Dollar rose yesterday after Philadelphia Fed President Patrick Harker said the central bank is likely to raise rates above 4%. Most likely, it will remain at this level, or increase further if needed. Fed member Lisa Cook said the same thing, stressing that rates need to continue to rise to control inflation. The current rate is between 3% and 3.25%.

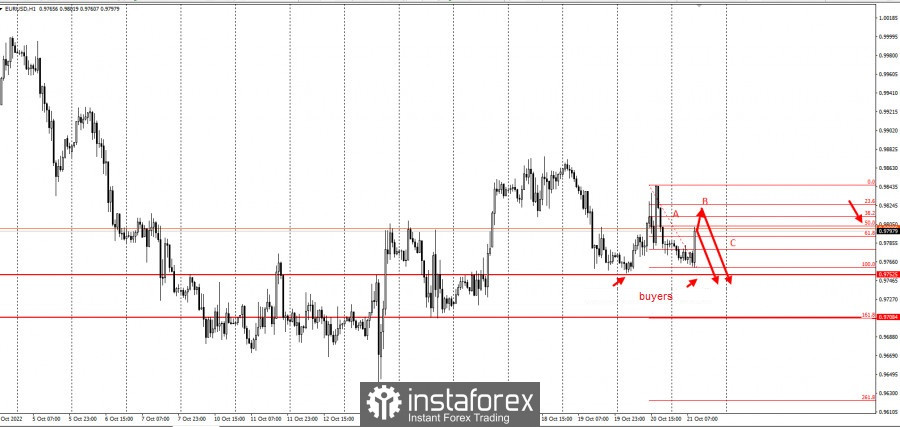

This scenario creates opportunities to open short positions in EUR/USD.

Since a three-wave pattern (ABC) developed, where wave "A" represents the selling pressure from yesterday, traders can enter the market by taking short positions to the 50% retracement level. Stop loss could be set at 0.98500, then exit the market on the breakdown of 0.97500.

If you want to enter more technically, pay attention to the breakdown of 0.98180. In this case, the risk will be reduced to 300 pips.

This trading idea is based on the "Price Action" and "Stop Hunting" methods.

Good luck and have a nice day! Don't forget to control the risks.