The euro did not react much to the fact that the European Central Bank doubled its key interest rate to the highest level in more than a decade and made it clear that it had made progress in the fight against record inflation. All this was already embedded in the quotes of the European currency, as I have repeatedly warned in my reviews. The focus was shifted to the US GDP report for the 3rd quarter, to which the market reacted much more quickly, but we will talk about it a little later.

ECB officials in Frankfurt today announced a three-quarter point increase in the key interest rate in a row — as economists had expected — while saying they expect the cost of borrowing to continue to rise. This suggests that the committee members have abandoned the more aggressive tone that was discussed this week and that everyone was so afraid of.

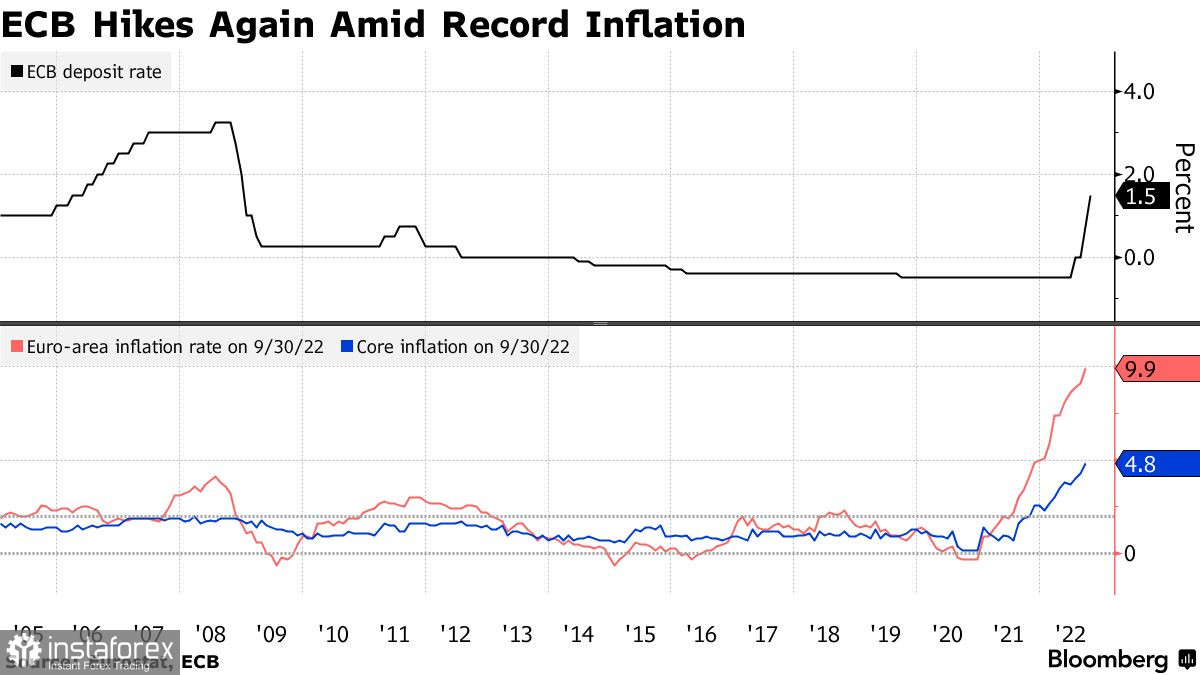

Referring to the significant progress in inflation, let me remind you that at the end of last month, it did not go beyond the level of 10.0%, the ECB decided that the fight against it was over, and decided to refrain from new hawkish statements. The ECB also raised the deposit rate, which was below zero in July this year, and now stands at 1.5%. However, according to ECB economists, inflation remains too high and will remain above the target level for a long time. The ECB has once again confirmed its commitment to regain control over prices, which have increased fivefold compared to the target of 2%.

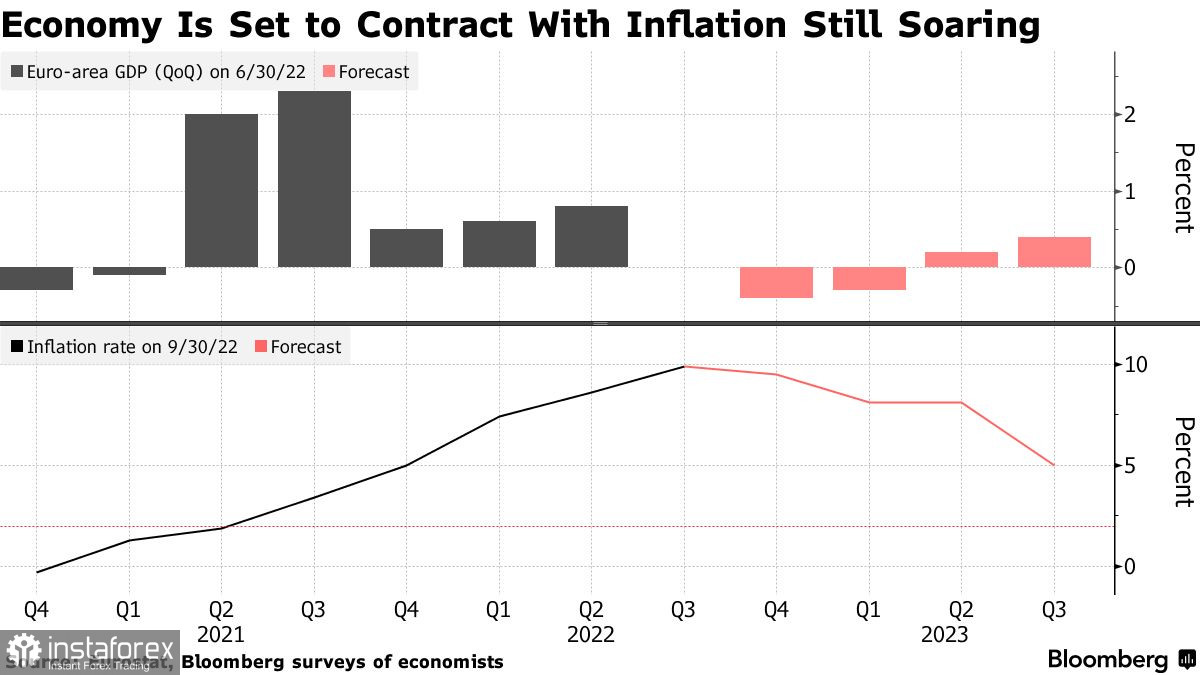

During a press conference, Christine Lagarde said: "Economic activity in the eurozone slowed significantly in the third quarter, as a result of which the probability of recession has increased significantly." Answering a question about changing the wording of the ECB's rate forecast, Lagarde said that the exact rate will be determined before each meeting separately.

It is worth noting that the actions taken on Thursday by the European Central Bank are in line with the recent pace of the Federal Reserve System, whose attack on inflation began earlier and led to a rise in the dollar against several risky assets.

As expected, officials also tightened the terms of "super-cheap" loans, known as TLTRO, worth more than 2 trillion euros. Changing the terms entails legal risks and may make banks wary of similar proposals in the future, which undermines their effectiveness.

Lagarde also raised the issue of the need to rid households of the impact of high borrowing costs, as they have to contend with rising heating and mortgage bills. The ECB President noted that the prospects for economic growth are clearly negative, and the higher cost of loans for consumers and businesses greatly affects the decline in confidence.

As for the statistics for the United States, the data showed that the US GDP growth was 2.6% year-on-year at the end of the third quarter, compared with the forecasts of economists who put on an increase of 2.3%. The first quarter of positive growth in 2022 eased investors' fears about the onset of a recession next year, which slightly cooled the ardor of buyers of risky assets. Although, if you look at the long term, if the US still manages to avoid slowing economic growth even against the backdrop of a record increase in interest rates, this will give an impetus to a more powerful movement of the euro and British pound.

As for the technical picture of EURUSD, the bears actively counterattacked, which led to a leveling of the situation. For further growth, it is necessary to return the pair above 1.0040, which will take the trading instrument to the area of 1.0090. However, the upward prospects will depend entirely on the further reaction of buyers of risky assets to recent news. A breakthrough of parity and the 1.1000 level will put pressure on the trading instrument and push the euro to a minimum of 0.9940, which will only worsen the situation of buyers of risky assets in the market. Having missed 0.9940, it will be possible to wait for the lows to update around 0.9890 and 0.9850.

As for the technical picture of GBPUSD, the pound remains within the side channel, as if ignoring everything that is happening around it. Now buyers will focus on protecting the support of 1.1560 and the breakdown of the resistance of 1.1640, limiting the upward potential of the pair. Only a breakthrough of 1.1640 will return the prospects for recovery to the area of 1.1690, after which it will be possible to talk about a sharper jerk of the pound up to the area of 1.1730 and 1.1780. It is possible to talk about the return of pressure on the trading instrument after the bears take control of 1.1560. This will deal a blow to the bulls' positions and completely negate the short-term prospects of the bull market. A breakout of 1.1560 will push GBPUSD back to 1.1490 and 1.1430.