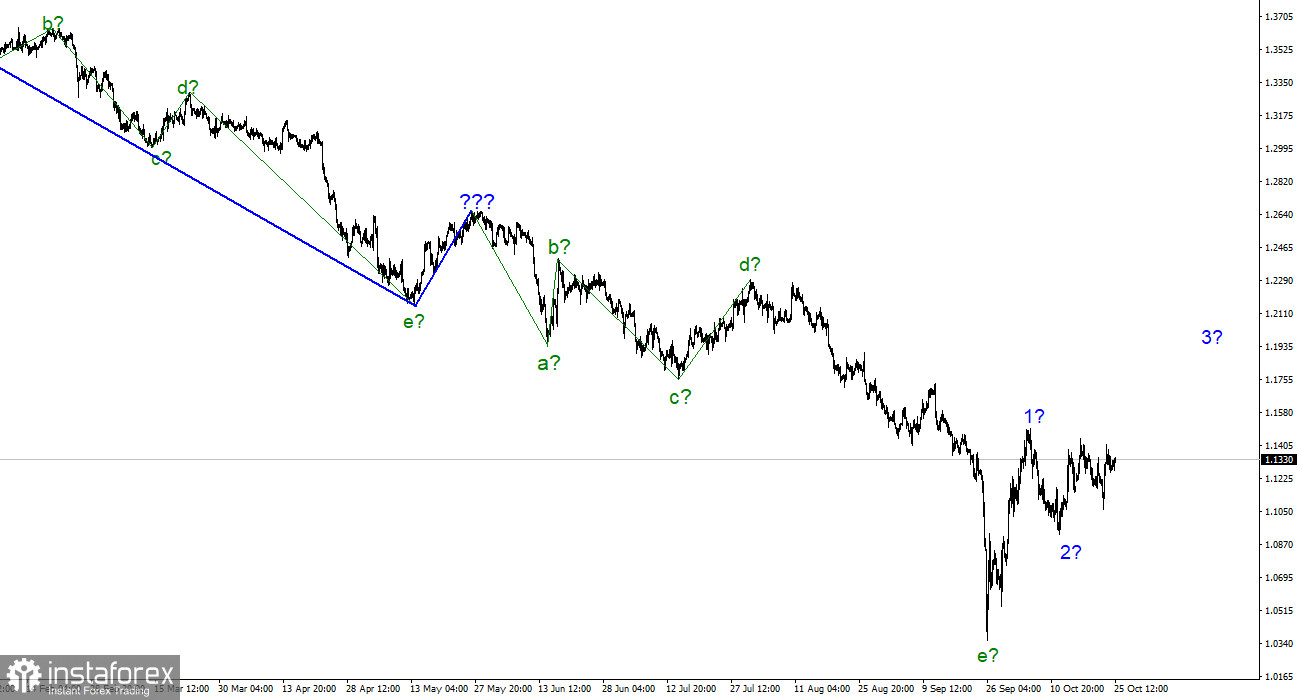

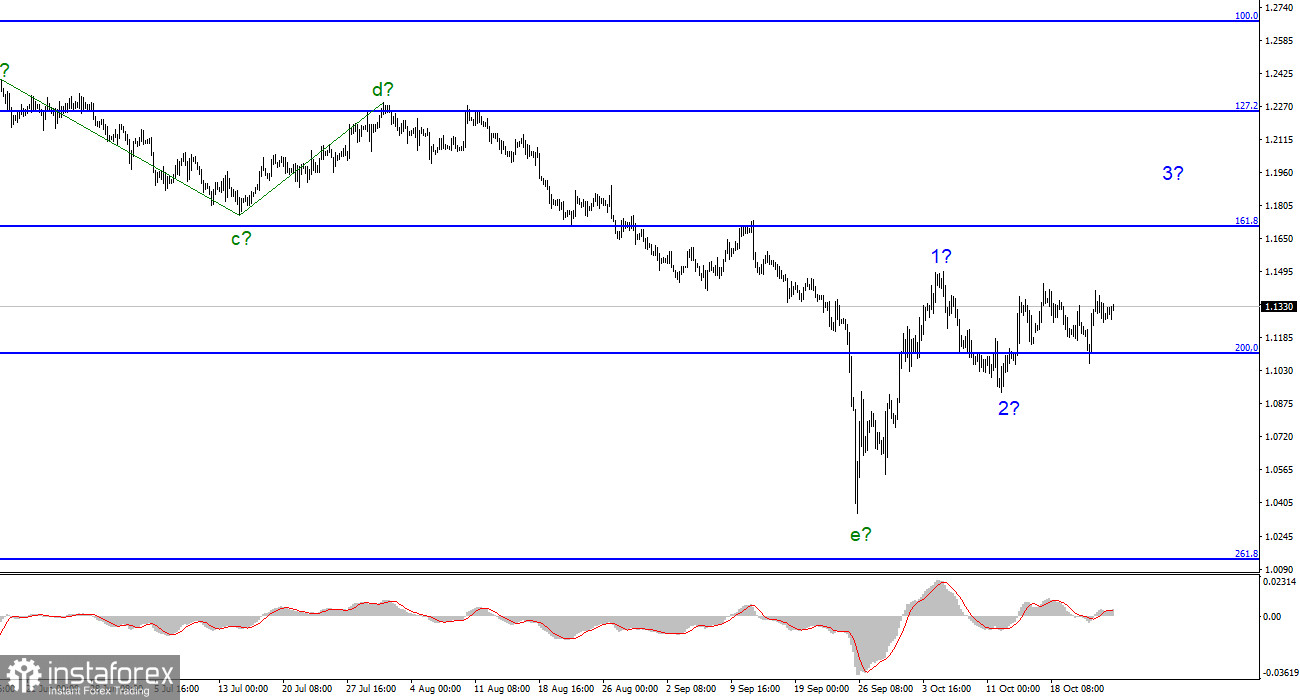

Currently, the wave layout of GBP/USD still looks complicated but it has to be revised. We suppose that the downtrend section consisting of five waves a-b-c-d-e has been complete. If it is the case, a new uptrend section has come into being. Its first and second waves could have been already complete. Unfortunately, we lack confidence in such developments. Indeed, the currency pair should surpass the peak of the last wave to prove that the instrument is ready to build the uptrend section, but not obscure the downtrend section again. The peak of the nearest wave d is located close to 1.23.

Thus, after GBP passes 1,000 pips up, it has to climb another 1,000 pips to reach this peak. Nevertheless, a failed attempt to break the 200.0% Fibonacci level indicates that the market is ready to buy the pound sterling. In this context, I reckon that the euro could also gain ground. Meanwhile, the wave layout for GBP/USD looks more or less convincing but it may easily turn into a downward structure, especially if the information background gets worse for the British pound.

Rishi Sunak takes office as new Premier. What does it mean for GBP?

On October 25, GBP/USD climbed 40 pips, albeit at a slower pace. Yesterday evening, it became clear that there were no other candidates for the UK Prime Minster apart from Rishi Sunak. Therefore, he was appointed as the new Premier. His inauguration will take place shortly after. Curiously, the British pound gave a lukewarm response to the news.

It would be unreasonable to expect GBP to click into gear because of the new Prime Minister. Let me remind you that cabinet reshuffles have become a common case in the UK over the last five years. Thus, the market has already gotten used to such political jitters. Now, investors are alert to the actions of Rishi Sunak which he will take to revitalize the British economy. Once definite measures are taken, investors will be able to make a conclusion that the country has elected the right head of government.

For the time being, the Kingdom is facing a daunting challenge. To be more exact, the economy is suffering the double whammy: soaring inflation and sky-high energy prices. Utility bills are so enormous that households in this high-income nation would find it tricky to pay them in the winter. If electricity and heating prices are capped, this measure will require generous government subsidies for electricity-providing companies. The government will have to offset energy companies against caps on energy bills to be paid by consumers. Unless electricity prices are not capped, British households and companies will have to pay twice or even thrice bigger bills than in the previous winter. The situation will aggravate the cost-living crisis and dent manufacturing rates.

Another thorny issue is tax cuts, the measure which has been already pledged by Liz Truss. This move was meant to make up for ballooning electricity and heating bills. In practice, Liz Truss has checked this measure for its consequences to the domestic economy, the forex rate of the pound sterling, and her political career. Rishi Sunak will hardly try to slash taxes. To sum up, Rishi Sunak will have to go through a real ordeal, tackling the same economic problems. He has to keep the national economy afloat.

Conclusions

The wave layout of GBP/USD assumes the building of the new uptrend section. Therefore, I would recommend buying the currency pair at upward MACD reversals with the targets close to 1.1705 which matches the 161.8% Fibonacci level. Importantly, we should both buy and sell GBP/USD cautiously because the downtrend section might get complicated again.

On a senior wave timeframe, the picture looks similar to EUR/USD. We also see the upward wave that doesn't fit into the ongoing wave layout. There are also five downward waves. The downtrend section could be indefinite in duration but could be already complete.