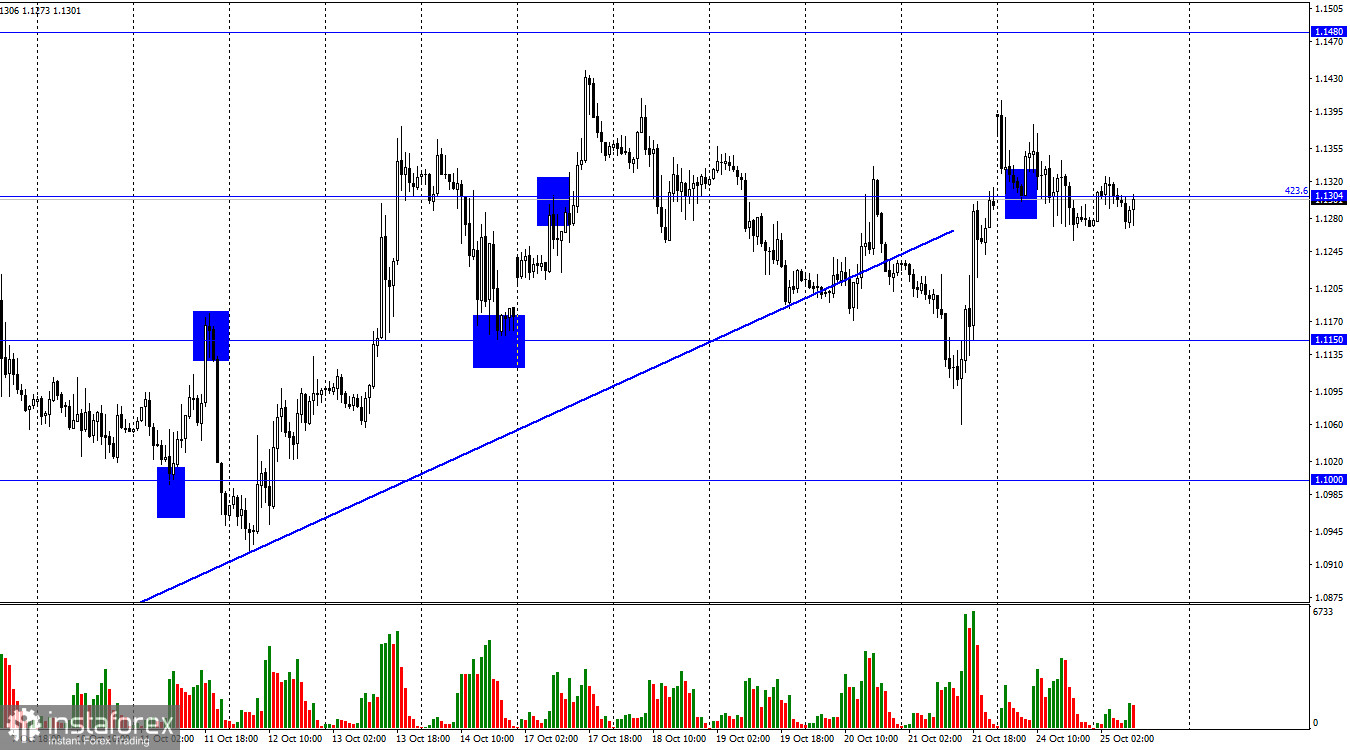

On Monday, GBP/USD reversed in favor of the US dollar on the 1-hour chart and settled below the retracement level of 423.6% at 1.1304. This suggests that the pair will continue to fall towards 1.1150. Yesterday, Rishi Sunak was declared the new prime minister. He was the only candidate to secure the support of 100 party members and apply officially. His only rival, Penny Mordaunt, pulled out of the race as she failed to garner the support of 100 Tory MPs. So, in the coming days, King Charles will formally appoint Sunak as Prime Minister. He will be the third UK PM this year.

However, the pound was not encouraged by the news. Traders have not decided yet whether the appointment of Rishi Sunak is a positive event. Most likely, Sunak, being a former finance minister, will not make the same mistakes as Liz Truss did. He served as the Chancellor of the Exchequer for 2 years. So he knows the UK economy very well. Yet, traders are hesitating to act as they are waiting for the new government to show itself. Previously, the pound tumbled when Liz Truss announced her plan to cut taxes, and experts evaluated the consequences of this initiative. When she canceled her plan, the pound recovered to previous levels. Before these events, the pound was trading relatively stable if we could call it so, keeping in mind that GBP has been depreciating against the dollar for the past 1.5-2 years.

So, the election is over, and markets will now focus on the upcoming meetings of the Fed and the Bank of England. Traders will be looking for hints from both central banks regarding their future monetary policies. Both regulators have made enough rate hikes, and this process should stop sooner or later.

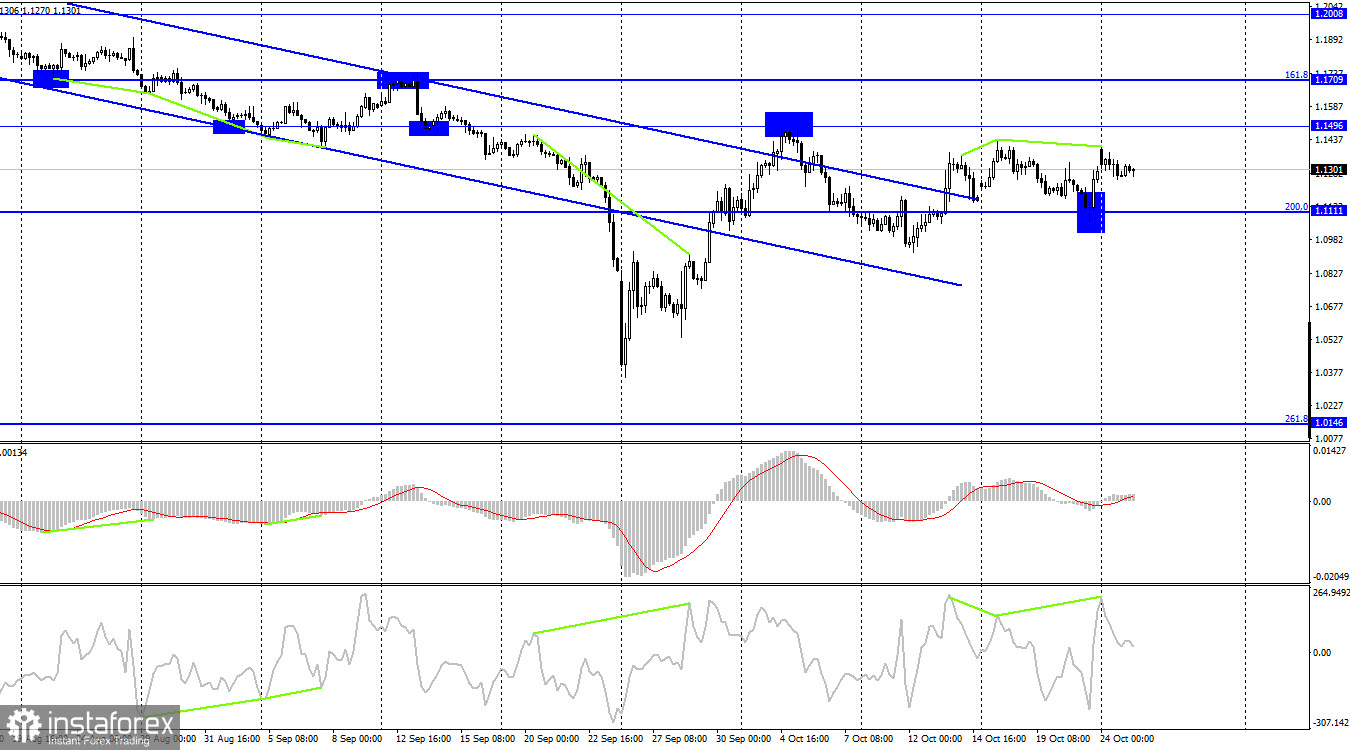

The pair reversed in favor of the US dollar on the 4-hour chart after the CCI had formed a bearish divergence. Then, the price began to return to the Fibonacci level of 200.0% at 1.1111. If it settles firmly below this level, the pair is likely to extend its fall to the low of 2022.

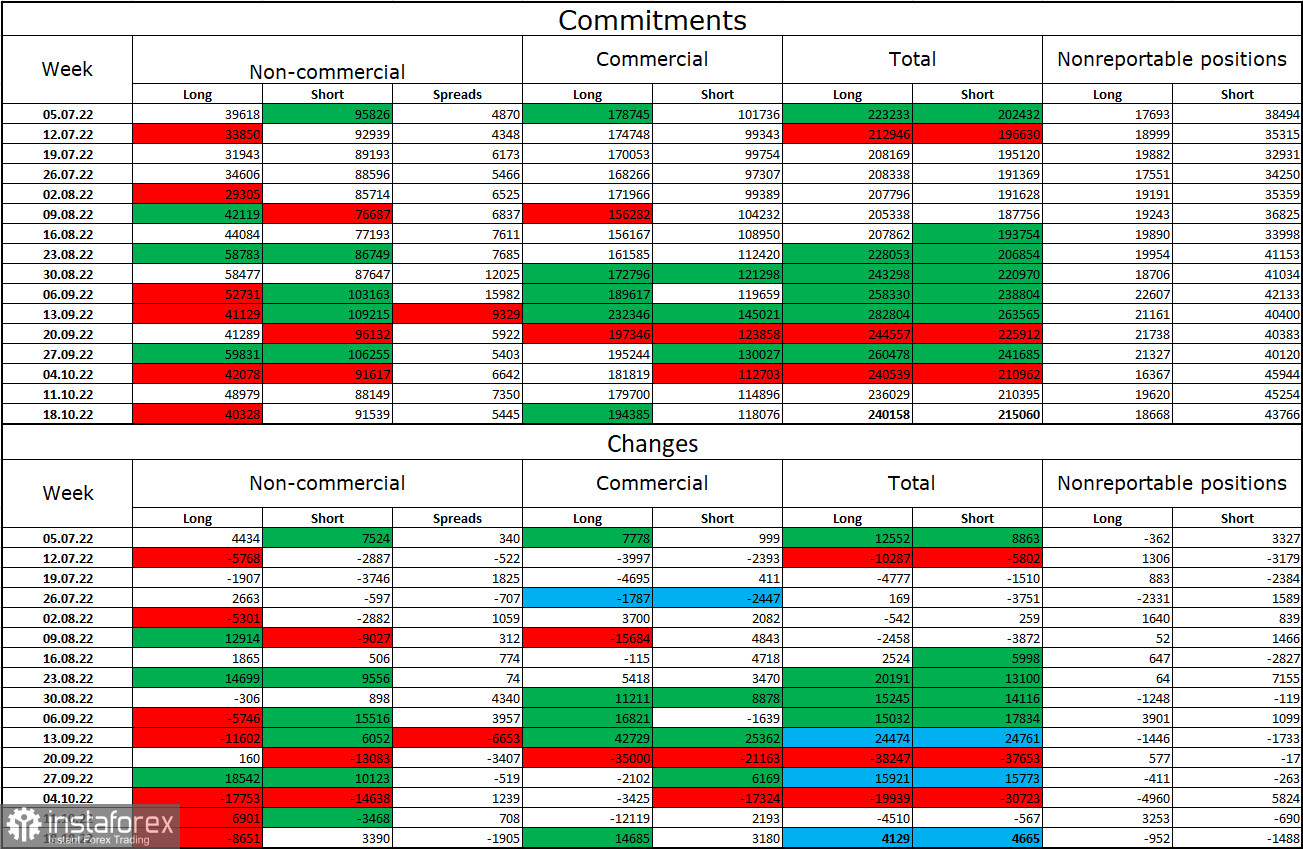

Commitments of Traders (COT) report:

Over the past week, the non-commercial group of traders became more bearish on the pair than the week earlier. Traders closed 8,651 long contracts and added 3,390 short contracts. However, the overall sentiment of large market players remains bearish as short positions still outweigh the long ones. Therefore, institutional traders still prefer to sell the pound even though their sentiment has been slowly changing towards bullish in recent months. However, this is a slow and lengthy process. The pound may continue its uptrend only if supported by strong fundamental data which has not been so favorable lately. I would like to point out that although the sentiment of the euro trades has become bullish, the euro is still depreciating against the US dollar. As for the pound, even COT reports do not favor buying the pair.

Economic calendar for US and UK:

On Tuesday, there are no important events either in the US or the UK. Therefore, the impact of the information background on the market will be zero today.

GBP/USD forecast and trading tips:

I recommend selling the pound when the price closes below 1.1304 on H1 with the targets at 1.1000 and 1.0727. Buying the pound is not advisable today.