So, the European Central Bank raised the refinancing rate by another 75 basis points, and confirmed its intention to raise it further. But despite this, the single currency has fallen below parity. And the thing is that the ECB has not given any guarantees that it will continue to raise rates at the same pace. According to ECB President Christine Lagarde, the central bank will make a decision on raising interest rates based on inflationary dynamics. That is, if inflation starts to slow down, then the growth rate of interest rates will be reduced. In fact, exactly the same thing was recently announced by the Federal Reserve, which led to the opinion that next year the level of interest rates in Europe may be higher than in the United States. Now this assumption is in question. And much will depend on the preliminary data on inflation in the euro area, which will be published next Monday. Until then, the market will consolidate in the parity area, remaining slightly below this level.

Refinancing rate (Europe):

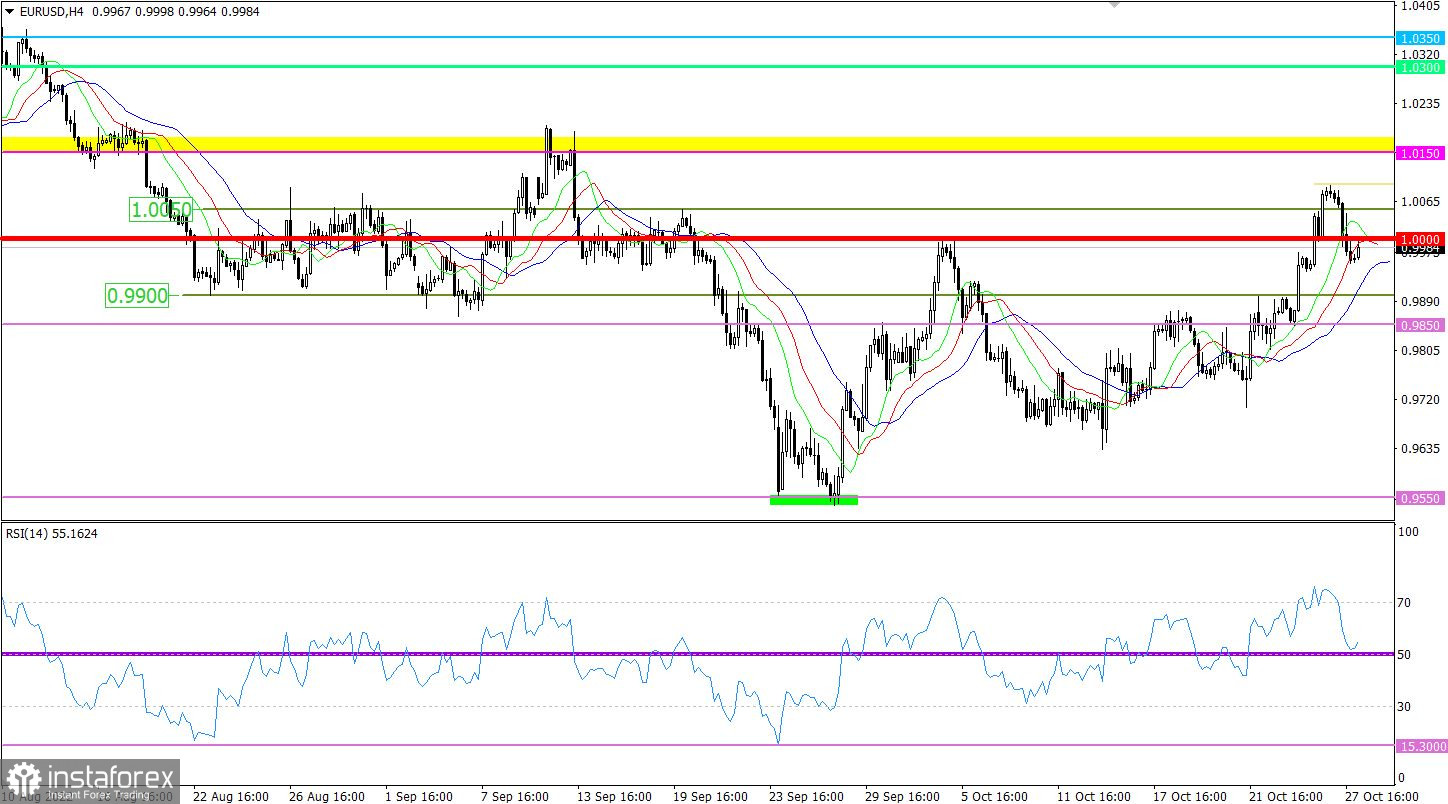

The EURUSD currency pair has moved into the stage of a pullback after an intense upward move. As a result, the quote returned to the limit of the parity level, focusing below it.

The RSI H4 technical instrument left the overbought zone at the time of the pullback, which may be a signal of a regrouping of trading forces. The RSI D1 is moving in the upper area of the 50/70 indicator, which indicates a fairly high interest of traders in the upward cycle.

The MA moving lines on the Alligator H4 are directed upwards, which corresponds to the price movement during the week. Alligator D1 has also moved into the ascent stage.

Expectations and prospects

In this situation, the upward cycle is still considered by traders as a possible prospect in the market. For the subsequent growth of the volume of long positions, it is necessary to observe a number of technical points. The first is to return the quote above the parity level and keep it there steadily for at least a four-hour period. The second is to overcome the value of 1.0100, which will indicate the continuing upward cycle in the market.

As for the downward scenario, it will be actively considered by traders if the price is kept below 0.9900 in a four-hour period.

A comprehensive indicator analysis in the short-term and intraday periods indicates a short position, meaning a pullback is formed in the market.