Futures on US stock indexes have risen as investors are still counting on good reports on the income and expenses of the world's largest companies. Treasury bond yields fell, and the dollar rose. Futures contracts for the S&P 500 rose 0.3%, while the high-tech NASDAQ added about 0.5%, taking advantage of the growth of Twitter Inc., which rose 2.1%, closing the gap with the price of Elon Musk's buyout offer. Shares of Tesla Inc. fell more than 2%.

The focus remains on the dynamics of interest rates in the United States. This week, investors' attention will be focused on the earnings of large-cap technology companies, which are among the key engines of the S&P 500. The five largest technology companies by revenue will report this week: Apple Inc., Microsoft Corp., Alphabet Inc., Amazon.com Inc., and Meta Platforms Inc. Most likely, companies will report the sharpest decline in revenue in three years. And if the stock market withstands this pressure, it will be possible to start treating its future more positively and seriously say that the bottom is still gradually being felt. Much more positive times are ahead of us.

As for the reduction in company profits, it was evident that demand was slowing down. However, companies working with software and cloud computing technologies are still quite resistant to everything happening, which can support the market.

The dollar index rose in morning trading, accompanied by sharp fluctuations in the yen amid signs of a second intervention by the Japanese authorities. British bonds rose after Boris Johnson refused to participate in the race for the right to lead the ruling Conservative Party of Great Britain, and former Chancellor Rishi Sunak became the new prime minister.

The Stoxx Europe 600 index rose by more than 1%. Shares of media companies, travel, leisure, and utilities rose in price, while the securities of energy companies declined.

The Chinese yuan fell in Hong Kong to its lowest level since the global financial crisis in 2008, even though economic growth data exceeded estimates. Chinese economic data, postponed last week and released today, showed a mixed recovery with rising unemployment and weakening retail sales, despite accelerating growth.

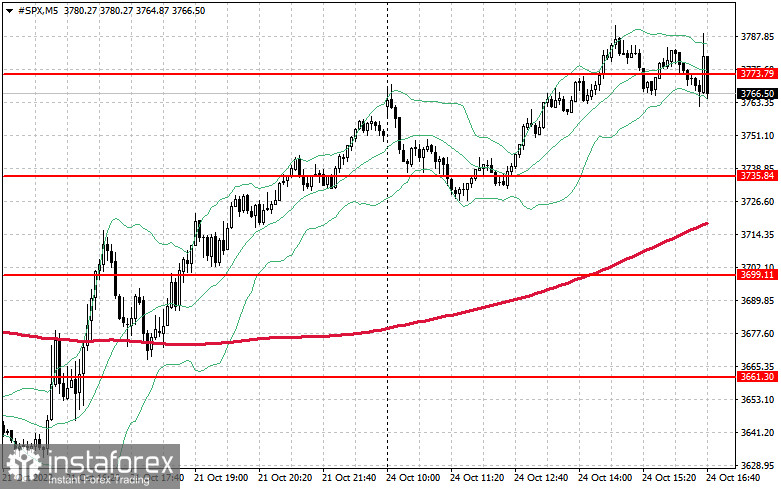

As for the technical picture of the S&P500, after a small phase of decline at the opening, the bulls pulled themselves together and continued the growth observed last Friday. The main task for buyers now is to protect the support of $3,735. As long as trading is conducted above this level, we expect continued demand for risky assets. This will also create good prerequisites for further strengthening of the trading instrument and a breakout of $3,773. Only such a scenario will strengthen the hope for a further upward correction with an exit to the resistance of $3,801. The furthest target will be the area of $3,835. In case of a downward movement, buyers are obliged to declare themselves in the area of 3,735 and $3,699. Only a breakdown of these ranges will quickly push the trading instrument to $3,661 and $3,621, as well as open the possibility of updating support and $3,579 – a new annual minimum for the index.