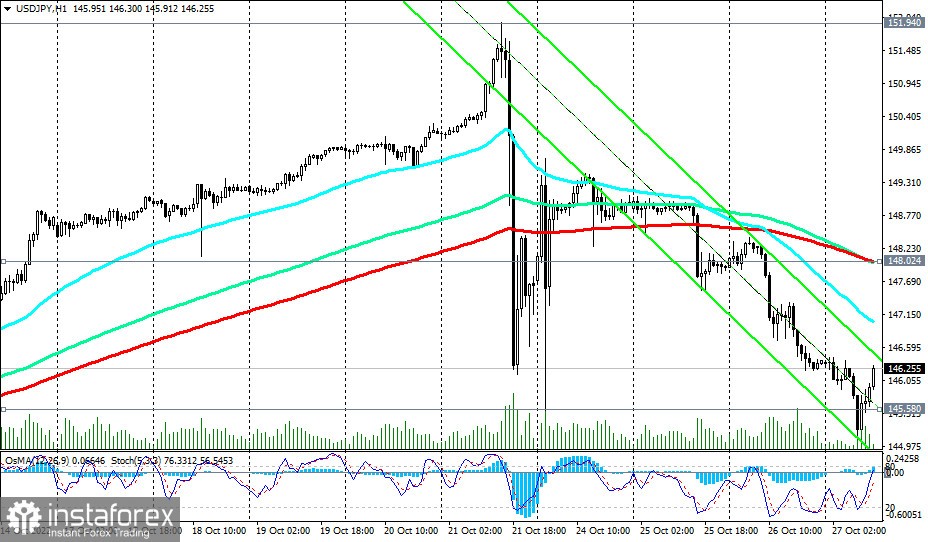

During today's Asian trading session, USD/JPY dropped to a 3-week low at 145.11. However, at the beginning of today's European trading session, the USD/JPY pair resumed growth, trying to move into positive intraday territory.

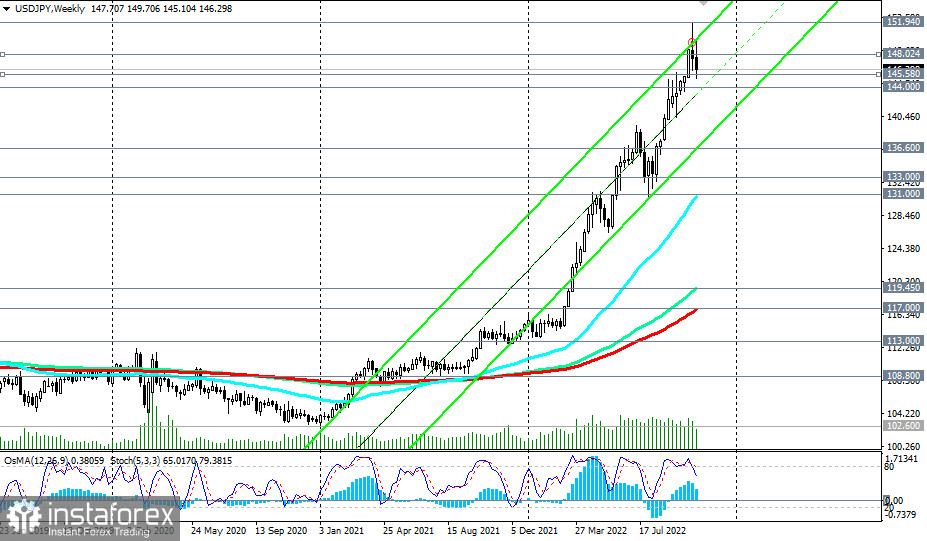

The USD/JPY pair remains positive. Strong bullish momentum based on fundamental factors is pushing it to new all-time highs.

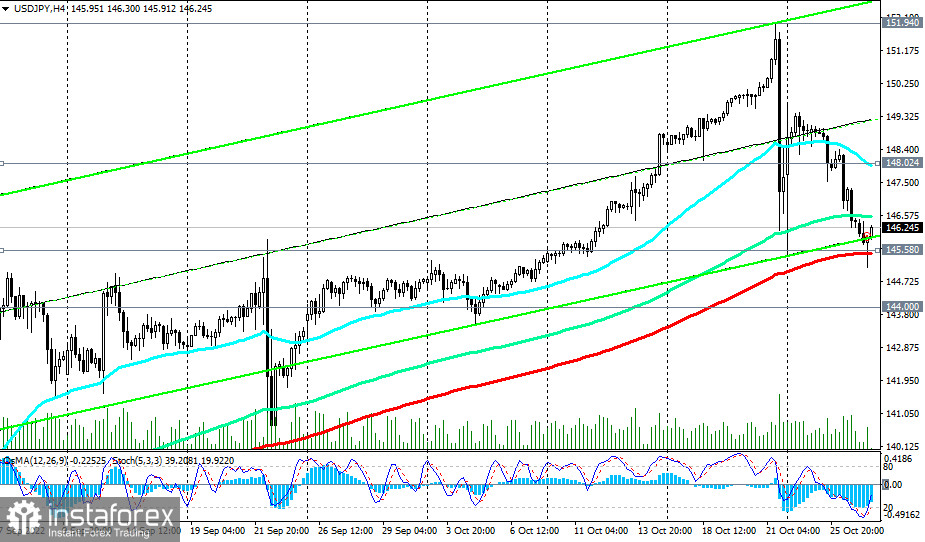

Two strong support levels at 145.58 (200 EMA on the 4-hour chart) and 144.00 (50 EMA on the daily chart) keep the pair from deeper corrective decline. Only their breakdown will strengthen the negative dynamics of the pair, sending it towards the key support levels 136.60 (144 EMA on the daily chart), 133.00 (200 EMA on the daily chart).

In the main scenario, we expect growth to resume. The first signal for the resumption of long positions will be a breakdown of the short-term resistance level 147.04 (200 EMA on the 15-minute chart). However, it is better to wait for a confirmation signal—a breakdown of the short-term resistance level 148.02 (200 EMA on the 1-hour chart).

As we noted in one of our previous reviews, the divergence in the monetary policy rates of the Fed and the Bank of Japan is likely to increase, creating prerequisites for further growth of USD/JPY.

Support levels: 145.58, 144.00, 140.00, 136.60, 133.00, 131.00

Resistance levels: 147.04, 148.02, 149.00, 150.00, 151.00, 152.00

Trading Tips

Buy Stop 147.35. Stop Loss 145.90. Take-Profit 148.02, 149.00, 150.00, 151.00, 152.00

Sell Stop 145.90. Stop Loss 147.35. Take-Profit 145.58, 144.00, 140.00, 136.60, 133.00, 131.00