Yesterday, Rishi Sunak delivered his first speech as a prime minister. It was mainly devoted to economic issues. Rishi Sunak said that the government would primarily focus on these problems. He sees the necessity of new approaches that will allow to create new conditions for confident and stable economic growth. Investors positively welcomed his speech, which immediately affected the pound sterling. The jump was so significant that boosted other currencies.

Meanwhile, the US dollar is falling against all the currencies. Thus, the euro was just following the British pound and approached the parity level. However, since Friday, the greenback has dropped enough to enter the oversold area. Notably, the decline could be explained by political factors only. That is hope for the settlement of many thorny issues, especially the economic ones. In other words, a rise in the European currencies has no ground. That is why they may bounce or show a downward correction. Since today the macroeconomic calendar is empty, the likelihood of this scenario is very high. What is more, tomorrow, the ECB will hold a meeting at which it is expected to raise the benchmark rate by 75 basis points. In this light, the euro may lose value.

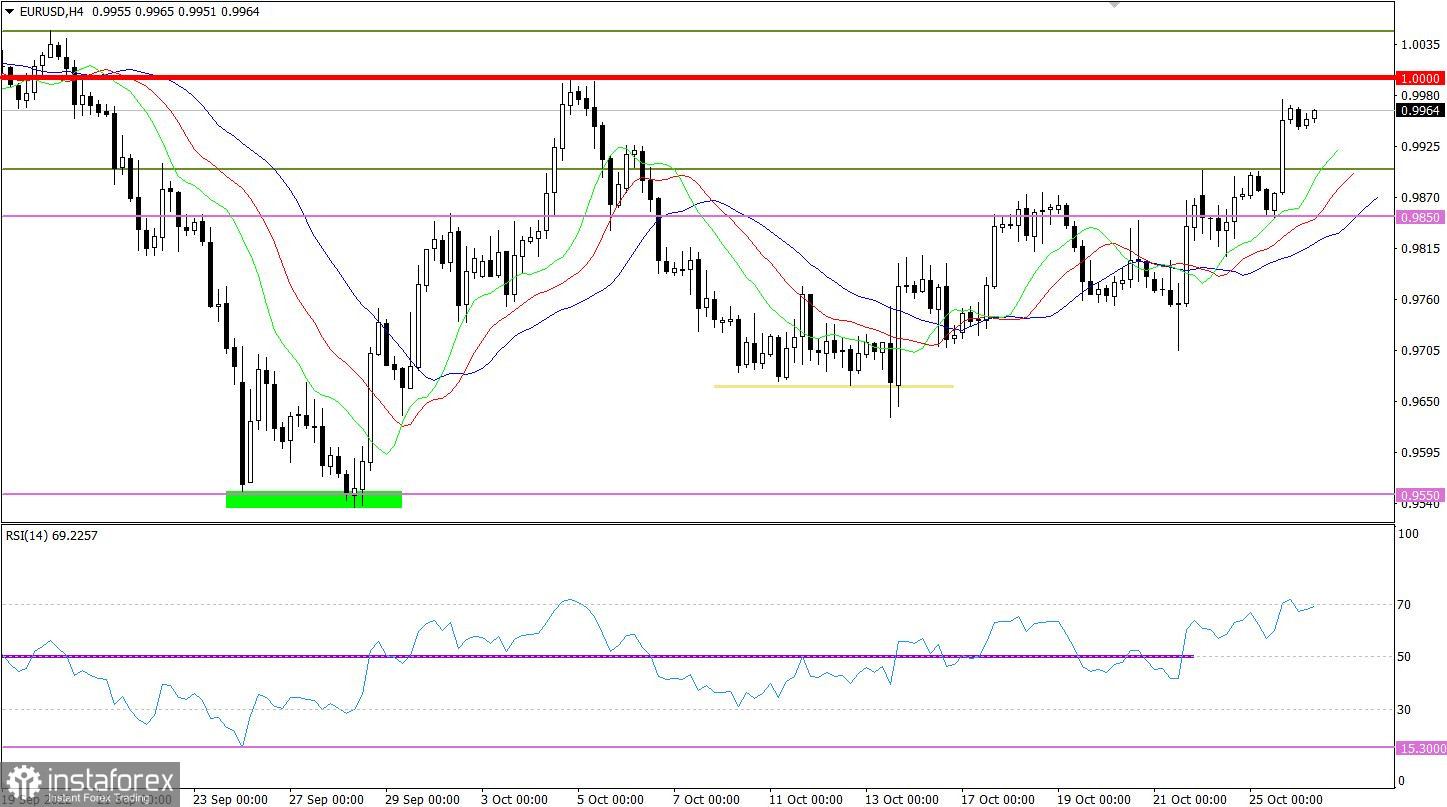

The euro/dollar pair stopped hovering within the intermediate level of 0.9850. As a result, the upward inertial movement allowed the euro to return to the parity level.

On the four-hour chart, the RSI technical indicator upwardly crossed line 70 at the moment of the upward impulse. This movement coincided with the price's approach of the parity level. This may correspond to the euro's overbought signal in the short-term periods.

On the four-hour chart, the Alligator's MAs are headed upward, which reflects the price impulse.

Outlook

After the rally, the pair remained stuck during the Pacific and Asian trades. This consolidation led to the accumulation process, which boosted speculative activity.

The pair's future movement will depend on traders' behavior within the parity level. Under the current conditions, the pair may bounce amid an overbought signal in the short-term periods.

In terms of the complex indicator analysis, we see that in the short-term period, the indicator has a mixed signal amid the price consolidation. In the intraday period, the indicator is providing a buy signal because of the recent upward impulse.