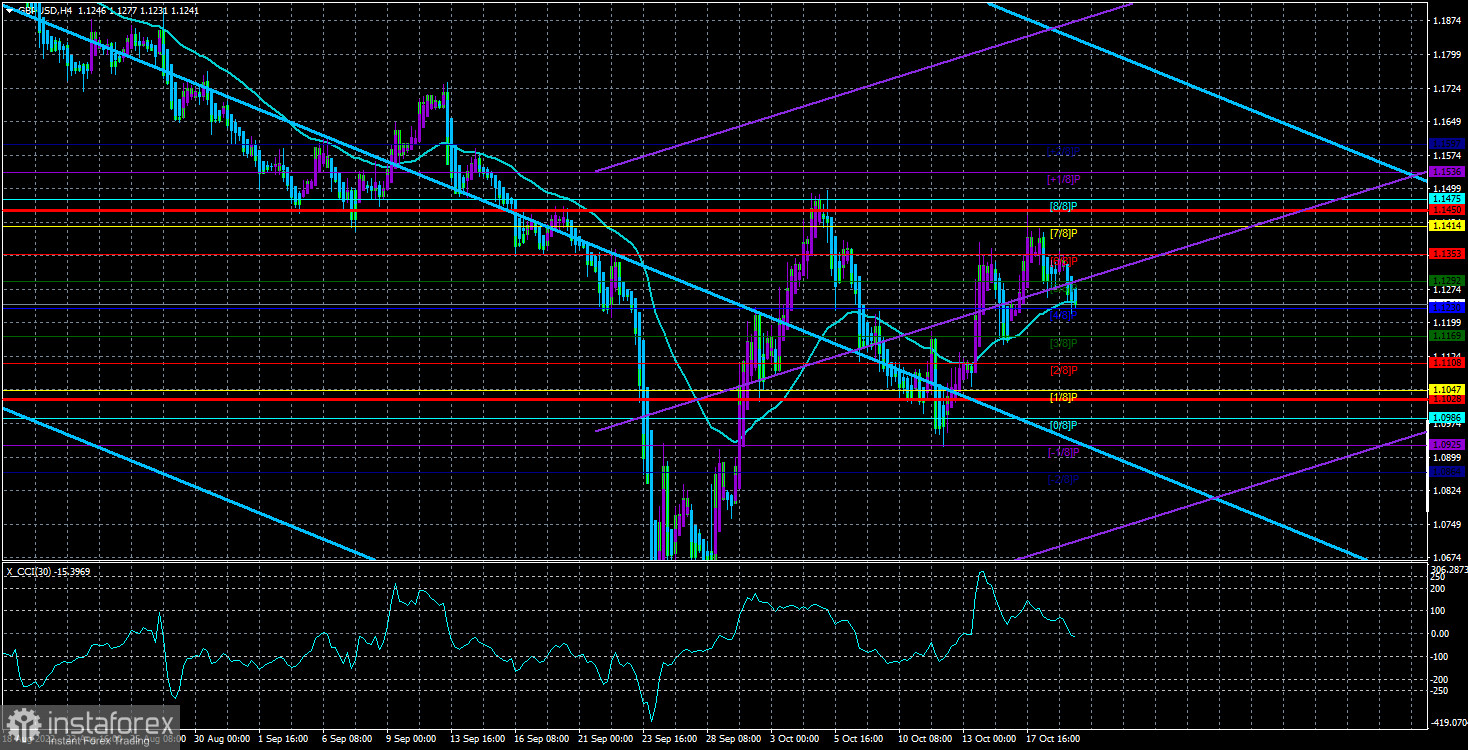

On Wednesday, the GBP/USD currency pair began a new round of decline and may soon fall below the moving average line. You don't need to look particularly closely at the 4-hour TF right now to see that each subsequent price peak is lower than the previous one. Thus, the probability of a new fall in the pound is quite high, although the probability of forming a new upward trend is also preserved. Recall that just a couple of days ago, all the cards were in the hands of the pound. The British currency managed to stay above the critical line on the 24-hour TF, which is very important for its prospects. But what do we see on the 4-hour TF? Instead of developing growth, the pound is pushing around its local peaks. It was achieved simply because, in the UK, they first announced a tax cut (after which the pound collapsed to its absolute lows) and then canceled this initiative (due to which the pound recovered by 1000 points). As we have already said, if this "tax pun" had not happened, there would have likely been neither a collapse nor subsequent powerful growth. It turns out that the pound now has one trump card in its hands – the fact that it continues to be located above the Kijun-sen line on the 24-hour TF. And I must say that the price is not far from this line. So far, we would not like to "put an end" to the pound, but its technical picture is deteriorating again.

I don't even want to talk about the foundation and geopolitics, which have become the main factors of the pound's fall in the last 7-8 months. There is no new geopolitical data. As for the "foundation," the Bank of England announced the completion of the next QE program, which was aimed at stabilizing the swap market, and also, most likely, will postpone the start of the QT program, which involves the sale of long-term bonds from the regulator's balance sheet. It turns out that right in the middle of the monetary policy tightening cycle, we saw monetary policy easing.

Jeremy Hunt has announced the cancellation of tax initiatives.

Well, Jeremy Hunt became the new finance minister. He replaced Kwasi Kwarteng, who had been on it for more than a month. Hunt immediately announced the government's mistakes three weeks ago and noted that almost all tax initiatives would be canceled indefinitely. The basic income tax rate will remain at 20%. From our point of view, Hunt took the right step in the current circumstances. If the market has experienced such a shock because of the tax changes that have not even been adopted, then it is best to postpone this decision for a long time. However, it is completely unclear what Liz Truss, who promised to lower taxes throughout all stages of the election, will look like now. It turns out that earlier she was criticized by parliamentarians and party members because she was going to lower taxes. However, this was known at the time of the election of the prime minister, and the conservatives themselves chose her. Now she will be criticized for not keeping her promise to reduce taxes. The beginning of Liz's premiership is very unfortunate.

The most interesting thing is that the abolition of tax initiatives may not save the British pound. In the past few weeks, investors have understood that the UK economy is, if not in a deplorable state, then in a difficult one. Their desire to invest in it will only decrease over time. Why even buy the pound now if there is a stable and beloved dollar by everyone? Thus, the pound has a few days to start growing urgently and keep on its hands the few "technical" trumps still left. If this fails, the pound may rush down again.

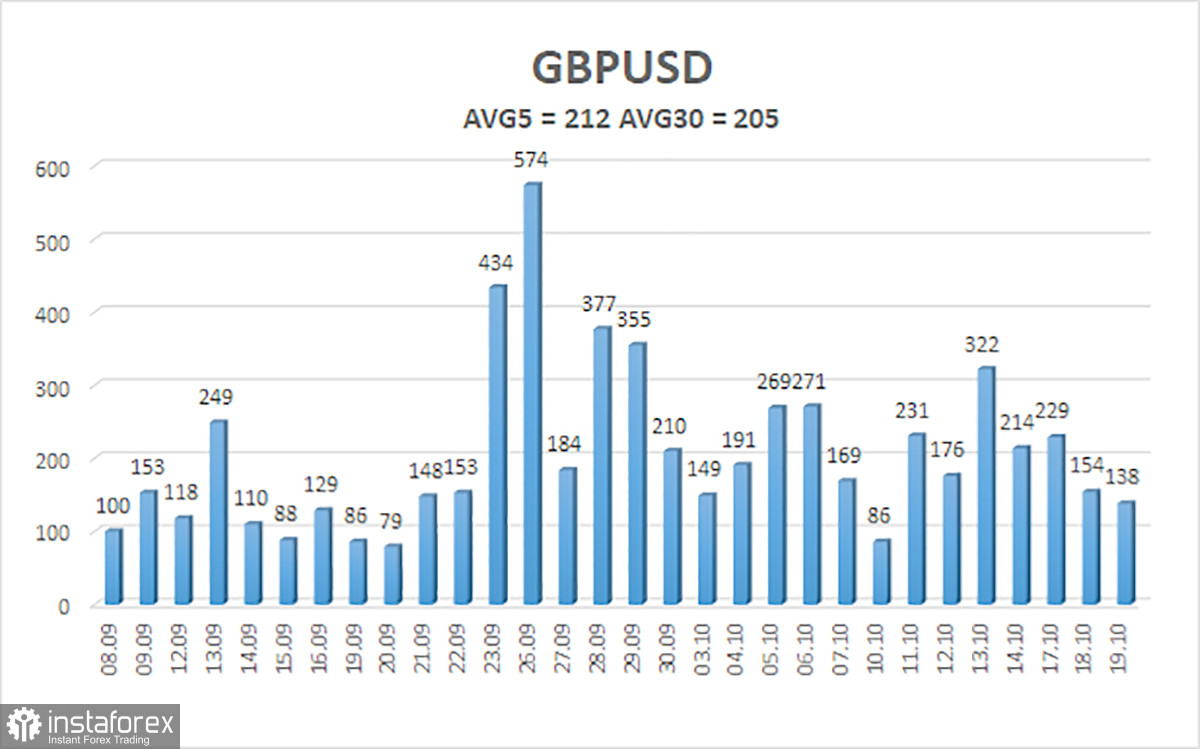

The average volatility of the GBP/USD pair over the last five trading days is 212 points. For the pound/dollar pair, this value is "very high." On Thursday, October 20, thus, we expect movement inside the channel, limited by the levels of 1.1028 and 1.1450. A reversal of the Heiken Ashi indicator upwards will signal a possible resumption of the upward movement.

Nearest support levels:

S1 – 1.1230

S2 – 1.1169

S3 – 1.1108

Nearest resistance levels:

R1 – 1.1292

R2 – 1.1353

R3 – 1.1414

Trading Recommendations:

The GBP/USD pair has started a new round of correction in the 4-hour timeframe. Therefore, at the moment, new buy orders with targets of 1.1353 and 1.1414 should be considered in the event of a reversal of the Heiken Ashi indicator up or a rebound from the moving average. It is necessary to open sell orders when fixing below the moving average with the goals of 1.1108 and 1.1047.

Explanations of the illustrations:

Linear regression channels help determine the current trend. If both are directed in the same direction, then the trend is strong.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction to trade now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.