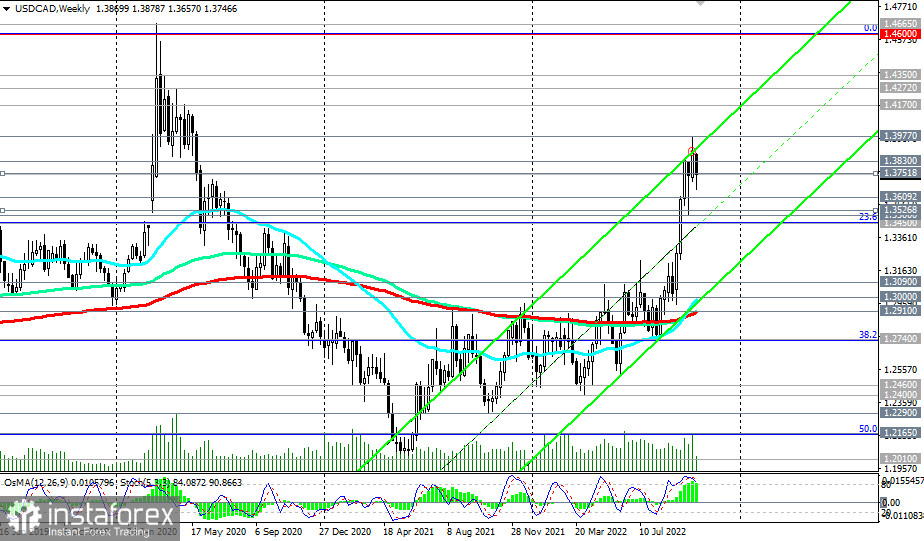

In general, the USD/CAD bullish trend prevails, and given the strong upward momentum, it is logical to assume further growth. USD/CAD is in the bull market zone, above the key support levels 1.3000 (200 EMA on the daily chart), 1.2910 (200 EMA on the weekly chart).

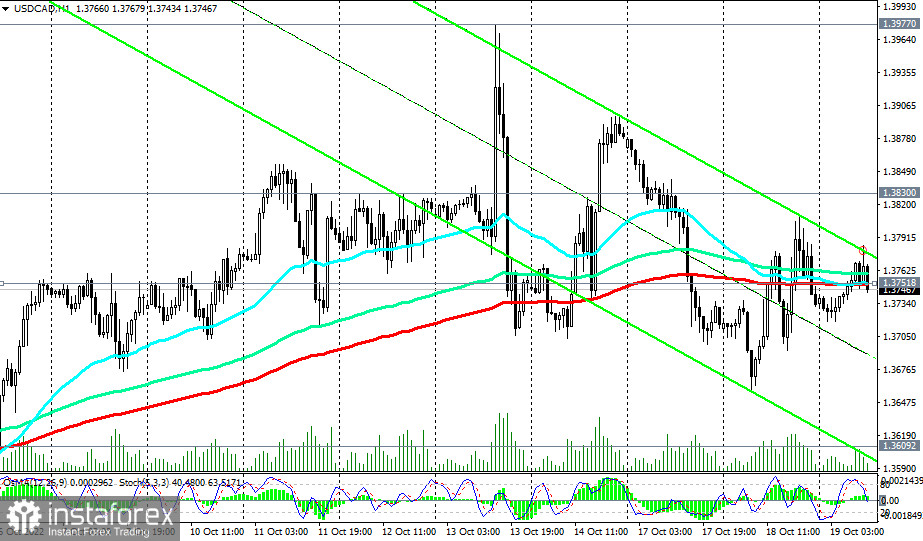

As of writing, USD/CAD is trading near 1.3751, an important near-term support level, expressed by the 200-period moving average on the 1-hour chart. Its breakdown and the breakdown of the local support level 1.3657 may provoke a deeper corrective decline.

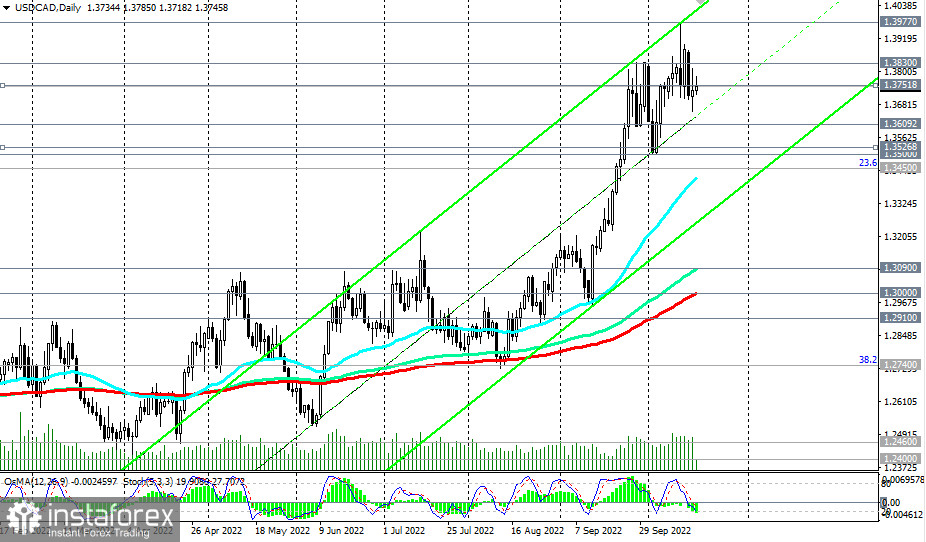

In the main scenario, and after the breakdown of the local resistance level 1.3830, the growth of USD/CAD will resume towards the upper border of the rising channel on the daily chart and the local resistance level 1.3977.

The driver of today's movements in the pair may be the publication at (12:30, 14:30, 18:00 GMT) of important macro statistics for the US and Canada and the speech (at 22:30) of Federal Reserve Bank of St. Louis President James Bullard.

Support levels: 1.3751, 1.3609, 1.3526, 1.3500, 1.3450, 1.3090, 1.3000, 1.2910

Resistance levels: 1.3800, 1.3830, 1.3900, 1.3977, 1.4000

Trading Tips

Sell Stop 1.3650. Stop-Loss 1.3820. Take-Profit 1.3609, 1.3526, 1.3500, 1.3450, 1.3090, 1.3000, 1.2910

Buy Stop 1.3820. Stop-Loss 1.3650. Take-Profit 1.3900, 1.3977, 1.4000