The GBP/USD currency pair showed identical movements with the EUR/USD pair on Friday. As we have already said in other articles, there were no special reasons to show such powerful movements and high volatility. Nevertheless, the pound has been trading very volatile for a month, as seen in the illustration below. Unlike the euro currency, the pound generally retains a higher chance of growth. The technical factor speaks in favor of this scenario, as the British currency managed to stay above the critical line on the 24-hour TF. Unfortunately, there are no more factors to support the pound. We do not believe that the departure of Liz Truss from the post of Prime Minister of Great Britain is a positive for it. Yes, Truss made a global mistake with the tax plan, which was poorly worked out, and other members of the British parliament were not ready for it. However, the market has already worked out the factor of canceling the implementation of this plan, thanks to which the pound rose after falling to absolute lows by 1100 points. The other prime minister, whoever it is, will face the same problems as Truss. The British population needs to compensate for at least part of the increased energy bills and the rapid devaluation of the British pound. Probably, taxes will no longer be lowered, but programs will be needed to compensate for the strong increase in the price of energy resources. Therefore, the British budget will still face a deficit.

As for the "foundation," nothing changes here. The pound may feel some support simply because the market has long taken all possible negative factors into account. The Bank of England, there is no doubt, will continue to raise its rate, as will the Fed, but the seven previous increases did not affect the pound positively. Maybe you must wait for traders to get tired of selling the pound? However, it should be remembered that economic problems in the UK will not disappear overnight.

It would be almost an empty trading week if not for the elections.

Apart from the election of the Prime Minister, there will be a few important events in the UK this week. On Monday, business activity indices will be published, remaining below or equal to 50.0 with a high probability. There are already negative trends in the British economy, although GDP has been relatively stable in recent months. And no more important events are planned.

The situation will be a little better in the States. On Monday, the same indices of business activity in the service and manufacturing sectors will be released, but not ISM, but less significant ones – S&P. The reaction to them is unlikely to be strong. On Tuesday and Wednesday – nothing noteworthy. On Thursday, a report on orders for long–term use goods, which once provoked a strong market reaction but not recently. However, it does not matter for the pound/dollar now since its volatility is off the scale even without macroeconomic statistics. On Friday, there will be reports on changes in personal income and expenses of the American population (also absolutely secondary reports) and the consumer sentiment index from the University of Michigan. This can provoke a reaction only if its actual value is very different from the previous forecast.

As you can see, there will be practically no important events this week, so we will have to focus on the elections in the UK. From our point of view, the absence of important news is rather a positive sign for the pound than a negative one. All the latest news was that the pound was only losing ground against the dollar. Therefore, there is less news, less negativity, and more chances to see the continuation of the growth of the British currency. On Friday, the pair returned to the area above the moving average. Thus, we can count on an upward movement. But it may be "torn" in the near future, that is, with frequent rollbacks and corrections.

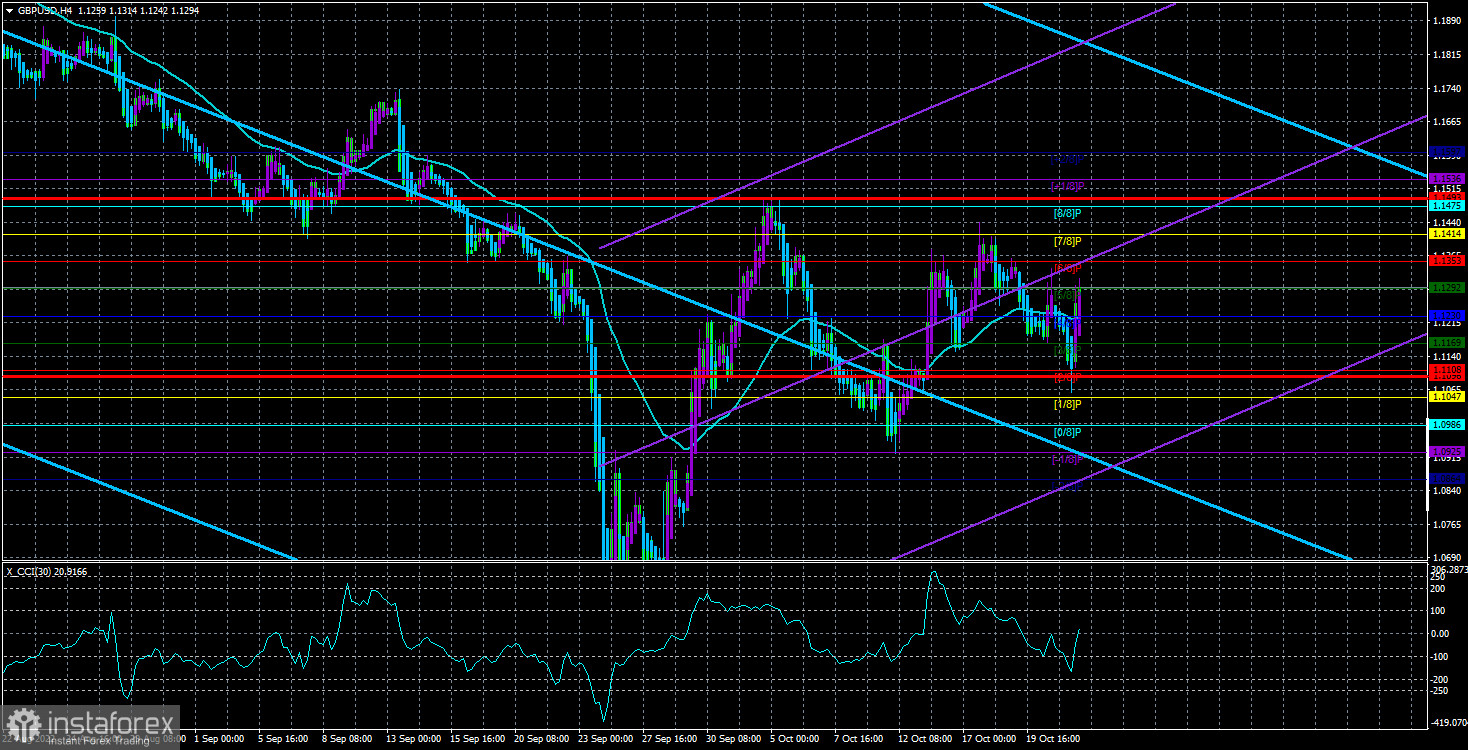

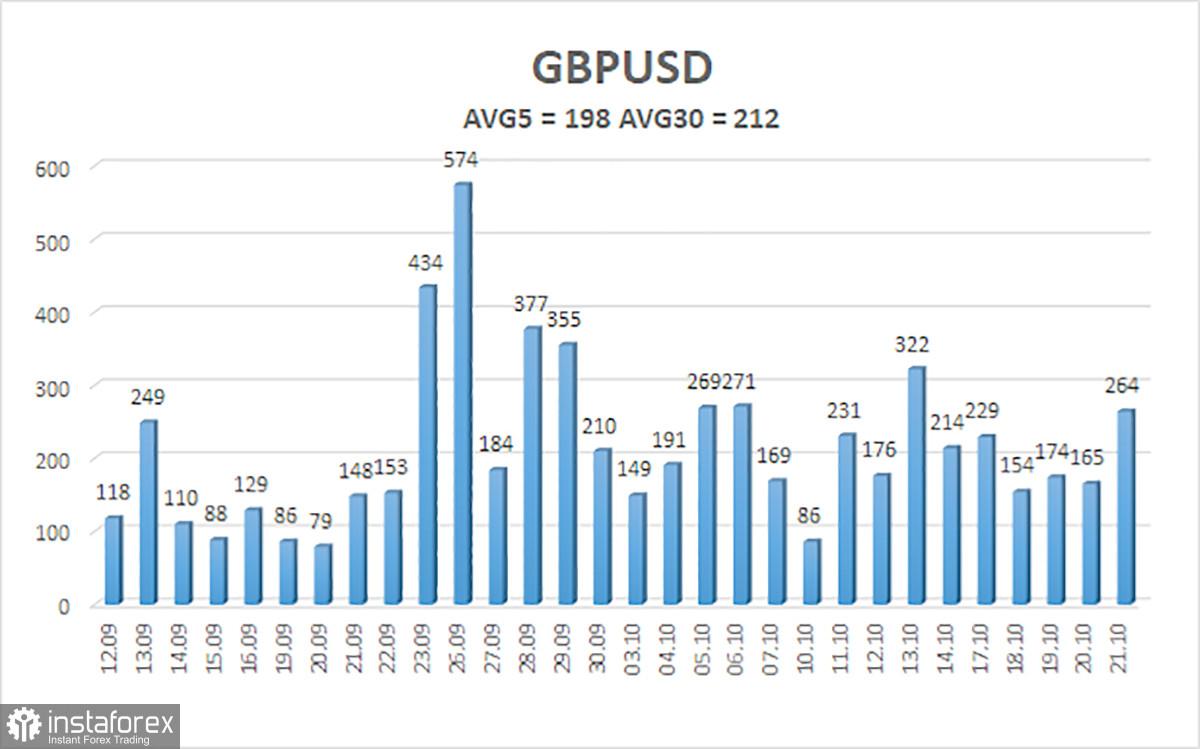

The average volatility of the GBP/USD pair over the last five trading days is 198 points. For the pound/dollar pair, this value is "very high." On Monday, October 24, thus, we expect movement inside the channel, limited by the levels of 1.1098 and 1.1493. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement.

Nearest support levels:

S1 – 1.1230

S2 – 1.1169

S3 – 1.1108

Nearest resistance levels:

R1 – 1.1292

R2 – 1.1353

R3 – 1.1414

Trading Recommendations:

The GBP/USD pair has started a new upward movement in the 4-hour timeframe. Therefore, at the moment, buy orders with targets of 1.1414 and 1.1475 should be considered before the Heiken Ashi indicator turns down. Open sell orders should be fixed below the moving average with targets of 1.1169 and 1.1098.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.