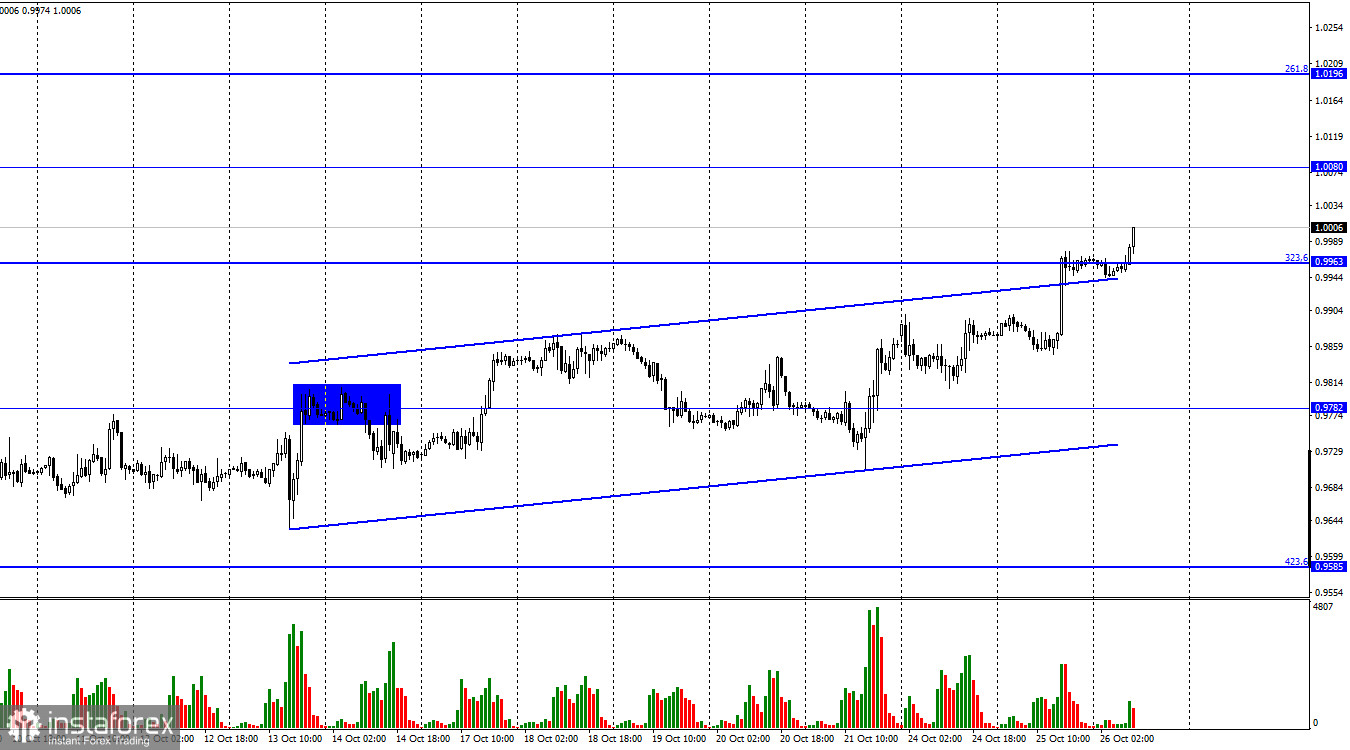

On Tuesday, EUR/USD continued to move up. By the end of the day, it hit the retracement level of 323.6% at 0.9963 and closed below it on Wednesday. This indicates that the pair may continue to rise to the levels of 1.0080 and 1.0196. The chance for a continued uptrend is getting higher.

The main driver which is pushing the euro upward is the ECB meeting on Thursday. There are simply no other reasons for traders to buy the euro. For your reference, the only reports that were issued this week, the EU services and manufacturing PMIs, turned out to be below expectations. So, they could not have caused a rise in the euro. The closest important event is the ECB meeting where the regulator is widely expected to raise the rate by 0.75%.

As I see it, traders are slowly shifting their focus from the dollar to the euro. The European currency has been declining for too long. So, the market sentiment had to change sooner or later. It is not even about the ECB lifting the rate (the Fed is also lifting it a week later). The main reason which is pushing the euro higher is that the gap between the rates of the ECB and the Fed is narrowing. The US central bank is approaching the level where it will pause its monetary tightening. If the rate is up by 0.75% next week, we may see two more hikes at the next meetings, and that's it. At the same time, the ECB has a long way to go as its rate is currently standing at 1.25%. So, it can stick to the policy of monetary tightening for a long time. In the first half of the year, the US dollar was rising as the Fed's rate was going up. Now, the opposite scenario may take place when the Fed stops raising the rate while the ECB will continue. This is how traders have finally begun to consider this factor which may eventually boost the euro that has already lost its hope to strengthen against the US dollar.

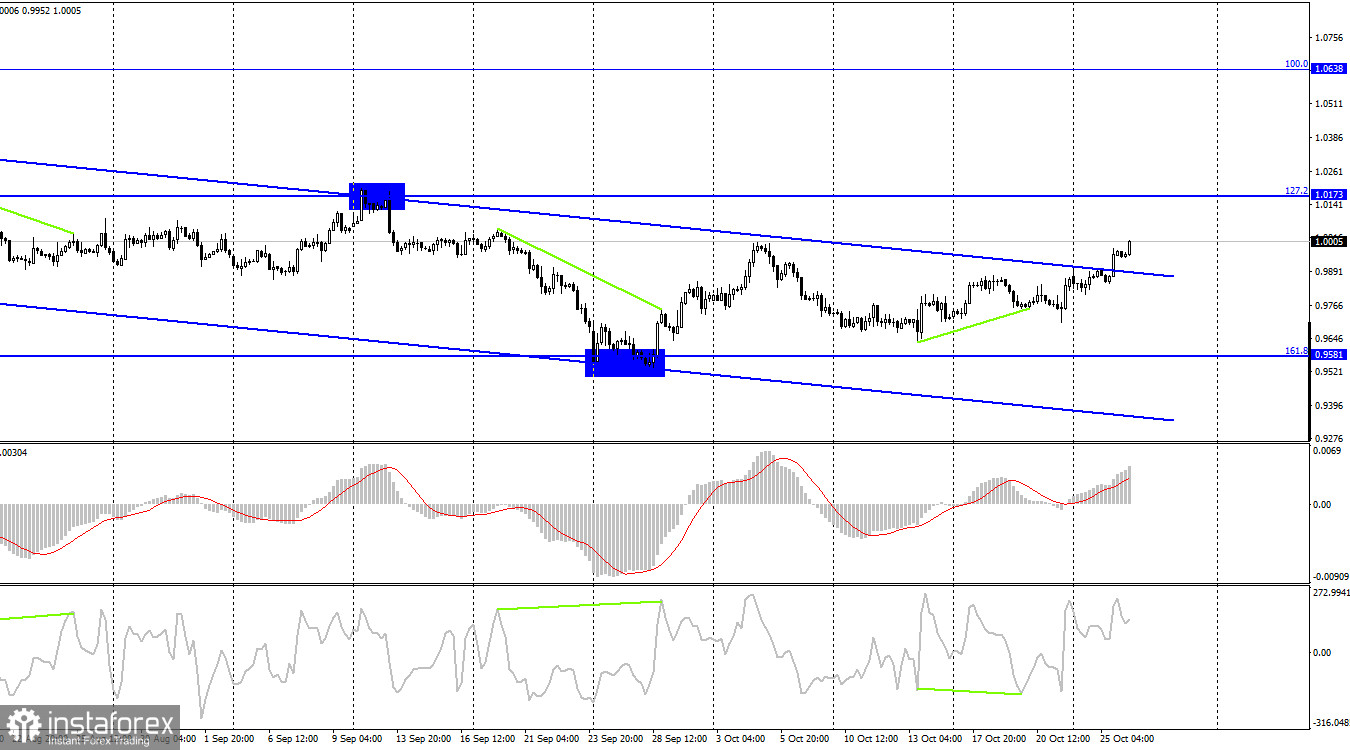

On the 4-hour chart, the pair settled above the descending trend channel and continued to rise toward the retracement level of 127.2% at 1.0173. This is the pivotal point in the pair's trajectory in this week and even month as this consolidation changes the technical picture to bullish. The euro is not so strong yet to cancel the dollar's rally. However, there is an 80% chance that EUR will develop growth in the coming months.

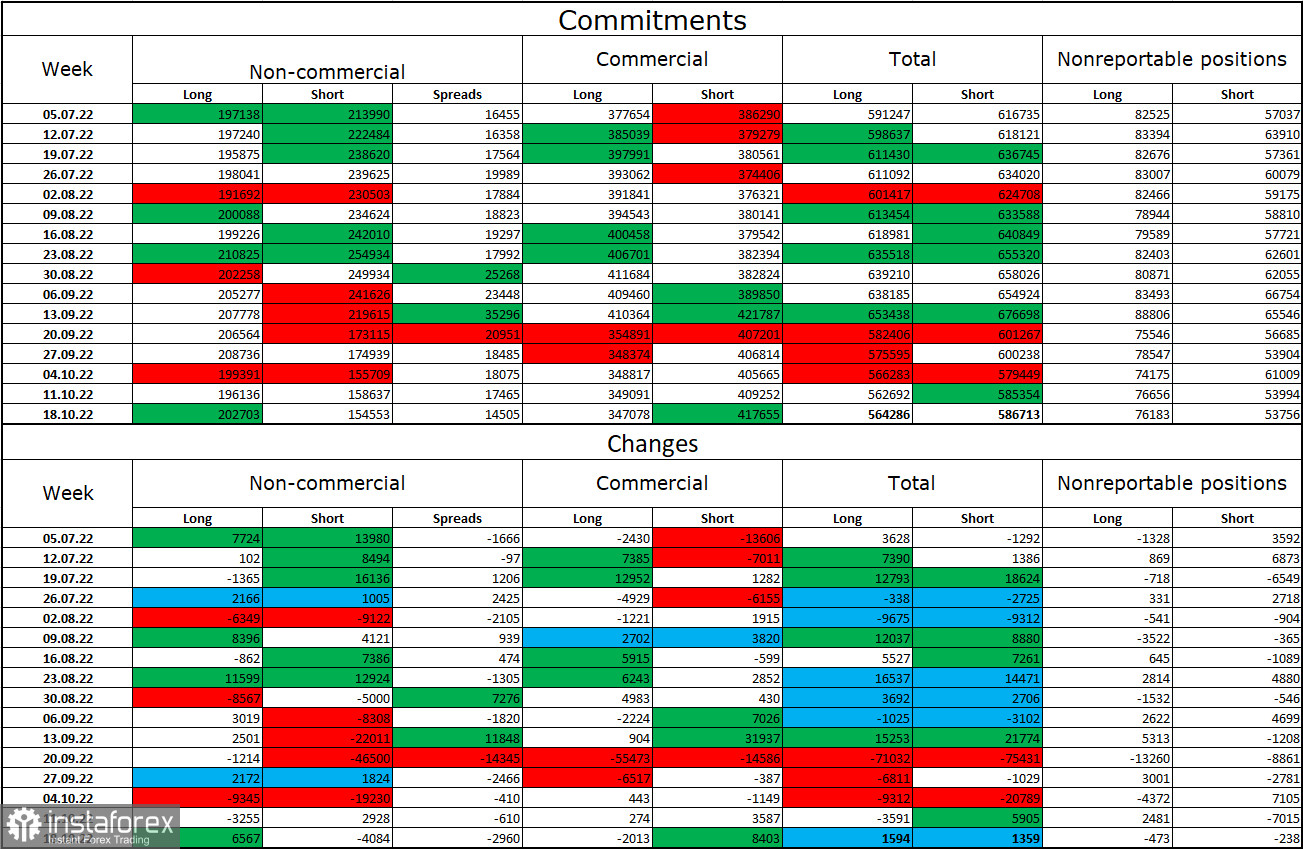

Commitments of Traders (COT) report:

Last week, traders opened 6,567 long contracts and closed 4,084 short contracts. This means that large market players became a bit more bullish on the pair. The sentiment is clearly bullish not bearish like with the British pound. The total number of long contracts opened by traders is 202,000 while the number of short contracts stands at 154,000. Yet, the euro is still struggling to develop a proper uptrend. In recent weeks, there were some chances for the euro to recover. However, traders are hesitant to buy it and prefer the US dollar instead. Therefore, I would advise you to focus on the main descending channel on the H4 chart although the price failed to close above it. So, we may see another fall in the euro soon. Even the bullish sentiment of larger market players does not allow the euro to develop growth.

Economic calendar for US and EU:

US - New Home Sales (14-00 UTC).

There is only one event worth noting in US the economic calendar. Yet, the report on new home sales has never been a decisive one. Therefore, the impact of the information background on the market will be weak today.

EUR/USD forecast and trading tips:

I don't recommend selling the pair now. Buying the pair may be possible if the quote settles above the upper line of the channel on the 4-hour chart. The level of 1.0173 will serve as a target. These trades should be kept open for now.