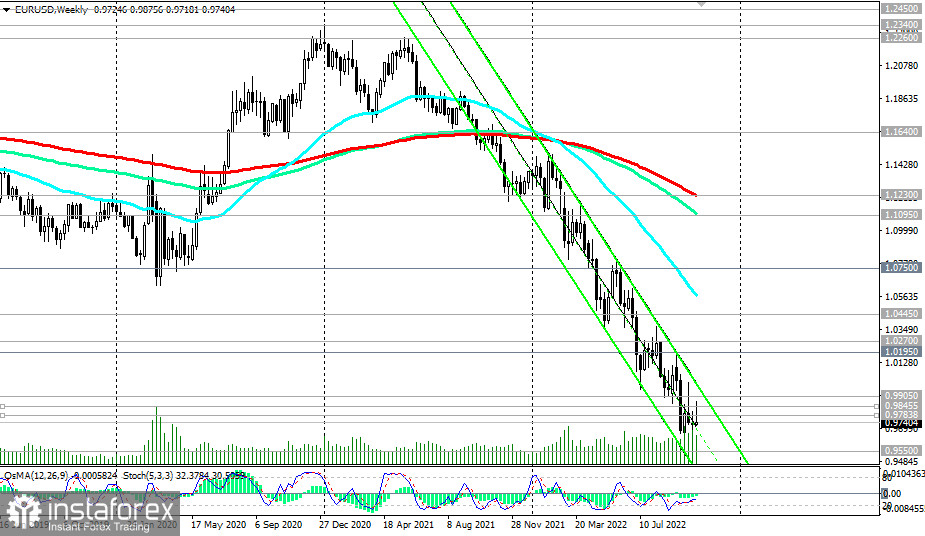

As of writing, EUR/USD was trading near 0.9740 in a sustained bear market zone.

From a fundamental point of view, we should expect at least a strong bearish momentum in the EUR/USD pair, and at a maximum, a further fall of the pair towards 20-year lows, when it was trading near 0.8700, 0.8600. In general, the downward dynamics of EUR/USD remains, and the breakdown of today's low at 0.9732 may provoke further decline.

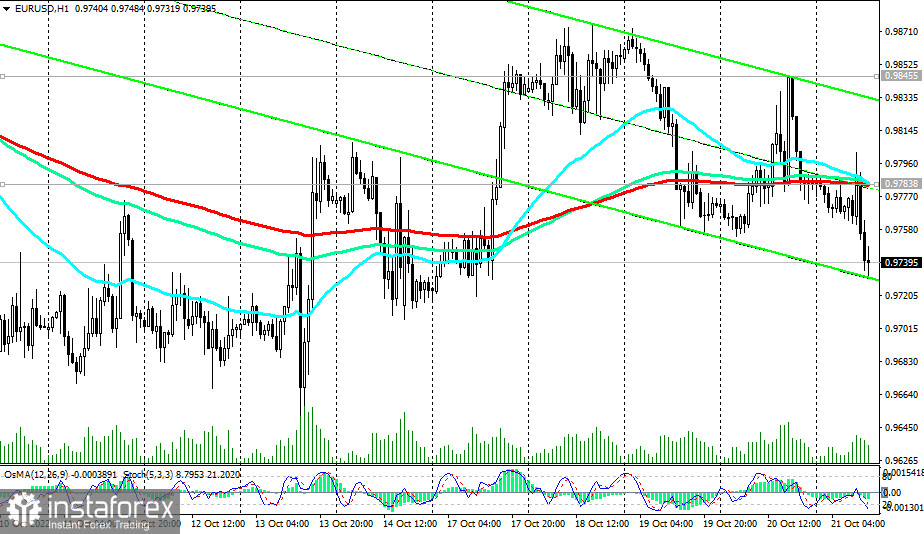

In an alternative scenario, from a technical point of view, a corrective growth is likely towards the resistance levels 0.9905 (50 EMA on the daily chart), 1.0000. Their breakdown will be a signal for a stronger corrective growth with targets at the resistance levels 1.0270 (144 EMA on the daily chart), 1.0445 (200 EMA on the daily chart).

The first signal for the implementation of the alternative scenario will be a breakdown of the short-term important resistance level 0.9783 (200 EMA on the 1-hour chart).

Support levels: 0.9732, 0.9700, 0.9600, 0.9535, 0.9500, 0.9400, 0.9300, 0.9200, 0.9000

Resistance levels: 0.9783, 0.9800, 0.9845, 0.9905, 0.9935, 1.0000, 1.0195, 1.0270, 1.0445

Trading Tips

Sell Stop 0.9730. Stop-Loss 0.9815. Take-Profit 0.9700, 0.9600, 0.9535, 0.9500, 0.9400, 0.9300, 0.9200, 0.9000

Buy Stop 0.9815. Stop-Loss 0.9730. Take-Profit 0.9845, 0.9905, 0.9935, 1.0000, 1.0195, 1.0270, 1.0445