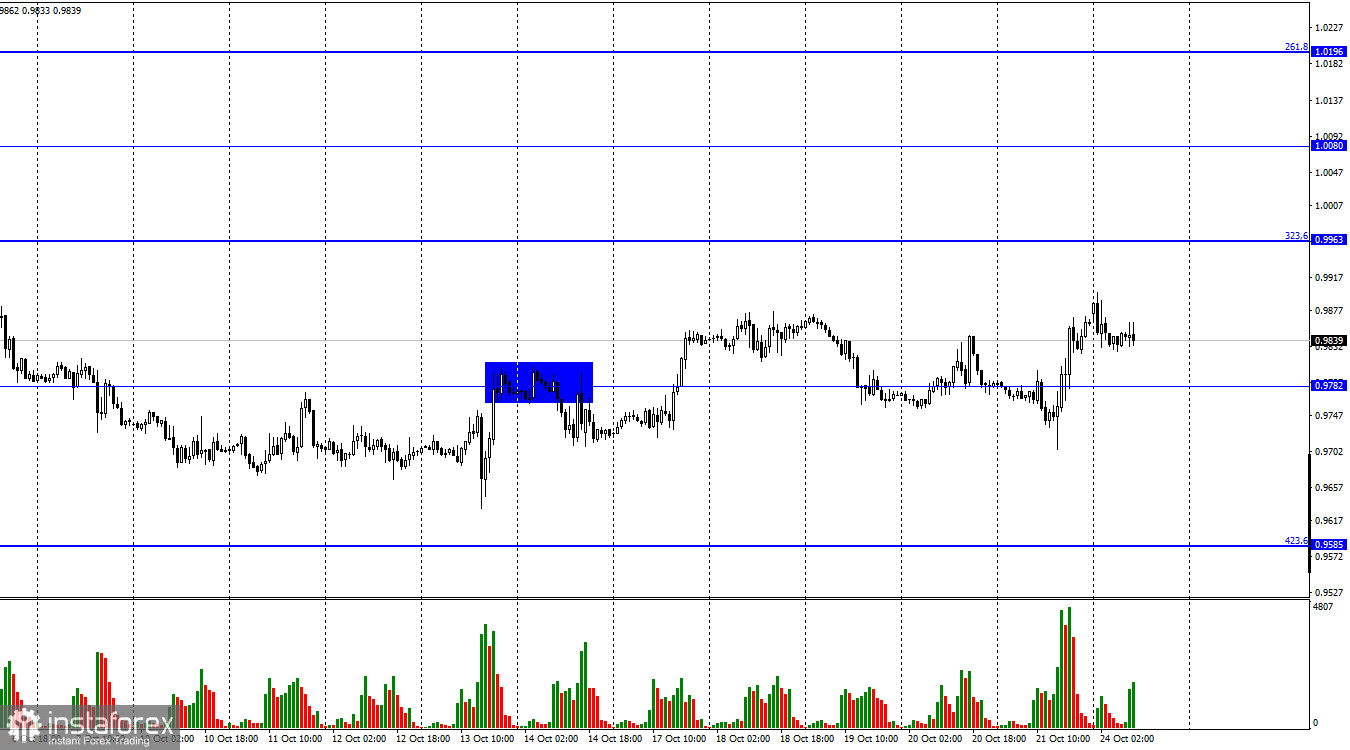

On Friday, EUR/USD reversed in favor of the euro and rose to the Fibo retracement level of 323.6% at 0.9963. Overall, the pair has been trading flat in the past two weeks, especially on the 4-hour chart. This time frame also confirms that the market sentiment is still bearish and the euro is at risk of falling again.

The pair opened the week on a curious note. Just recently, the EU released the PMI data according to which the services PMI stands at 48.2, the manufacturing PMI holds at 46.6 while the composite PMI is at 47.1. All three indices declined from their September readings and ended up below 50.0. This can be an invitation for the euro bears to enter the market. In the afternoon, the PMI data will be published in the US.

Other important events are expected this week. On Thursday, the ECB will hold its penultimate meeting this year. Earlier, Christine Lagarde promised to continue raising the rate, and it seems that she will keep her promise. According to the official forecast, the regulator will lift the rate by another 0.75% to 2.00%. This is good news for the euro. Let's hope it is actually true. There have been speculations lately that the rate could be increased by just 0.50%, and the ECB will fail to keep up with the Fed. So, the euro may get some support on Thursday but it is likely to lose its ground in the long term.

The speech by Christine Lagarde will be another important event on Thursday. If she announces that the ECB will continue to raise the rate until inflation goes down (which is not happening at the moment), the euro will get a chance to strengthen. On the contrary, if Lagarde's speech is full of dovish comments, bears will have more reasons to sell the pair.

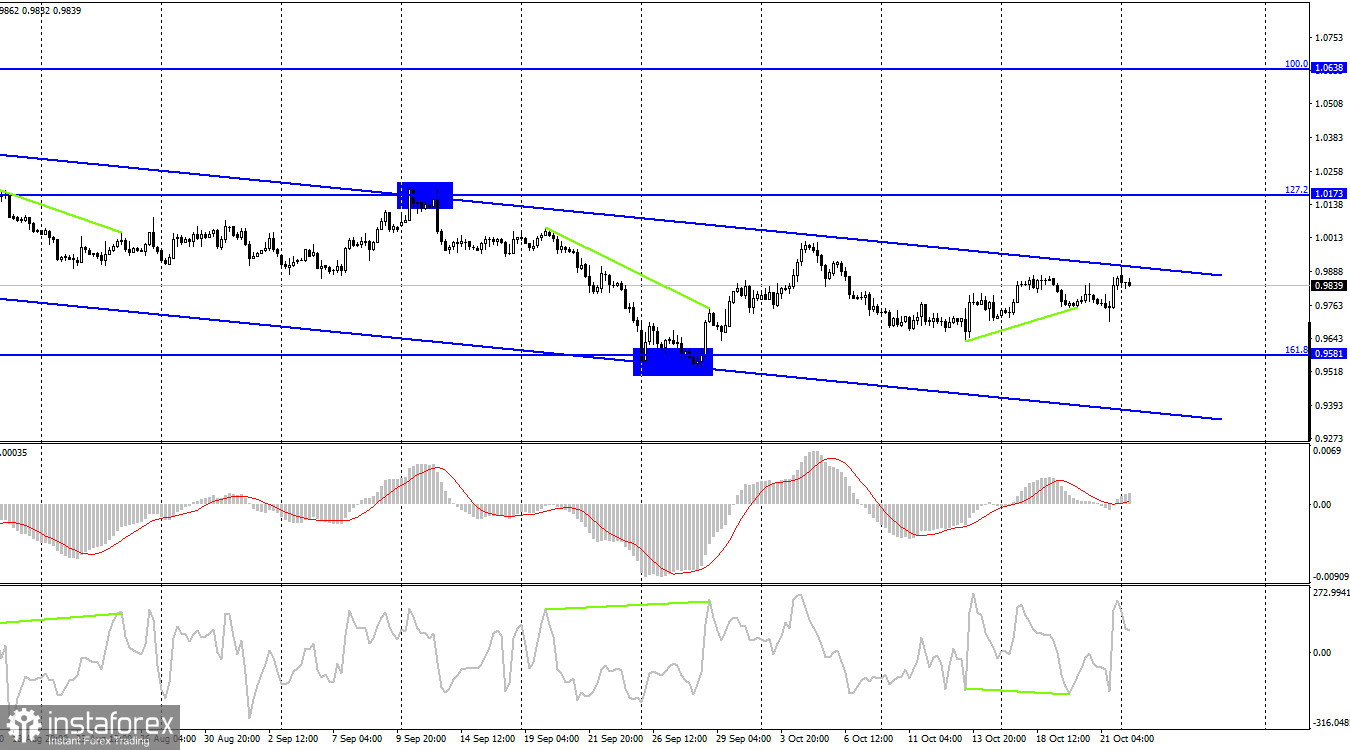

On the 4-hour chart, the pair continues to rise towards the upper line of the descending trend channel. Yet, the market sentiment is clearly bearish in this time frame. Only a firm hold above the descending channel will allow the euro to notably advance towards the Fibonacci retracement level of 127.2% at 1.0173. If the price bounces off the upper boundary of the channel, it will resume the fall to the level of 161.8% at 0.9581. The bullish divergence of the CCI has been canceled.

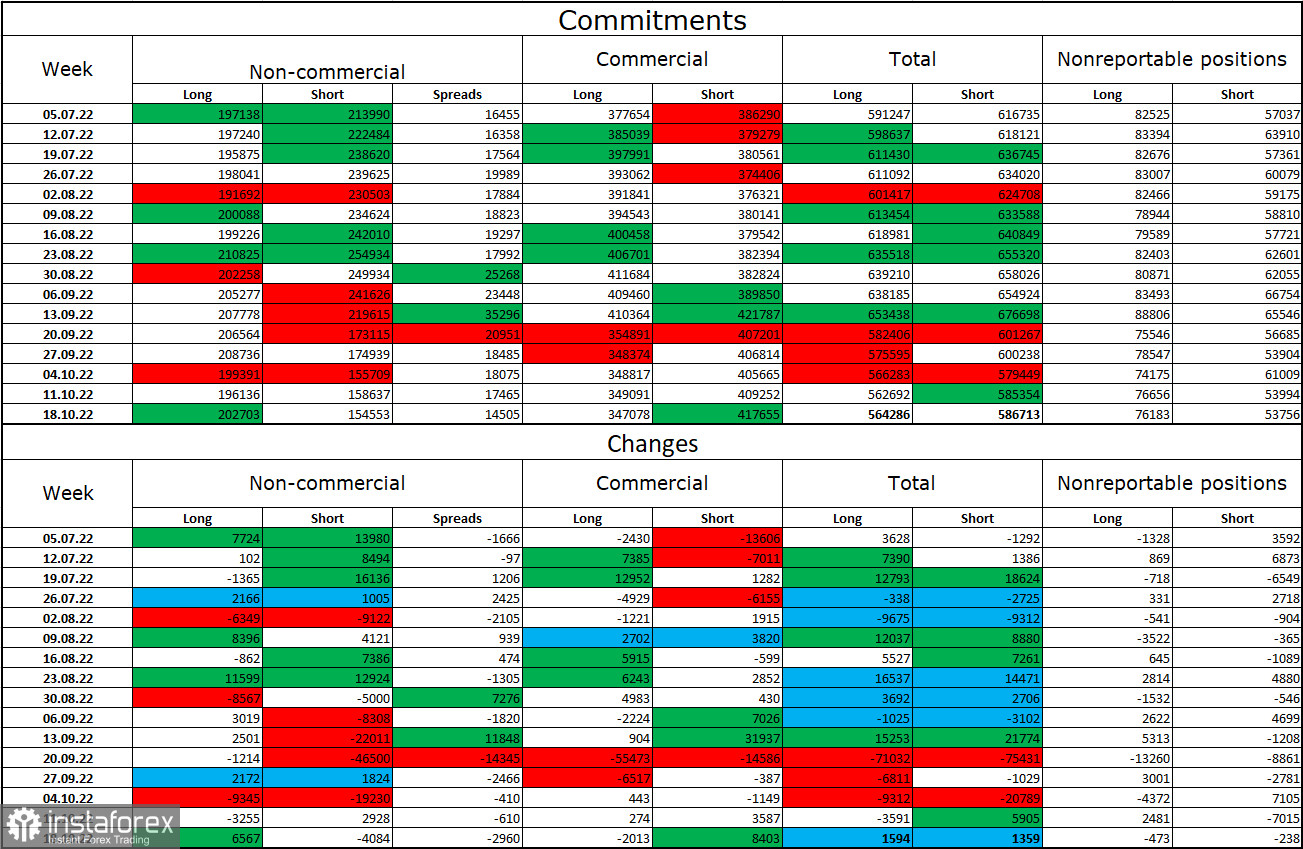

Commitments of Traders (COT) report:

Last week, traders opened 6,567 long contracts and closed 4,084 short contracts. This means that large market players became a bit more bullish on the pair. The sentiment is clearly bullish not bearish like with the British pound. The total number of long contracts opened by traders is 202,000 while the number of short contracts stands at 154,000. Yet, the euro is still struggling to develop a proper uptrend. In recent weeks, there were some chances for the euro to recover. However, traders are hesitant to buy it and prefer the US dollar instead. Therefore, I would advise you to focus on the main descending channel on the H4 chart although the price failed to close above it. So, we may see another fall in the euro soon. Even the bullish sentiment of larger market players does not allow the euro to develop growth.

Economic calendar for US and EU:

EU - Manufacturing PMI (08-00 UTC).

EU - Services PMI (08-00 UTC).

US - Manufacturing PMI (13-45 UTC).

US - Services PMI (13-45 UTC).

On October 24, there are two minor events in both the US and the EU economic calendars. Therefore, the impact of the information background on the market sentiment will be very weak today.

EUR/USD forecast and trading tips:

I would recommend selling the pair if the price bounces off the upper line of the channel on the 4-hour chart. The target in this case should be the level of 0.9581. Buying the pair will be possible when the price holds firmly above the upper line of the channel on the H4 chart, with the target at 1.0173.