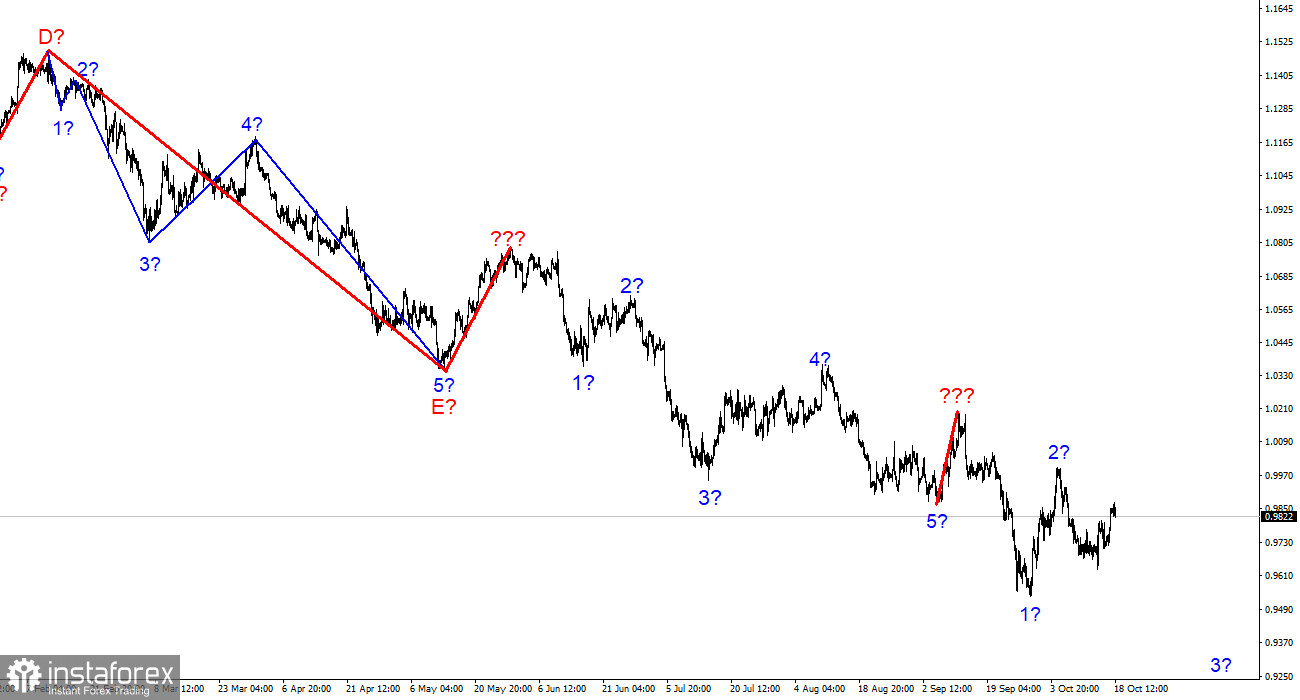

The wave marking of the 4-hour chart for the euro/dollar instrument still does not require adjustments, but it is undoubtedly becoming more complicated. It may become more complicated than ever in the future. We saw the completion of the construction of the next five-wave impulse descending wave structure, then one upward correction wave (marked with a bold line), after which the low waves of 5 were updated. These movements allow me to conclude that the pattern of five months ago was repeated when the 5-wave structure down was completed in the same way, one wave up, and we saw five more waves down. There has been no talk of any classical wave structure (5 trend waves, 3 correction waves) for a long time. The news background is such that the market even builds single corrective waves with great reluctance. Thus, in such circumstances, I cannot predict the end of the downward trend segment. We can still observe for a very long time the picture of "a strong wave down-a weak corrective wave up." Even now, when the construction of a new upward wave seems to have begun, which may be 3 as part of a new upward trend section, the entire wave marking can transform into a downward one, and the waves built after October 4 will be waves 1 and 2 in 3.

The inflation report is unlikely to change the market mood.

The euro/dollar instrument fell by 20-30 basis points on Tuesday, but the demand for it has recently increased. Therefore, we can deal with a new upward wave. I have already said that one of the two wave markings (euro or pound) should be transformed since I do not believe these two instruments can move in different directions. So far, everything is going according to the fact that the wave marking is transformed according to the European. But considering how quickly everything is changing in the current world, I would not bet everything on the growth of the euro or the British dollar, which have been falling for almost 2 years nonstop.

The news background this week is practically zero. Today will be the first more or less interesting report on industrial production in the USA. I don't think the market is looking forward to this report or tomorrow's report on European inflation. Whatever this report may be, it is unlikely to affect the ECB's plans for further tightening monetary policy. Although the rate in the European Union is unlikely to rise even to the current levels in the Fed (which may begin to increase demand for the dollar again), the European regulator will raise it steadily.

It seems to me that, at this time, the market has already formed a certain plan of action, which can be changed only under the influence of a strong news background. Thus, I do not exclude that the instrument can build an ascending wave 3. Still, it should be remembered that we can easily see a total of three waves up, which will be interpreted as a completed corrective structure, followed by the construction of a new downward trend section. Thus, I still urge everyone to be careful.

General conclusions.

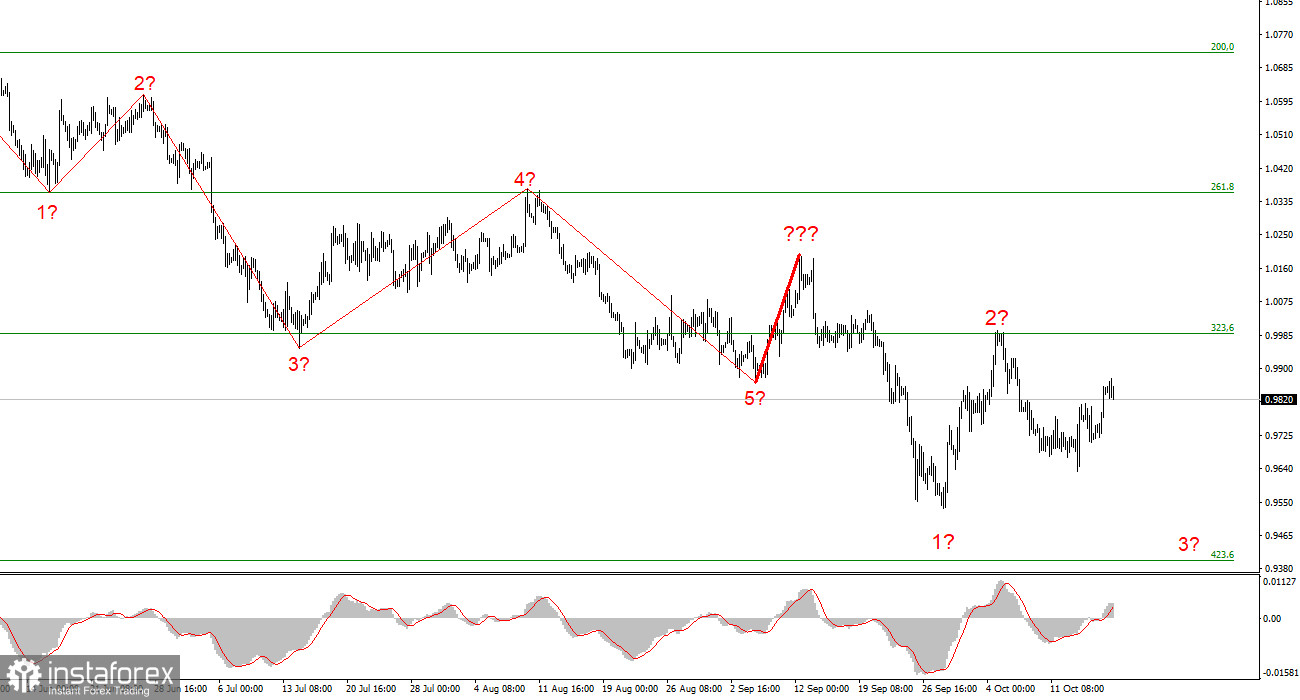

Based on the analysis, I conclude that the construction of the downward trend section continues but can end at any time. At this time, the instrument can build a new impulse wave, so I advise selling with targets near the calculated mark of 0.9397, which equates to 423.6% by Fibonacci, by the MACD reversals "down." I urge caution, as it is unclear how much longer the overall decline of the instrument will continue and whether the current wave structure will transform into an upward one.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate the three and five-wave standard structures from the overall picture and work on them. One of these five waves has just been completed, and a new one has begun its construction.