Bitcoin continues to trade in an almost absolute flat, just above the $18,500 level. This movement has been going on for a month, and so far, there is no sign that this flat will end in the near future. The trend line has already been overcome and can no longer be considered relevant. Participants of the cryptocurrency market not only do not sell bitcoin but also do not buy it, although many experts call the current levels "very attractive." But real investors and traders do not think so since they are in no hurry to buy the first cryptocurrency in the world. We believe that most market participants do not yet believe that the bearish trend is over. The Fed may seriously raise the key rate at least 2-3, creating pressure on risky assets. In early 2023, we will expect the first signs of the emergence of a "bullish" trend. But we do not believe that from the very beginning of next year or from the moment when the Fed officially announces its refusal to tighten monetary policy further, bitcoin will immediately go into uncontrolled growth. Everything will happen gradually.

Meanwhile, one of the world-renowned traders, Ton Weiss, predicted a powerful growth of the cryptocurrency next year. He has previously stated the possible fall of bitcoin to $ 14,000 before it starts to grow. He also admitted that the cryptocurrency might drop to $ 10,000 per coin, but in this case, everyone will rush to buy it, so he will not stay in this area for a long time. Weiss cited capital flows from Europe to the United States and the "lost profit syndrome" as the reasons for a possible "bullish" trend. Many who failed to catch the minimum in 2018 will want to do it now. He also noted that international sanctions against Russians have led to the freezing of many accounts. Bitcoin may become a salvation from this in the future. Central banks and governments manage fiat money and classic assets that can do whatever they want with them. This is impossible in the case of decentralized bitcoin, so many will want to transfer part of their capital into it. We believe this is a fair statement, and we expect strong growth in the future. But at this time, we do not yet believe that the time has come for this.

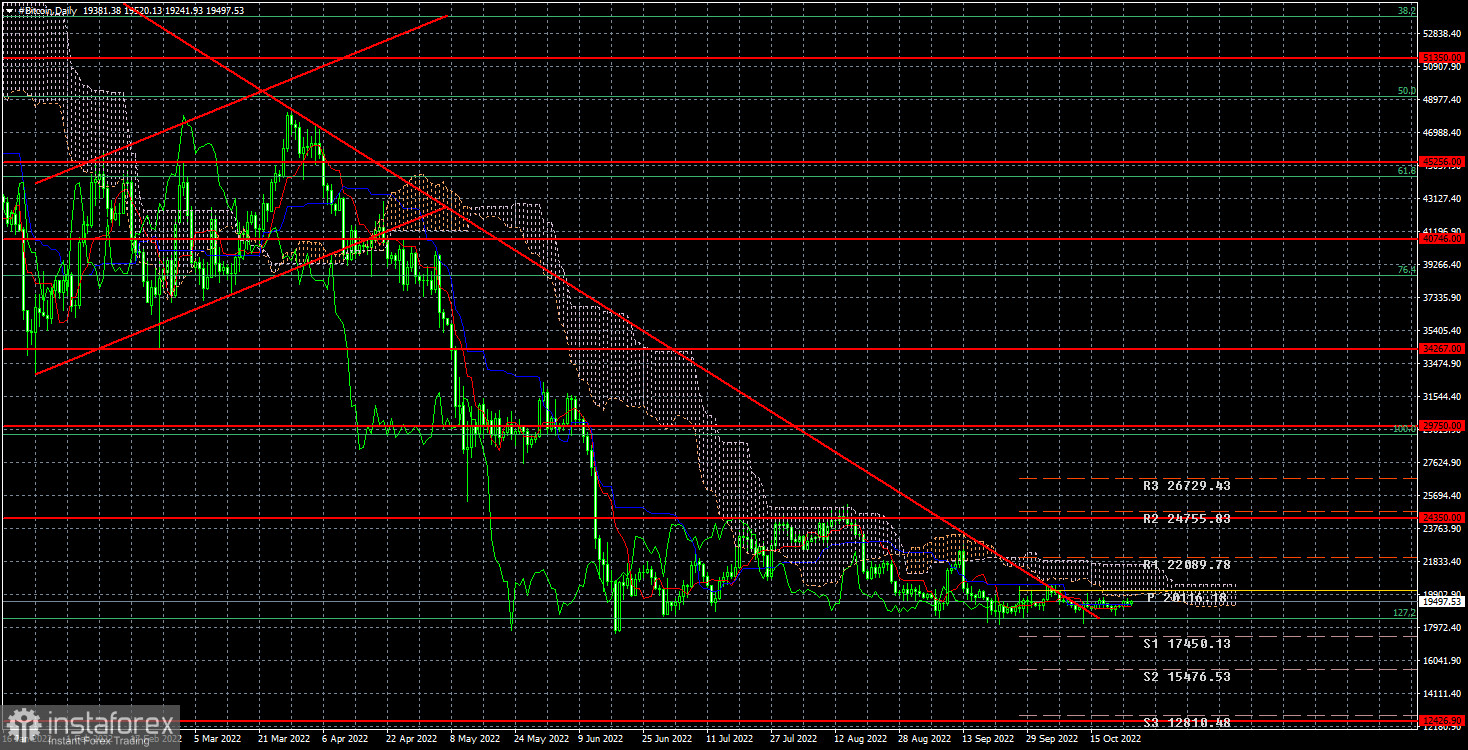

In the 24-hour timeframe, the quotes of the "bitcoin" cannot overcome the level of $ 18,500 (127.2% Fibonacci) for several months. Thus, we have a side channel, and it is unclear how much more time bitcoin will spend on it. We recommend not rushing to open positions. It is better to wait for the price to exit this channel and only then open the corresponding transactions. Overcoming the $18,500 level will open the way to the $12,426 level.