EUR/USD

Higher timeframes

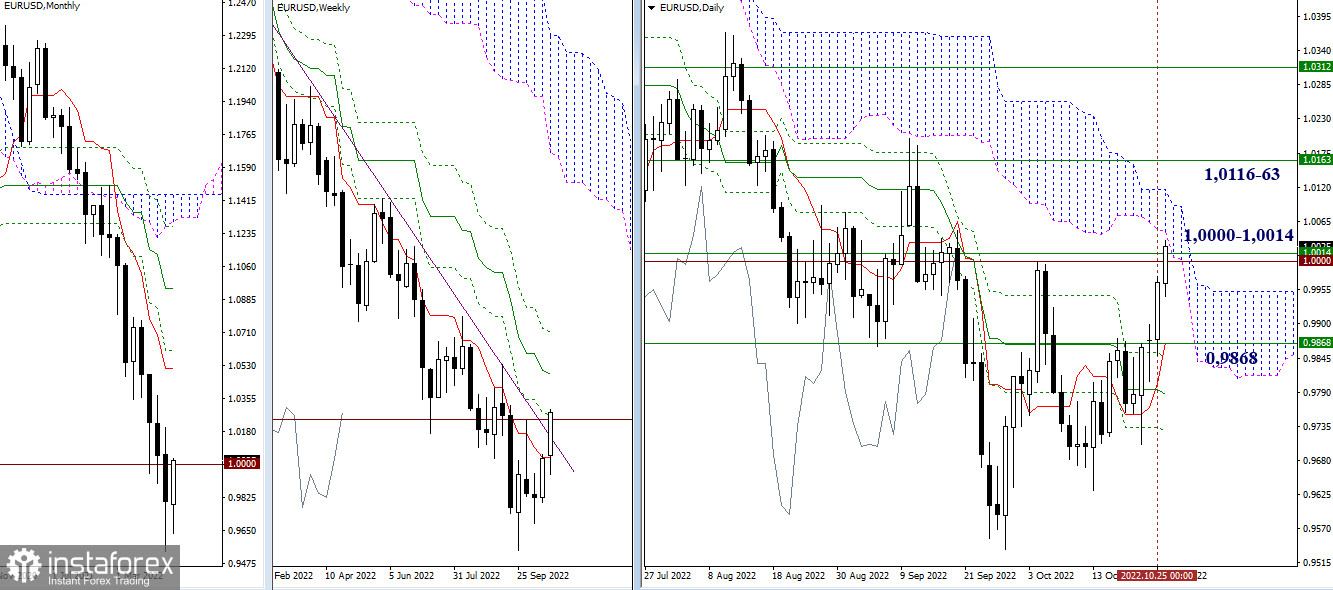

Bulls yesterday rebounded from the weekly short-term trend (0.9868) and continue to rise. As of writing, they have started testing the encountered resistance at 1.0000 – 1.0014 (psychological level + weekly Fibo Kijun), further, a little higher, there is a daily cloud. The result of the interaction will determine further opportunities and prospects.

H4 – H1

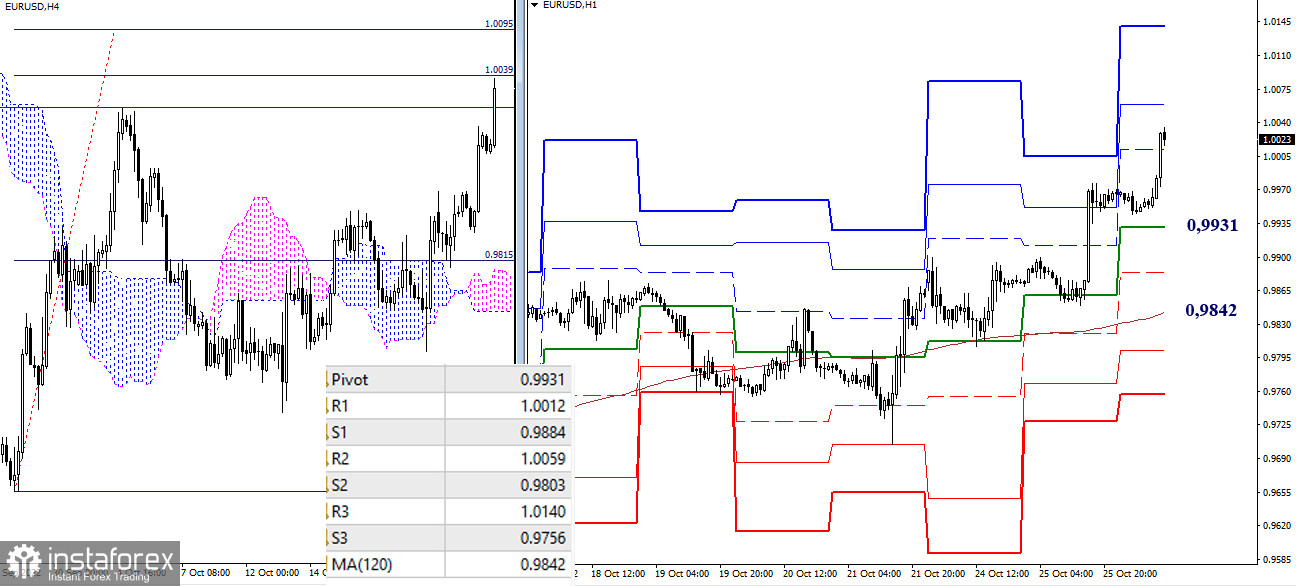

On the lower timeframes, the main advantage is on the side of the bulls. The benchmarks for the continuation of the rise within the day can now be noted at 1.0059 and 1.0140 (resistance of the classic pivot points), as well as the target levels of the target for the breakdown of the H4 cloud (1.0039 - 1.0035). The key supports responsible for the current balance of power are located today at 0.9931 (central pivot point of the day) and 0.9842 (weekly long-term trend).

***

GBP/USD

Higher timeframes

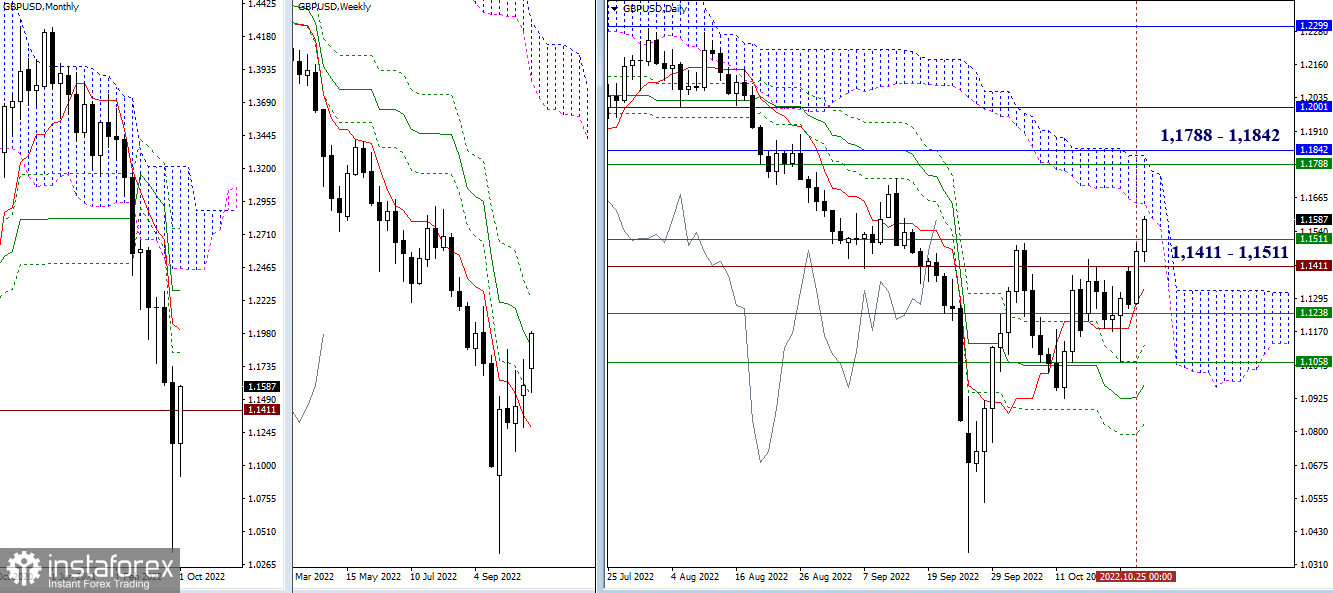

The pair continues to rise. The levels of 1.1411 (historical level) and 1.1511 (weekly medium-term trend) met earlier were left behind in the daytime and are now playing the role of supports. Ahead of the bulls is the resistance of the daily cloud (1.1645 - 1.1822), reinforced by the bundle of the final level of the weekly Ichimuko death cross (1.1788) and the monthly Fibo Kijun (1.1842).

H4 – H1

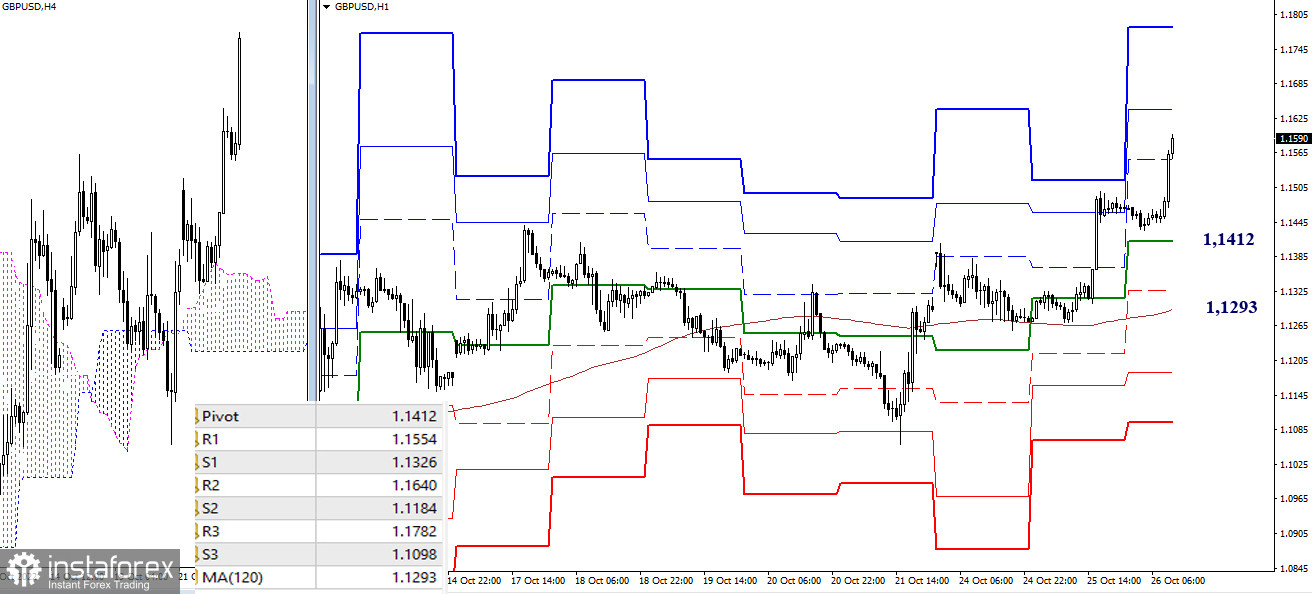

As of writing, bulls have the main advantage on the lower timeframes. From the bullish benchmarks within the day, now we can distinguish the resistance of the classic pivot points 1.1640 and 1.1782. The key levels of the lower timeframes today are located at 1.1412 (central pivot point of the day) and 1.1293 (weekly long-term trend) and will come into play only in case of active development of corrective decline. Consolidation below will change the current balance of power.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)