New government measures aimed at restoring market confidence in the UK and its finances seem to have had an effect. Short-term forecasts for the pound have been improved, there is no more talk of parity, although increased volatility and updating of lows is quite possible, since the English authorities are still at the stage of solving a whole heap of economic and financial problems.

As for the long-term perspective, expectations for sterling can be adjusted for the better here, but on condition that the country's Prime Minister Liz Truss vacates her seat. At BMO Capital, this could happen in the next two weeks.

The newly appointed Chancellor of the Exchequer of the United Kingdom, Jeremy Hunt, canceled all tax breaks of his predecessor. A reversal was inevitable as global markets were disappointed by the generosity of Truss' fiscal plans.

The promises were accompanied by a lack of clear independent forecasts. It was difficult for the markets to navigate, which led to a huge premium to British assets, including the pound.

BMO Capital analysts believe that the country needs drastic measures. There is no time to give someone a chance and wait for someone to succeed. We need to act right now if the country plans to achieve further growth. It's from the basics – it's a change of leadership.

Such calls are being made in connection with speculation about Truss' stability in the prime minister's chair now that her entire economic program has been rejected.

The fate of the trails

Conservative MPs have publicly called on Truss to resign in light of the government's announced tax reform program. The still-acting prime minister has already apologized for thoughtless economic initiatives that could have led to collapse and severely damaged the reputation of the party. Truss said that she is interested in working more closely with MPs and plans to regain her lost trust.

Tory MPs this week may raise the question of the need for a party vote on a vote of confidence in the prime minister. Truss has been premiering for a little more than a month, so technically it is insured against such a vote for a year. However, it's worth remembering about the Johnson story here. The norms can be changed if the idea is supported by the majority.

Jeremy Hunt calls for giving a chance to the new prime minister. He believes that Truss should remain, despite calls from some deputies of the ruling Conservative Party and representatives of the opposition to force Truss to resign.

It is unlikely that her departure will change something radically in the country, Hunt noted.

The new head of the Treasury also ruled out the possibility of his own participation in a possible future party struggle for the post of the new head of the cabinet. Meanwhile, he has already tried to take the post of prime minister, but lost both times. In 2019 – Boris Johnson, and in July of this year – Liz Truss.

The fate of the pound

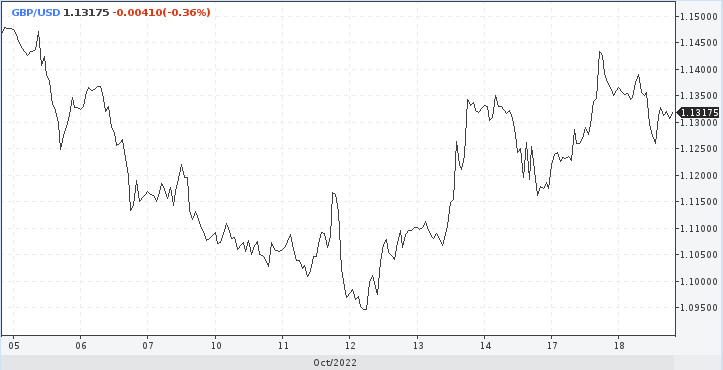

Due to the change of management, there is a risk of high volatility in the markets both in securities and in the pound. At the same time, such changes would benefit the British currency, according to BMO Capital.

There is a potential for a transition to the range of 1.1500-1.1700 for the GBPUSD pair within one or two weeks, followed by a correction in the dynamics of negative GBP flows.

If we talk about parity, the risk of such a scenario is now minimized. Most analysts agree that the 1.0350 mark was the low for the pair in this cycle, perhaps it was the bottom of the fall.

This means that the 1.0500-1.1000 range represents some value for bulls who are betting on a further recovery of sterling.

Nevertheless, the stability of the pound should be tested by the upcoming winter, events in the credit market and emerging risks associated with additional special shocks in the UK.

A rally in the 1.1500-1.1700 range is now the high that the pound can offer. It is possible that it will be short-term.

ING believes that now we need to look for interesting turns from the central bank. It is in this direction that the possibility of short-term support for the pound is located. If not, the pound rally may continue.