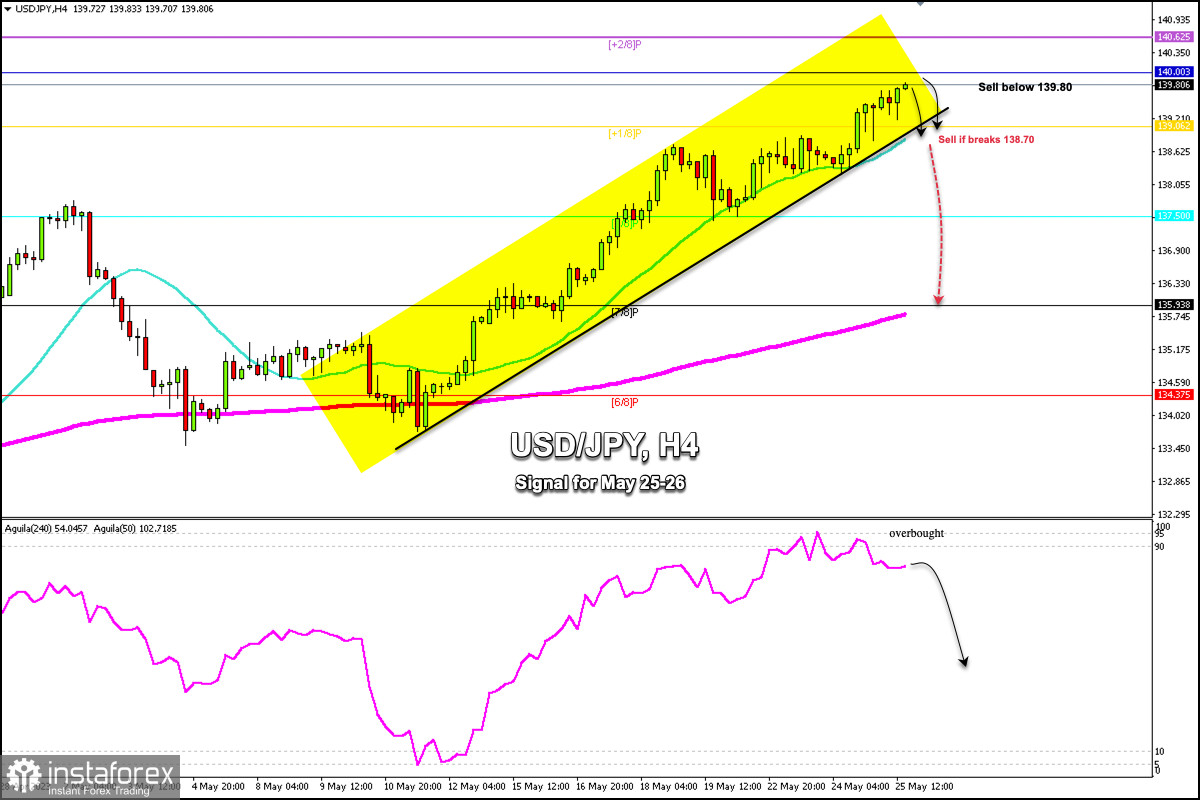

Early in the American session, USD/JPY is trading around 139.80. It is about to reach a strong resistance zone and a psychological level of 140.00.

USD/JPY has been testing the 139.70 zone during the European session and we can see a technical accumulation on the 4-hour chart which could be a sign of exhausting bullish strength. In the next few hours, a correction is expected to occur towards the +1/8 Murray area located at 139.06.

In case the Japanese Yen breaks the uptrend channel formed since May 9, this could be a sign of a change in trend and we could expect a fall towards the 7/8 Murray located at 135.93 or to the 200 EMA located at 135.70.

On the other hand, if USD/JPY continues to rise, strong resistance pressure is expected around the psychological level of 140.00 and finally, the instrument could face +2/8 Murray located at 140.62. From 140.00 to 140.62 is a strong rejection zone and the yen could find strong bearish pressure.

Given that the Eagle indicator is signaling extremely overbought levels, an imminent technical correction is likely to occur in the next few hours. Therefore, this could be seen as an opportunity to sell USD/JPY below 140.00 with targets at 139.06.

In case the yen breaks and consolidates below the 21 SMA located at 138.70, this could be a clear signal to sell with targets at 137.50 (8/8 Murray) and 135.93 (7/8 Murray).