The market sentiment is changing dramatically after significant political changes in the UK and new decisions taken by the government. The pound sterling is taking advantage of these changes. It also climbed higher following news about the likelihood of a 100 basis point rate increase at the BoE meeting on November 3.

This is quite bullish for the pound sterling given that there is speculation about a slowdown in the Fed's monetary tightening. This week, the trajectory of the pair will become clearer. On November 2, the Fed will announce its key rate decision followed by the BoE. In the meantime, traders are largely looking for positive fundamental factors.

Expectations of a more aggressive rate increase by the Bank of England in November have increased considerably after Britain's new Prime Minister Rishi Sunak delayed the announcement of a keenly awaited plan for repairing the country's public finances until mid-November.

Interest rate futures put the chance of a 100 basis-point rate hike by the BoE at about 37%, higher than before the announcement of the delay.

Earlier in October, traders sharply scaled back their almost 100% bets on such a significant rate increase in the cost of borrowing. The reason for this was political turmoil, new economic decisions inconsistent with the current situation, and a change of power.

Who to expect after rally?

The trajectory of the pound sterling will depend on the Fed's key rate decision and Fed officials' comments on further steps. Some speculators are pricing in smaller rate hikes at the next meetings. However, is this scenario feasible?

Analysts expect the Fed to raise the interest rate by 0.75% next week and by less than 0.5% in December. If so, it will be in line with the Fed's September forecasts. Back then, it pointed out that interest rates could rise to 4.5% by the end of the year and to 4.75% at the beginning of next year.

Economists at Nomura noted that there are signs of a possible slowdown in monetary tightening. Stocks are still rising. However, it is not clear whether the Fed will make any dovish remarks next week.

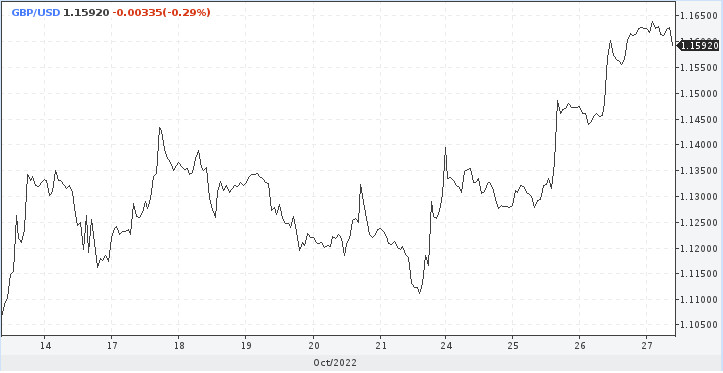

Now, the pound sterling is climbing, pushing the GBP/USD pair up amid external and internal political, factors. Thanks to the rally, the pound sterling returned to the mid-September range. The long-term outlook is quite foggy.

A test of 1.1600 does not indicate the prolongation of the rally. The GBP/USD pair is now in the middle of the range, offering traders a good opportunity to sell the pound sterling in anticipation of a downward correction.

The pound sterling is widely expected to end the year somewhere between 1.0800 and 1.1200.

The current rally of European currencies is unlikely to be a long-term one because of high interest rates. The BoE and the ECB are hiking rather far slower than the Fed does. This is why some traders locked in profits yesterday.

As for the euro, the ECB meeting is likely to have a big impact on its further trajectory.

The single European currency has finally regained momentum amid lower gas prices and positive trade surplus data. A rise of the EUR/USD pair above the parity level is extremely important. However, an even more positive signal will be the breakout of the bearish channel. The euro has been falling in this range since the beginning of the year.

There are plenty of positive fundamental factors for the euro. So, it is likely to climb higher. If the ECB raises the cash rate by 75 basis points, the euro may jump to new highs.

Today, we will see whether the pair will be able to start an upward momentum and touch the resistance level of 1.0200.