forming the result of the interaction from the meeting with the resistance levels in the area of 1.1304 - 1.1411 (weekly Fibo Kijun + historical level). The breakdown will open the way to new frontiers, for example, to the weekly medium-term trend (1.1600). The rebound will return the pound to support led by the weekly short-term trend (1.1127) and daily levels (1.1046 - 1.0883).

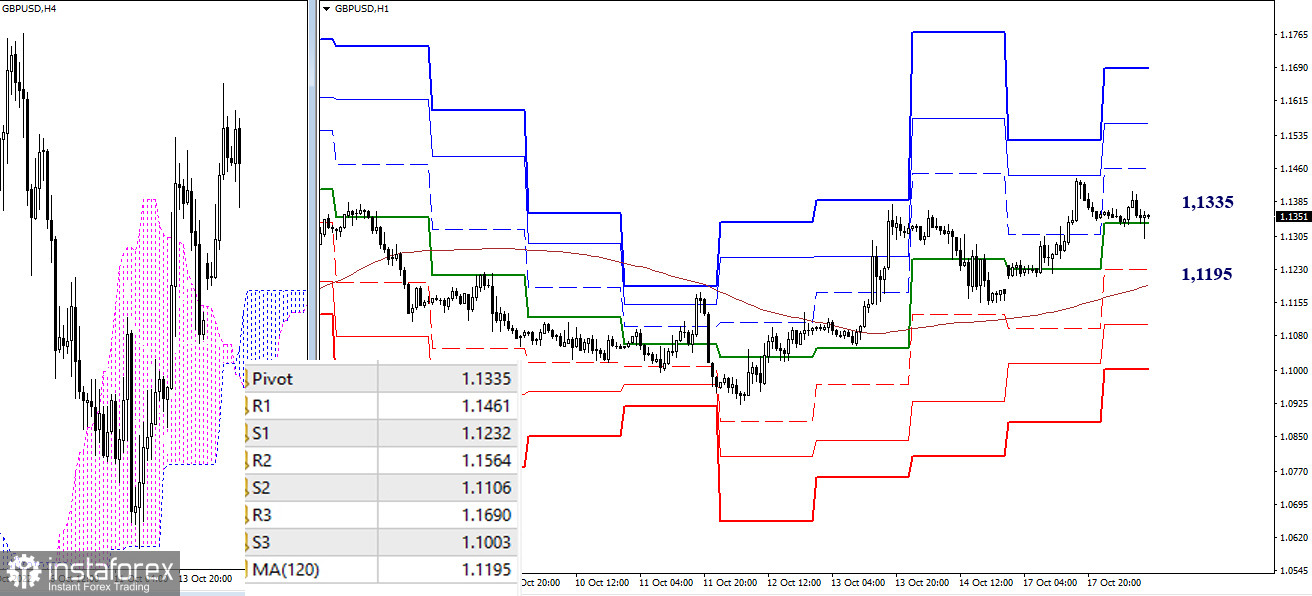

H4 – H1

The main advantage on the lower timeframes is on the side of the bulls. The reference points for the continuation of the rise today can be noted at 1.1461 - 1.1564 - 1.1690 (classic pivot points). As of writing, the pair is in the correction zone and relies on the support of the central pivot point of the day (1.1335). Further, the most significant line of correction is the support of the weekly long-term trend (1.1195). Its breakdown will affect the current balance of power, giving an advantage to the bears. The reference points for further decline, in this case, will be 1.1106 - 1.1003 (classic pivot points).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)