What doesn't kill makes us stronger. No matter what the Federal Reserve's rival central banks try to rein in the US dollar, it still blooms. It would seem that high inflation-induced rate hikes in other countries outside the US should have cooled the ardor of the bulls on the USD index. It wasn't there! One piece of information about the acceleration of consumer prices in New Zealand, Britain and Canada was enough for the greenback to launch a new attack. The same can be said about foreign exchange interventions.

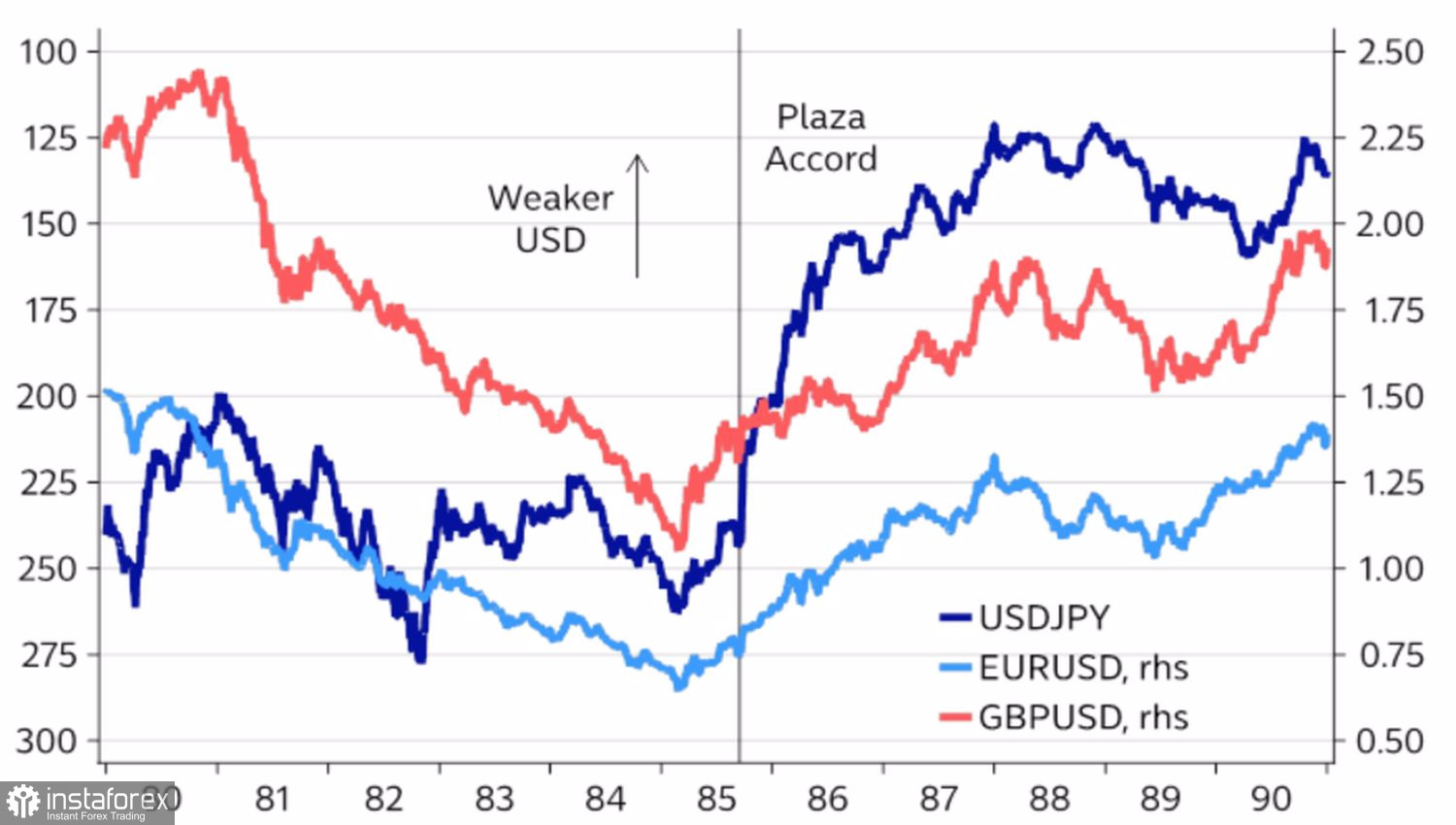

In conditions of low external demand and the highest inflation in decades, the interest in reverse currency wars, thereby strengthening rather than weakening the national currency, is understandable. As well as the dissatisfaction of governments with the fall of its exchange rate. Alas, intervention in the life of Forex does not help. Large-scale long positions on the yen managed to stop the USDJPY pair at 146 for just a few days, after which it rose to 151. At the same time, the experience of foreign exchange interventions with USDJPY in 1998 and 2011, with EURUSD in 2000, with GBPUSD in 1992 was also negative. A coordinated intervention is required, like the Plaza Accord in 1985.

Dollar pairs react to coordinated intervention

The problem is that the conditions then and now are significantly different. In those years, the Fed defeated high inflation and could afford the weakening of the US dollar. Today, the central bank still has a lot to do before consumer prices begin to move confidently towards the target. In addition, Finance Minister Janet Yellen notes that market-determined exchange rates are the best regime for the US dollar. Its strengthening is the result of differences in economic policies and the shocks that countries face.

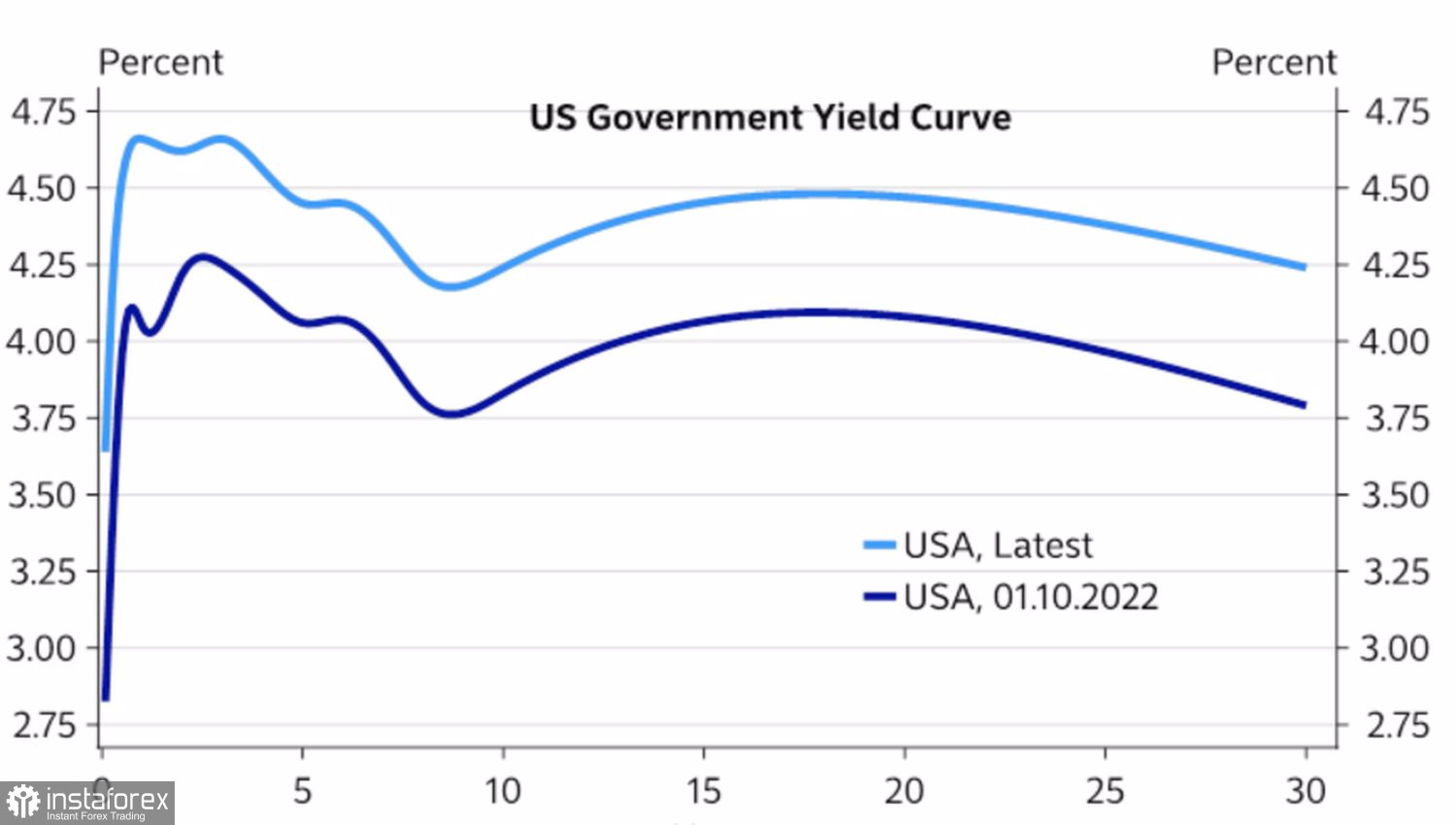

Without US support, currency interventions are doomed to failure. You don't need to go far for an example. Japan threw money to the wind, trying to support the yen diving into the abyss. Its interference in the life of Forex only made the situation worse. Gold and foreign exchange reserves were used to sell USDJPY. It was necessary to get rid of US Treasury bonds, which led to an increase in their yields and further strengthened the dollar.

Dynamics of US Treasury Bond yields

Rates on 10-year securities have reached the highest level since 2007. The situation resembles the events of those years, and investors are beginning to argue that only an increase in profitability to 5-5.25% will allow the indicator to reach a plateau. Until this happens, the US dollar will continue to sweep away everything in its path. No matter how hard its opponents try, raising rates or using currency interventions.

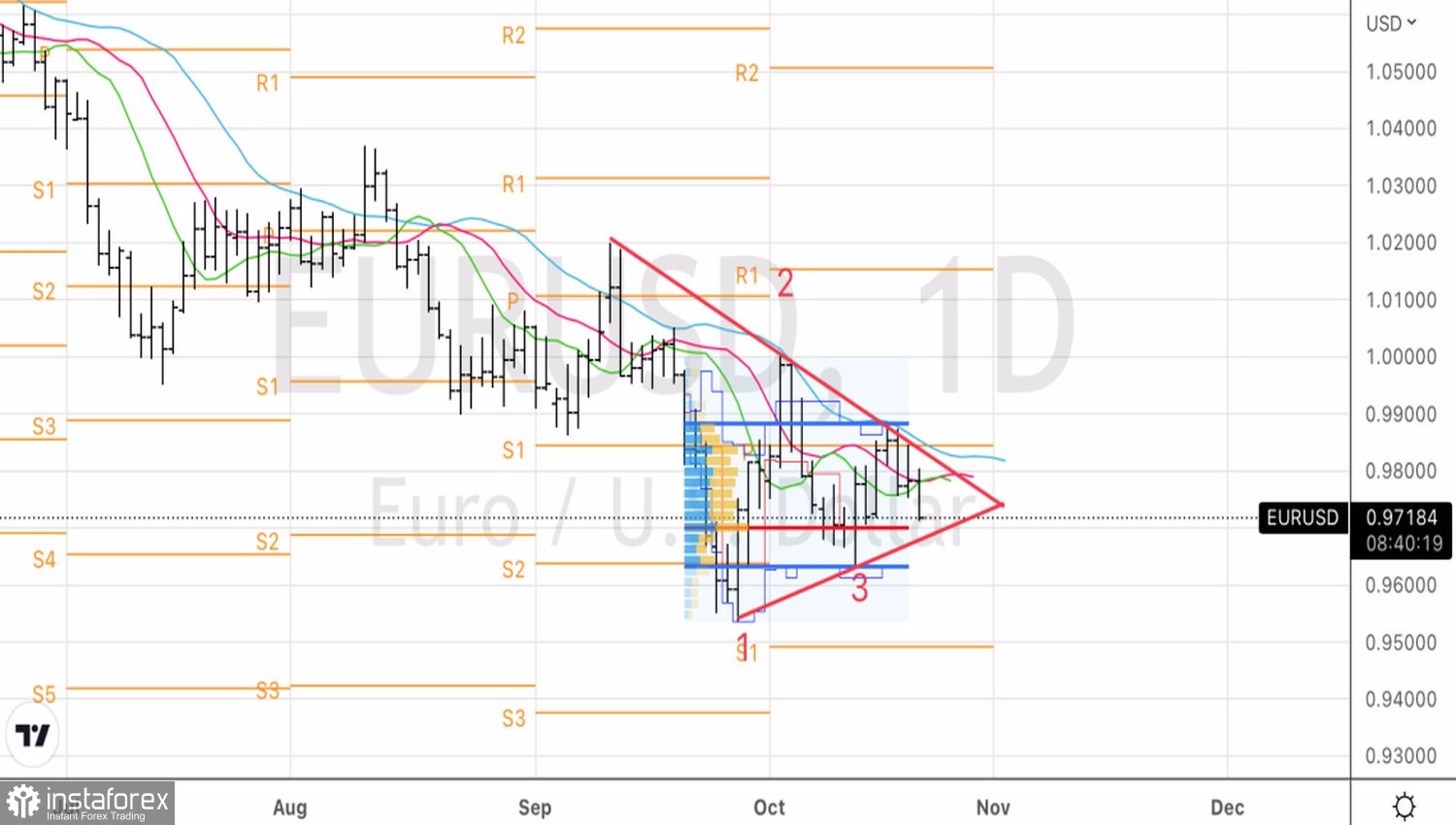

Only the European Central Bank is able to suspend the fall of EURUSD. Its meeting is rightly regarded as a key event of the economic calendar in the last full week of October.

Technically, the EURUSD peak continues on the daily chart. We hold the short positions formed from the 0.9845 and 0.9815 levels and increase them on the breakout of support at 0.97. The initial target is the 0.95 mark.