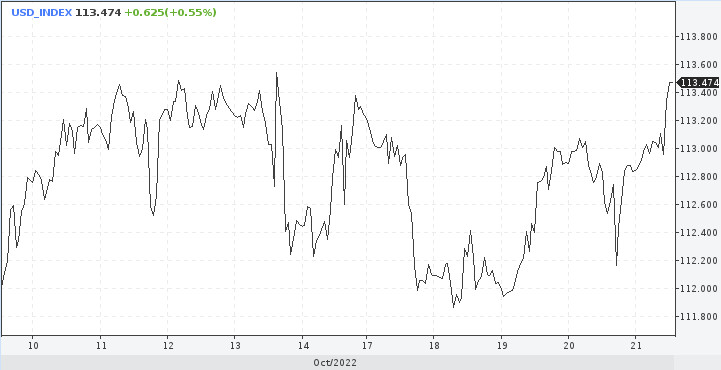

The upward trend of the dollar index remains in force, and reaching the 114.00 mark is just a matter of time, and, perhaps, the next one. The 114.00-115.00 area may be covered in the coming weeks. Although under certain circumstances and periodically emerging risk appetite, there may be risks of a breakout of the 110.00-109.30 area. With such a development of the scenario, the US currency will most likely not only face further losses, but there will be a risk of a deeper downward trend.

Breaking the recent lower high at 113.90 could fuel the dollar's rally. The level of 117.00 is another potential obstacle. If it is surpassed, the dollar will rush to 11-year peaks, located in the area of 121.00-122.00. Here, too, obstacles await.

After yesterday's hitch, the dollar went on the offensive again on Friday. The unexpected decline in jobless claims data and hawkish comments from Federal Reserve members fueled expectations for more aggressive rate hikes in the coming months. This offsets the positive coming from high corporate earnings.

The representative of the US central bank, Lisa Cook, made it clear to the markets that the work to reduce inflation is in full swing, the Fed will act until it achieves its goal. The head of the Philadelphia Fed, Patrick Harker, made a similar statement and said that by the end of the year the rate would be raised to at least 4%.

At the end of the week, the dollar is in a fighting mood due to the growth in the yield of treasuries. The global background encourages the purchase of defensive assets. The UK is also playing a role. Investors are in suspense due to political events in Great Britain.

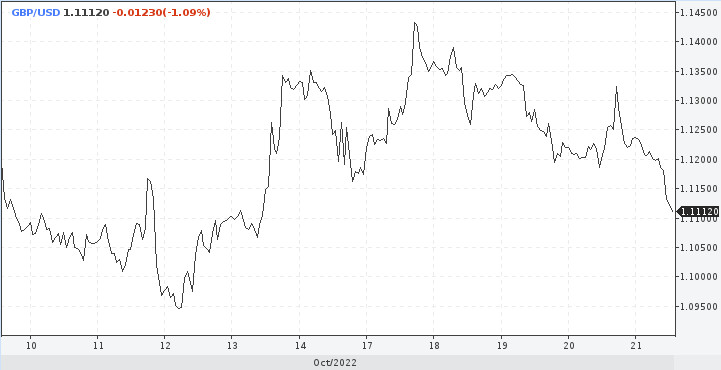

The resignation of Liz Truss and the potential return to the premiership of Boris Johnson are pulling the rug out from under their feet. On the one hand, the pound was pleased with the resignation of Truss, on the other hand, political uncertainty, huge inflation, weak economic data and inactivity of the Bank of England put strong pressure on pound bulls.

The UK retail sales data released on Friday once again highlighted the big problems. The September index fell 1.4%, well above the estimated 0.5% monthly drop.

Theoretically, retail sales could recover slightly before the end of the year, given that household disposable income is strongly supported by lump sum subsidy payments from the government. So far, this is only an assumption, and the reality looks very sad.

The retail reading came at the end of a volatile week that also included political imbalances in the country and confusion. In fact, a desperate struggle has been launched by the ruling party for the appointment of a replacement, whose identity is expected to become known before the end of the month.

Political analysts highly appreciate the chances of Boris Johnson returning to the chair of the British prime minister. For this, Johnson should return from a foreign vacation this weekend. According to the polls, he is well ahead of Rishi Sunak, who tried to fight for the post of prime minister in the summer.

"Markets may remain wary of yet another potential takeover by the right wing of the Tory party, which could complicate the Bank of England's job of fighting inflation. In turn, the reaction of the pound may be more negative," commented the strategies of Credit Agricole CIB.

There are also big doubts that currency players will be happy about Johnson's return, as his reign has been rather chaotic.

"They are likely to want more clarity on the course of the government's future policy, given that its equalization plans need to be aligned with the Bank of England's fight against inflation," economists concluded.

It is unlikely that British politicians will be able to restore market confidence in the near future. In this regard, the pound will remain under selling pressure. Sterling has too many reasons to go down right now.

The GBP/USD pair sank to more than a week's low on Friday. Bullish momentum is reduced and risks are skewed to the downside. Support is at levels 1.1130, 1.1060. Resistance - 1.1360, 1.1420.

Reverse impulsive upward movement is also not excluded, the pound is now volatile without a directional movement, so there may be bilateral trading in the range of 1.1060-1.1360. At the same time, the risk of reaching the value of 1.0800 remains elevated.