And while bitcoin is returning to monthly highs, the UK is on the path of further regulation of the cryptocurrency market in the country. As it became known on Tuesday, lawmakers voted to recognize crypto assets as regulated financial instruments.

The House of Commons, the lower house of Parliament, held a reading of the proposed Financial Services and Markets Bill, which broadly covers the UK's post-Brexit economic strategy. Lawmakers considered a list of proposed amendments to the bill, including an amendment proposed by MP Andrew Griffith to include crypto assets in the scope of regulated financial services in the country. Let me remind you that the draft law also included rules that are mandatory for use when working with stablecoins and payments based on them.

"The bottom line is to treat cryptocurrencies like other forms of financial assets and not make any exceptions," Griffith said.

According to experts, this kind of initiative, along with the appointment of Rishi Sunak as the new prime minister of the country, will help legal recognition of digital assets in the country. Let me remind you that the bill on the markets - and, accordingly, the rules for regulating the stablecoin in the country - was introduced during Sunak's tenure as finance minister.

The cryptocurrency regulation based on the definition of "crypto asset" included in the new bill indicates that digital assets may be subject to the existing Financial Services and Markets Act 2000 relating to financial activities. The measures can regulate the promotion of cryptocurrency and prohibit the activities of companies that do not have the right to operate in the country. "The Treasury will consult with the crypto industry and stakeholders before exercising its authority," Griffith said.

It is worth noting that the proposed changes will not come into force for a long time. It will take a long time before they are passed into law. The bill then has to pass through the House of Lords, the upper house of Parliament, before the amendments are finally considered, after which King Charles III approves them.

As for the technical picture of bitcoin on Wednesday, the "shot up" on Tuesday is good news for those who were very worried about bitcoin hanging in the horizontal channel and feared the risks of its new collapse. This indicates a return of investor interest in risk. The focus is now on the resistance of $20,540, the return of which is necessary to build a new upward trend. In the event of a breakout of this area, you can see a surge up to $21,140, but to consolidate at these levels, you need to break above the resistances of $21,840 and $22,525. If bitcoin is under pressure again, the bulls should make every effort to protect the $20,000 support. Its breakdown will quickly push the trading instrument back to a low of $19,360 and open the way to $18,700.

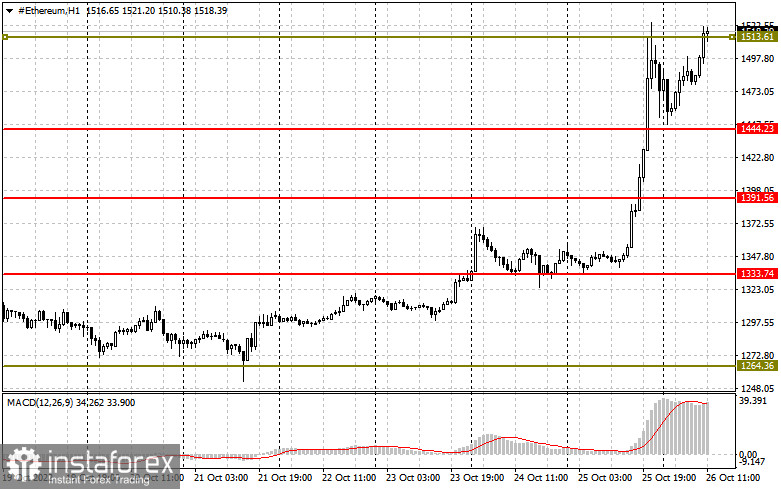

Ethereum has rebounded significantly and bulls are now placing some emphasis on breaking the immediate resistance of $1,510. This will be enough to lead to significant changes in the market. Consolidating above $1,510 will calm the situation and return balance to Ethereum with the prospect of continuing the bull market, counting on updating the high of $1,588. The more distant targets will be the areas: $1,645 and $1,707. recently. Its breakthrough will push the trading instrument to the lows of $1,390 and $1,333. A return to $1,264 will completely negate the upward potential of Ethereum.