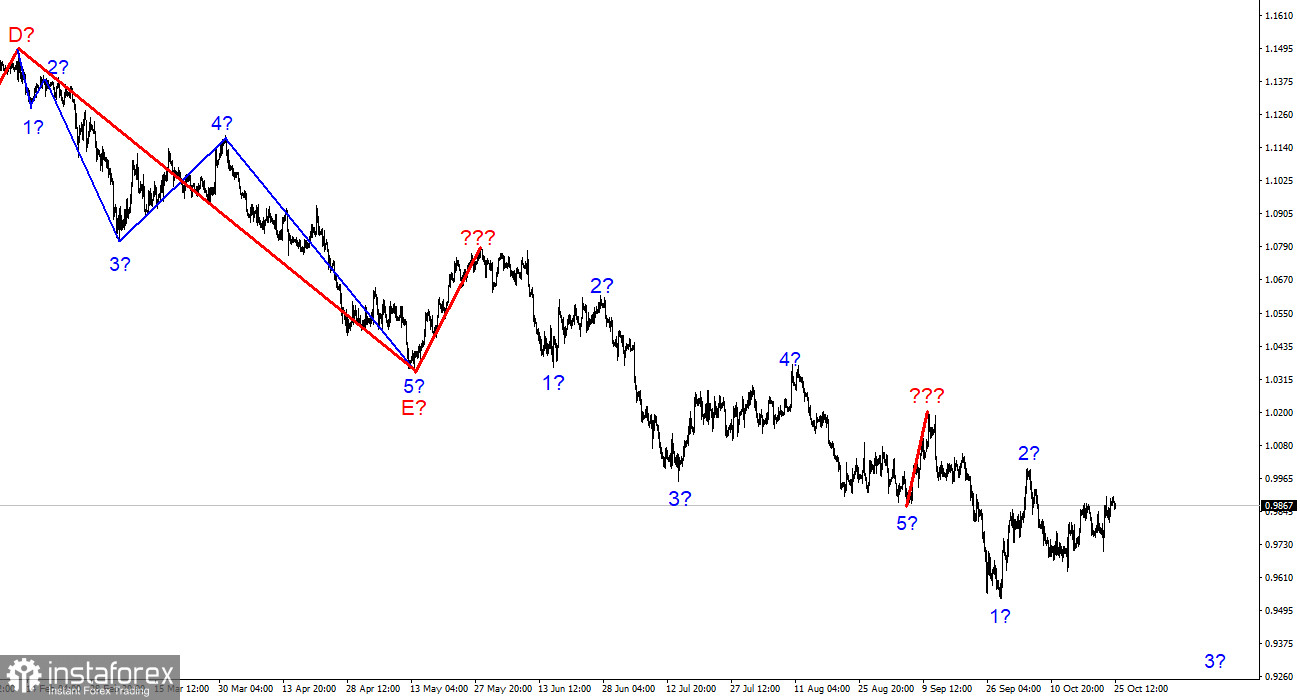

The wave marking of the 4-hour chart for the euro/dollar instrument still does not require adjustments, but it is undoubtedly becoming more complicated. It may become more complicated than once in the future. We saw the completion of the construction of the next five-wave impulse descending wave structure, then one upward correction wave (marked with a bold line), after which the low waves of 5 were updated. These movements allow me to conclude that the pattern of five months ago was repeated when the 5-wave structure down was completed in the same way, one wave up, and we saw five more waves down. There has been no talk of any classical wave structure (5 trend waves, 3 correction waves) for a long time. The news background is such that the market even builds single corrective waves with great reluctance. Thus, in such circumstances, I cannot predict the end of the downward trend segment. We can still observe for a very long time the picture "a strong wave down - a weak corrective wave up." Even now, when it seems that the construction of a new upward wave has begun, which may well be 3 as part of a new upward trend segment, the entire wave marking can transform into a downward one, and the waves built after October 4 will be waves 1 and 2 in 3.

How much will the European regulator raise the rate?

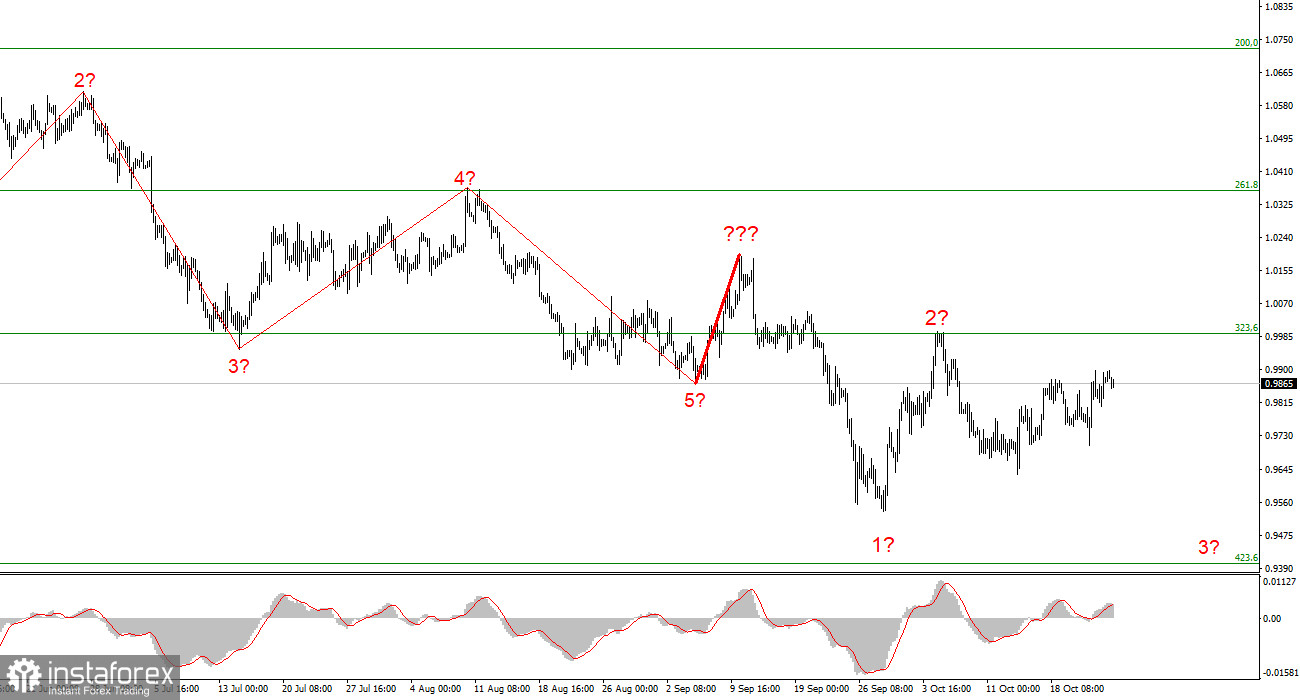

The euro/dollar instrument fell by 10 basis points on Tuesday, and the amplitude of movements was almost zero. During the last part of the day, there was no news background, and the market did not see support for active actions. And if there are no actions, then there are no changes in quotes. The instrument has been in such a state for several weeks now that it is easy to imagine its further decline and increase. The downward section of the trend has been complicated many times, and there is no guarantee that it will not do it again in the near future. Therefore, I cannot conclude that the construction of the downward trend section is completed. The market has obvious problems simply returning to the 323.6% Fibonacci level, where the last price peak is located. A successful attempt to break through this level would indicate readiness to build an upward trend segment, at least three waves, but even such a "gift" from the euro is very difficult to wait for now. The market seems to have paused, and now the waves can be corrective, and the wave structures can be horizontal.

The only hope this week is the ECB meeting. However, this is practically the only important event, and quite a lot has already been said about it. The European currency needs strong support. A weak news background for the dollar will also do. However, the European regulator is likely to do what the market expects: raise the interest rate by 75 basis points. I doubt that this will be enough to increase the demand for the euro. We can see a certain increase in the instrument, but let me remind you that around the 0.9993 mark, even the construction of an ascending trend section may end and take a three-wave form.

General conclusions.

Based on the analysis, I conclude that the construction of an upward trend section has begun. At this time, the instrument can build a new impulse wave, so I advise buying with targets above the calculated mark of 0.9993, which equates to 323.6% by Fibonacci, by MACD reversals "up." I have not changed the wave marking yet; the reasons for the growth of the euro are the high probability of an increase in the British.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate the three and five-wave standard structures from the overall picture and work on them. One of these five waves can be just completed, and a new one has begun its construction.