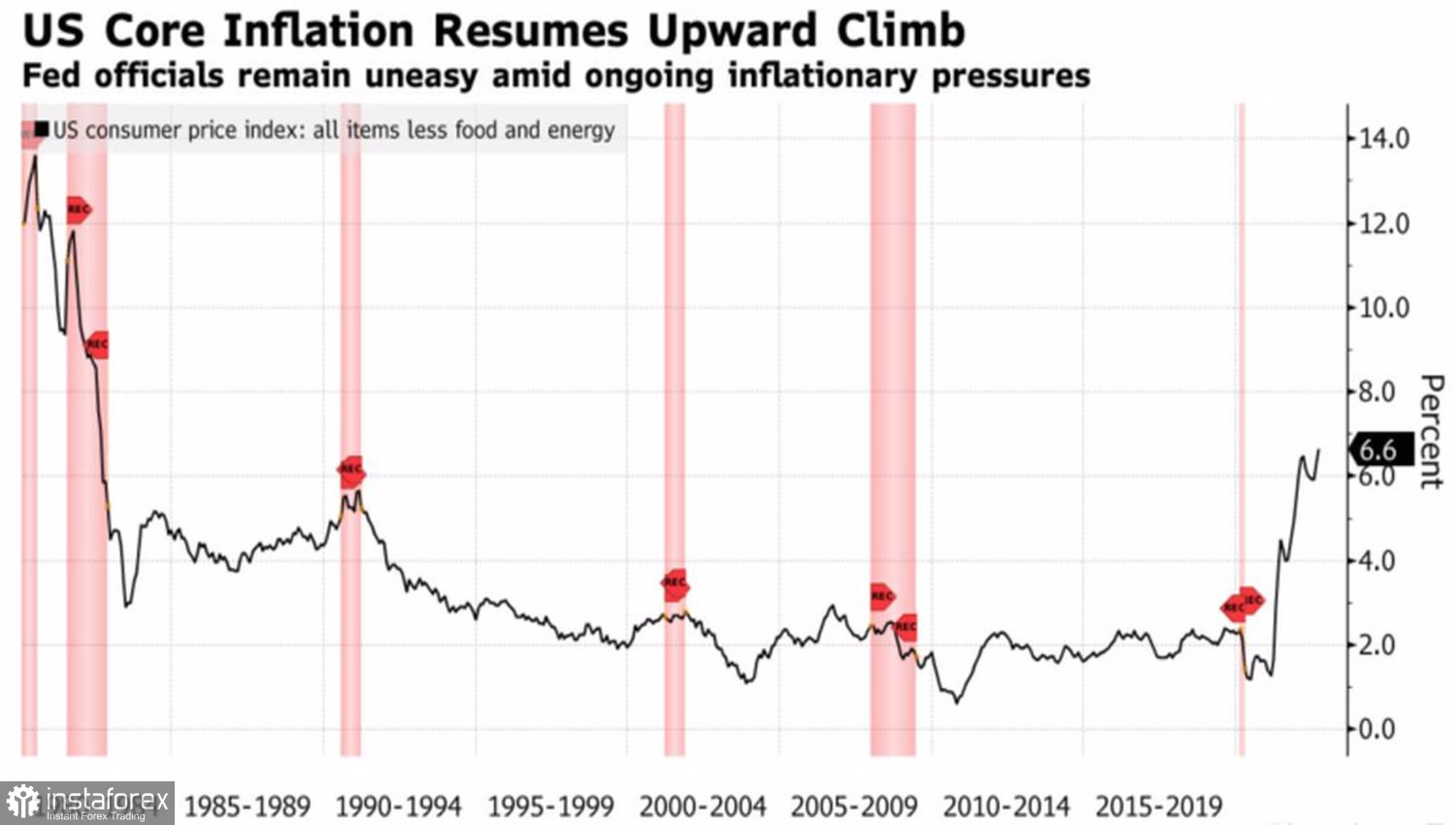

Managers make decisions, but employees prepare the ground for them. And when the Fed officials say in a Bloomberg insider that the US economy is doing much better than expected, which explains the acceleration of core inflation to 6.6%, investors return to buying dollars. Nobody has canceled American exceptionalism, which, coupled with high demand for safe-haven assets, increases the likelihood of an early recovery of the EURUSD downward trend.

Trends in dollar pairs break when the global economy starts to perform better than the US and (or) the Fed eases monetary policy. Looking at Germany and the Eurozone with their energy crisis and at China with its COVID-19, you understand that the two largest regions of the world are not able to adequately compete with the US. How can the global economy outpace America?

The Fed is not thinking about a dovish turn. Minneapolis Fed President Neel Kashkari is puzzled as to how the federal funds rate can stop at the 4.5–4.75% expected by the futures market if core inflation continues to accelerate. This means that the central bank has not done its job and will continue to tighten monetary policy.

Dynamics of American inflation

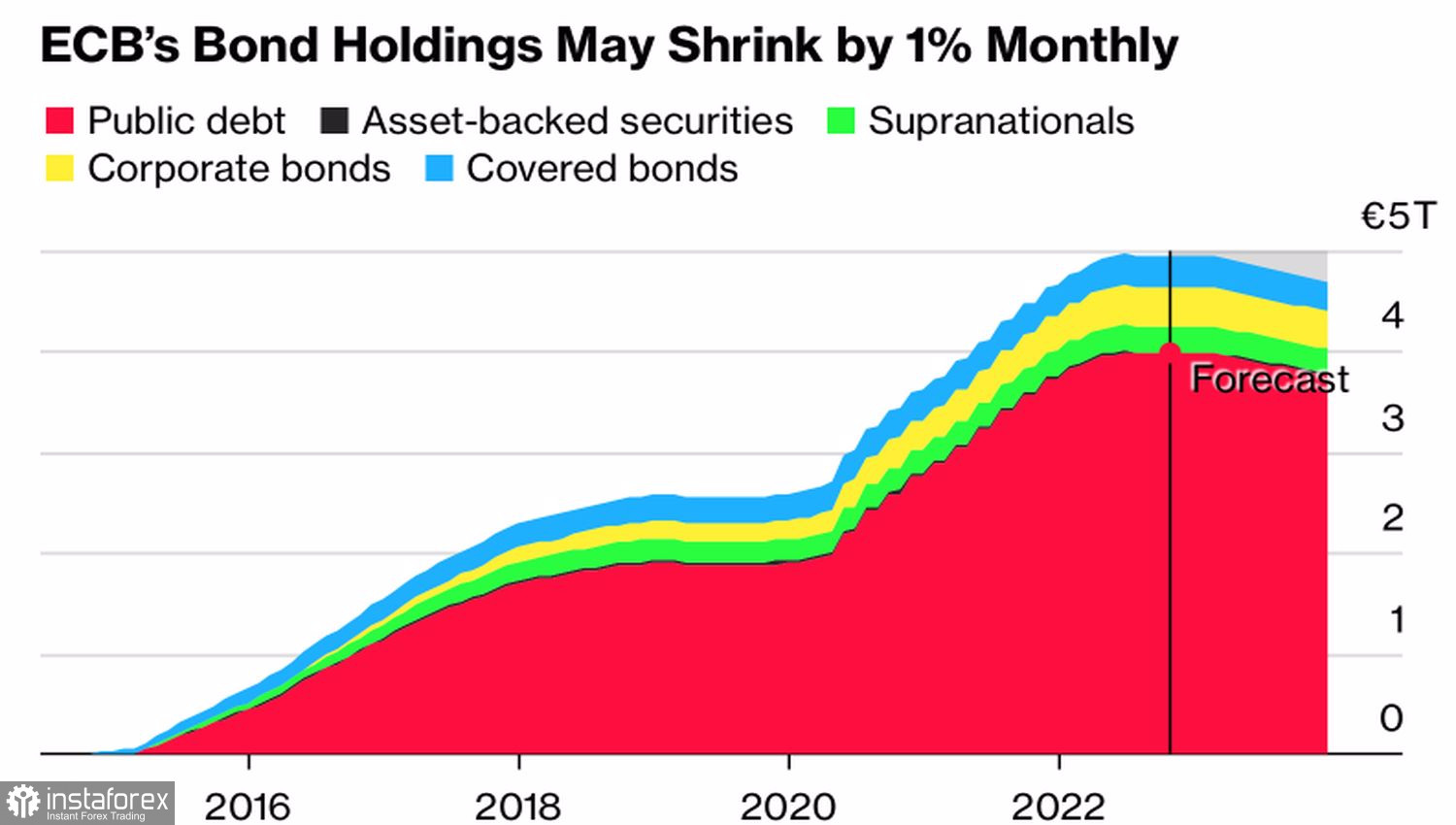

The ECB certainly does not intend to lag behind either. It understands perfectly well that by slowing down, it is possible to accelerate the fall of the EURUSD, which will adversely affect inflation. In the eurozone, devaluation contributed to the growth of exports and GDP. Now, when most economies are weak, it is difficult to count on strong external demand. It is better to wage not conventional, but reverse currency wars.

In this regard, the statements of Bundesbank President Joachim Nagel that it was time to stop reinvesting the income received from the repaid bonds, in other words, to reduce the balance sheet, on paper should have extended a helping hand to EURUSD. In fact, when the ECB is just talking about a quantitative tightening program, the Fed is already specifically promoting it.

Dynamics of the ECB's balance sheet

Thus, despite the fall in gas prices in Europe and the stabilization of financial markets in Britain, fundamentally nothing has changed in the main currency pair. The US economy is still stronger than Europe's. The Fed is still faster than the ECB. Demand for the dollar as a safe-haven asset is strong. These three key drivers provide EURUSD bears with a comfortable edge.

Of course, not a single trend is complete without a correction, and pullbacks will occur from time to time. Especially against the backdrop of rising stock indices and falling yields on US Treasury bonds. But at the moment, there is no reason to doubt the strength of the downward trend in the euro against the US dollar.

Technically, on the EURUSD daily chart, the inability of the bulls to cling to the pivot point at 0.9845 was evidence of their weakness and allowed us to form short positions. Including on a break of support at 0.9815. The recommendation is to keep and periodically build up shorts.