An unexpected intervention of the Bank of Japan led to a sharp drop in the US dollar against all other currencies. Judging by the situation, the BoJ pumped up the market with about $20 billion. Such a decision was taken because of the yen's slump to the lowest level last seen in July 1990.

The euro may bounce after such a rapid and unexpected rise. Nevertheless, it still needs a reason, for example, macroeconomic reports. The fact is that in both the EU and the US, business activity is expected to decline. Preliminary estimates unveiled such a trend. What is more, forecasts for the US PMI are causing a lot of questions. While the services and manufacturing PMI is expected to drop, the composite PMI may increase to 50.1 points from 49.5 points. Such predictions are illogical and considered a negative factor.

US Composite PMI

Traders should also keep in mind the election of a new prime minister in the UK. If Rishi Sunak wins the race, investors may define this as a positive signal. The fact is that the UK economy is coming across tough times and needs immediate solutions. Rishi Sunak has competencies in this field. That is why banks, the largest investors, suppose that Rishi Sunak is the best candidate for this post. This, in turn, may boost the pound sterling, which will drag the euro.

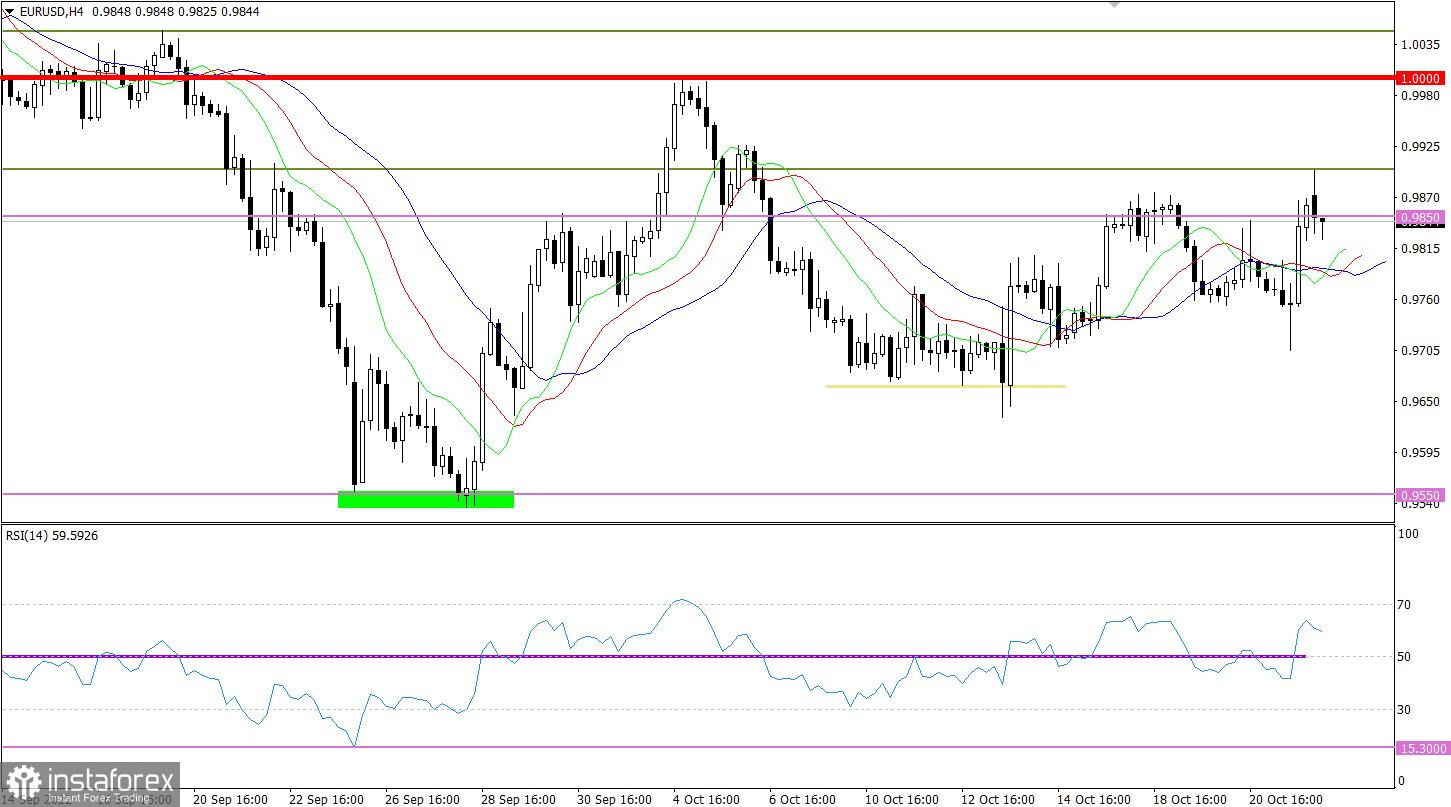

The euro/dollar pair returned to the area of the intermediate level of 0.9850 thanks to an impulsive jump. The pair locally broke the level.

On the four-hour chart, the RSI technical indicator upwardly crossed the middle line 50. This points to a rise in the volume of long positions.

In the same time frame, the Alligator's MAs are headed upwards, which corresponds to the recent price impulse. The MAs are still intersecting each other. That is why we cannot figure out a clear trend.

Outlook

Under the current conditions, the touch of 0.9850 once again led to a drop in the volume of long positions. As a result, the pair slackened and bounced. The strongest buy signal will be formed after the price consolidates above 0.9900 on the four-hour chart. Otherwise, the pair will bounce or get stuck.

In terms of the complex indicator analysis, we see that the in the short-term period, the indicator is signaling selling opportunities because of the bounce from the intermediate level. In the intraday period, the indicator is pointing to the recent upward impulse, providing a buy signal.