While the euro has reasons to rise, the pound sterling's appreciation could hardly be explained. Nevertheless, this week, both currencies have been gaining in value, whereas the US dollar has been falling. No analysts can explain such a situation. Of course, one may say that traders switch to risk assets, including the euro, the pound sterling, and even bitcoin. However, I suppose that it is not enough. It is necessary to find out the main driver of the higher demand for the euro and the pound sterling. I think that traders started buying the currencies ahead of the ECB and BoE meetings. If the market reacts after the publication of the results, the currencies will increase by 100-200 pips. However, the market started to buy the assets in advance. What is the reason? The fact is that such a jump is likely to be replaced by a slump.

Judging by the wave analysis, the assets have formed an upward trend but it may finish as early as today after the publication of the 75-basis-point rate hike by the ECB. From time to time, the market shows such a dynamic: currencies rise ahead of an important event and then fall. I think that today both the euro and the pound sterling will decline. There is no ground for their long-lasting growth against the US dollar. Neither the UK nor the EU has recently provided positive economic news that may boost the currencies. The economies of both countries have slipped into recession, business activity is dropping, and inflation is reaching new highs. What is more, the central banks are able to raise the key interest rate less than needed. It is highly likely that Christine Lagarde will drop a hint about a slower key interest rate hike in the near future. The fact is that in the European Union, there are such countries that may fail to cope with strong monetary policy. Greece is the best example of such countries. If Christine Lagarde makes such an announcement, traders will start selling off the assets.

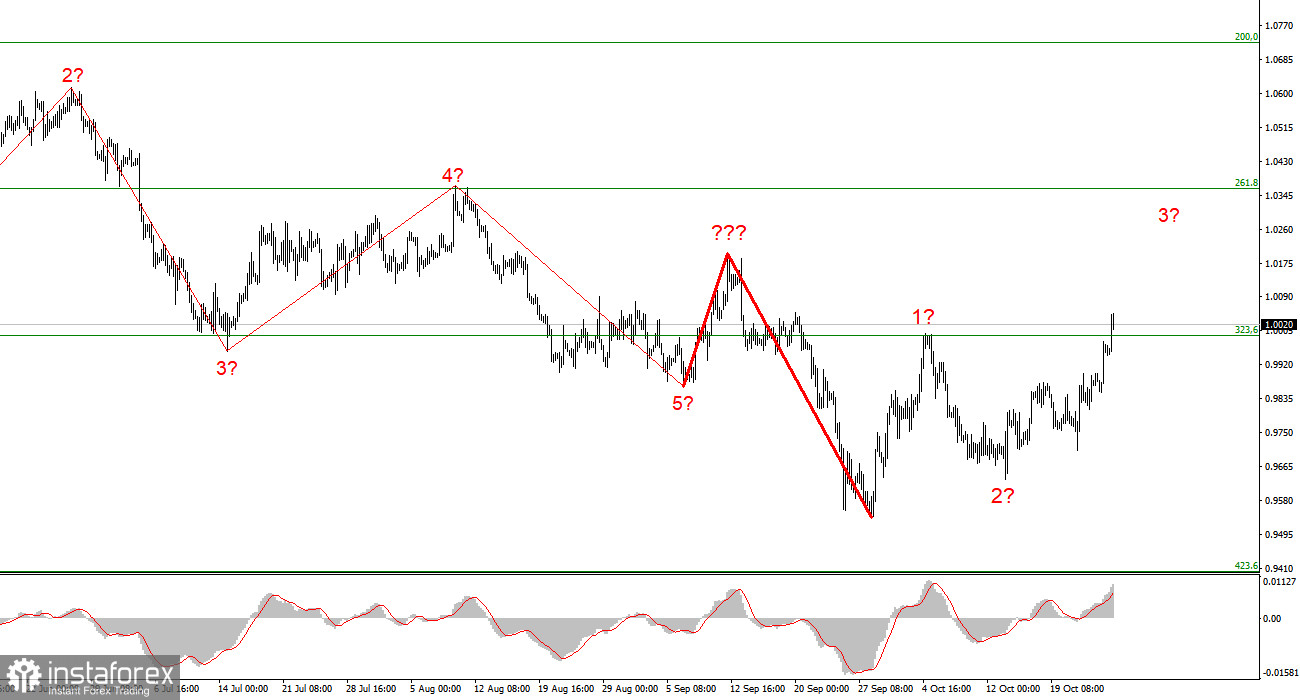

According to the wave analysis, this action will be quite logical. Since there are correctional waves, the asset may start forming a new downward section. Most analysts even suppose that the 75-basis-point hike is unlikely to provide the euro with long-term support since the EU's economy may slump this winter. Thus, the euro and the pound sterling may face a gloomy future.

Summing up, the asset has started forming an upward section of the trend. It may form a new impulsive wave. That is why traders may go long with the target above 1.0361, the 261.8% Fibonacci level. The MACD indicator should be headed upwards.