The dollar remains strong despite the recent rally in stock markets. The reason is the continued pressure from rising treasury yields, as well as the talks of an impending global recession. This morning, the yield of 10-year bonds exceeded 4%, and Fed members continuously hint at a further aggressive rate hike aimed at curb inflation.

Yesterday, Minneapolis Fed President Neel Kashkari said the Fed is not ready to announce a pause in raising interest rates as inflation is still high and there are no clear signals that it is ready to decrease. Atlanta Fed President Raphael Bostic echoed this, adding that inflation needs to be brought under control.

Existing factors that support dollar also remain effective, which means that pressure will most likely ease. Locally, there may be a price decrease amid rising risk appetite, but in the long term the scenario will be in favor of the US currency. A decline will also be perceived by market players as an invitation to purchases on the eve of the Fed meeting, and even more so after the central bank raises rates by another 0.75%.

The upcoming consumer inflation report in the Euro area, which is expected to show growth to 10% y/y/ and 1.2% m/m, may tempt traders to buy euro, but the existing economic problems in the region, aggravated by the geopolitical crisis in Ukraine, will put downward pressure on the currency. Thus, after a slight rebound, EUR/USD should be sold again.

Forecasts for today:

EUR/USD

The pair is trading above the level of 0.9820. Decline and consolidation below this mark may lead to a fall to 0.9720

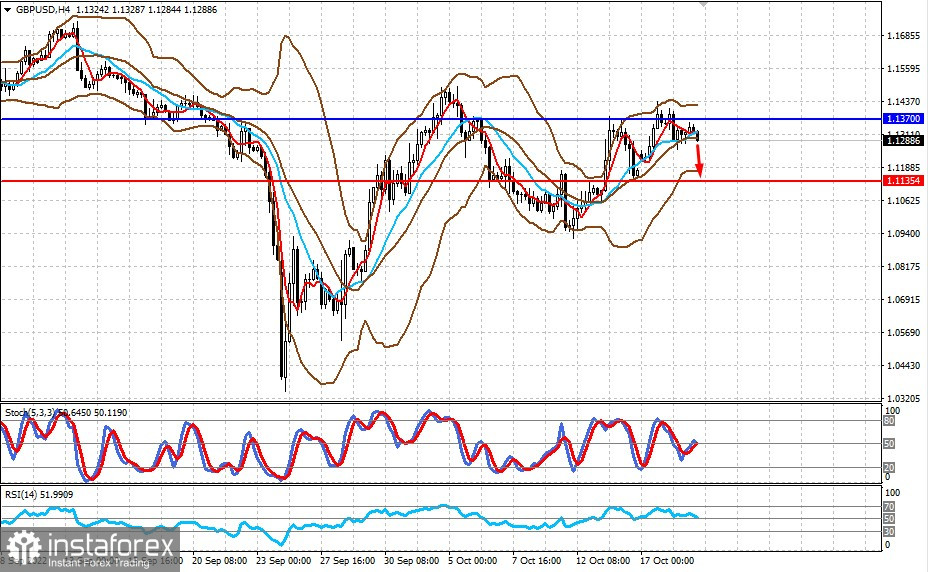

GBP/USD

The pair has not been able to consolidate above the level of 1.1370. This may lead to a decline to 1.1135.