Key data on inflation in the UK was just published. The indicators once again came out in the green zone: all components of the release exceeded the forecast estimates of most experts. But at the same time, the pound actually ignored this report. The pound has been declining for the second day in a row, apparently in response to the political crisis, the flywheel of which continues to spin.

And yet such a significant macroeconomic report a priori cannot be ignored – just everything in its own time. The report showed that the monetary measures taken earlier failed to curb inflation. Now the question is how the Bank of England will react to this report. The central bank is forced to extinguish fires in the markets in parallel, after a resonant anti-crisis plan was presented at Downing Street. According to the Financial Times, the central bank is likely to postpone the sale of government bonds from its portfolio "until the market is stabilized." Let me remind you that initially the central bank planned to start selling on Thursday before last, but then changed its mind, taking into account the existing risks (now the preliminary date is October 31). According to the Financial Times, members of the Monetary Policy Committee "are very concerned about the fall in the value of government securities in recent weeks, and at the same time they fear that the sale of bonds from the central bank's portfolio may further destabilize the market."

Now two additional components need to be added to this rebus: the continuing rise in inflation in the UK and the aggravating political crisis.

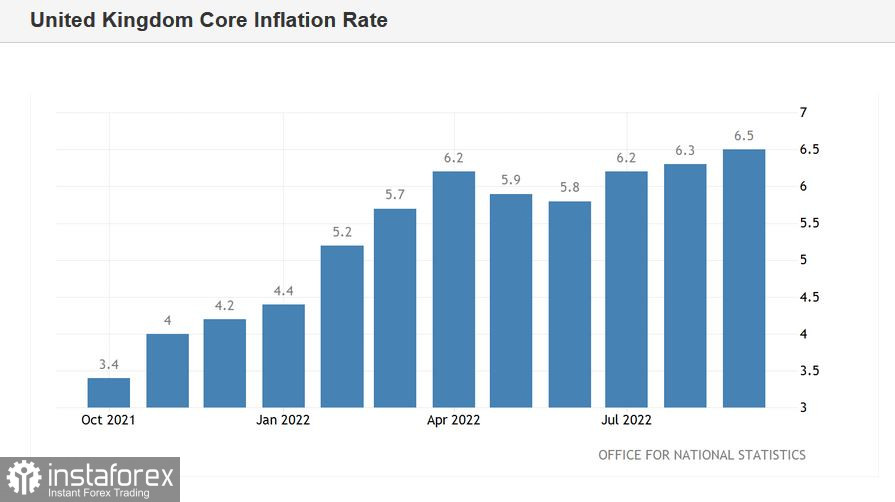

Let's start with inflation. The report really turned out to be on top – literally and figuratively. The general consumer price index on a monthly basis came out at the level of 0.5% with a forecast of growth to 0.4%. In annual terms, the index also showed strong growth, reaching 10.1% (in the previous month it was at the level of 10.0%). This is a long-term record: the indicator showed the strongest growth rate since April 1982. Core inflation showed a similar trend. The core consumer price index jumped to 6.5% (this result is a 30-year high). In addition, a significant increase in the producer purchase price index was recorded in September – both monthly (0.4%) and annual (20.0%). The retail price index showed similar dynamics.

The structure of the release suggests that in addition to energy, food prices have risen significantly – by 14.8% at once in annual terms. This is the strongest growth rate in more than 40 years. Furniture and household goods have become another driver of CPI growth – these categories of goods rose in price by almost 11% in September.

After the release of the report, fears began to sound in the market that inflation would again show a jumpy growth at the beginning of 2023 – after the British government weakened support for the population in the context of compensating electricity bills for households. In other words, the "ghost of stagflation" again reminded of itself.

The political crisis in the UK is putting additional pressure on the pound. The Conservative Party has taken up arms against its leader – the majority of representatives of this political force are in favor of the resignation of Liz Truss. At least this is evidenced by the results of the latest YouGov survey. According to published data, 55% of Conservative Party members "absolutely want" Truss to leave her position. And only 38% of respondents are in favor of the head of government remaining in office.

The prime minister's rating collapsed after the presentation of the so-called "anti-crisis plan". The pound collapsed, turbulence began in the markets, and leading politicians and financial institutions (ranging from rating agencies to the IMF) criticized the proposed scenario to the nines.

However, Truss refused to resign voluntarily (having dismissed only the finance minister), but at the same time the campaign against her cabinet is only gaining momentum. According to the current party rules, a vote of confidence cannot be announced to the prime minister for a year after taking office. However, this week it was reported that the UK Parliament may repeal this rule. This was stated not by anyone, but by a high-ranking Conservative MP Geoffrey Clifton-Brown. By the way, he is also the head of the 1922 Committee, which plays a key role in this parliamentary process.

There are more and more suggestions in the British press that Truss will be forced to resign, given the growing discontent both from her fellow party members-deputies and from ordinary conservatives. Amid plunging ratings (both the prime minister and the Conservative Party), such a scenario looks very realistic.

Thus, long positions for the GBP/USD pair in the current situation look, to put it mildly, risky. From a technical point of view, the nearest support level is located at 1.1130 (the middle line of the Bollinger Bands indicator on the D1 timeframe). This is the first and so far the main target for the bears of the pair.