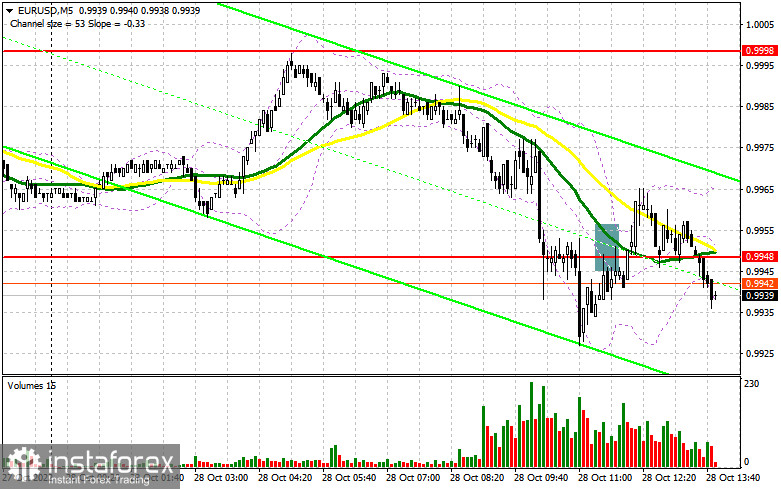

In my morning forecast, I paid attention to the 0.9948 level and recommended making decisions on entering the market there. Let's look at the 5-minute chart and figure out what happened there. The decline and breakdown of this range, with a reverse test from the bottom up – all this led to the entry point for the sale of the euro, but the pair went further down, which led to the fixation of losses. In the afternoon, the technical picture changed, as has the strategy itself.

To open long positions on EURUSD, you need:

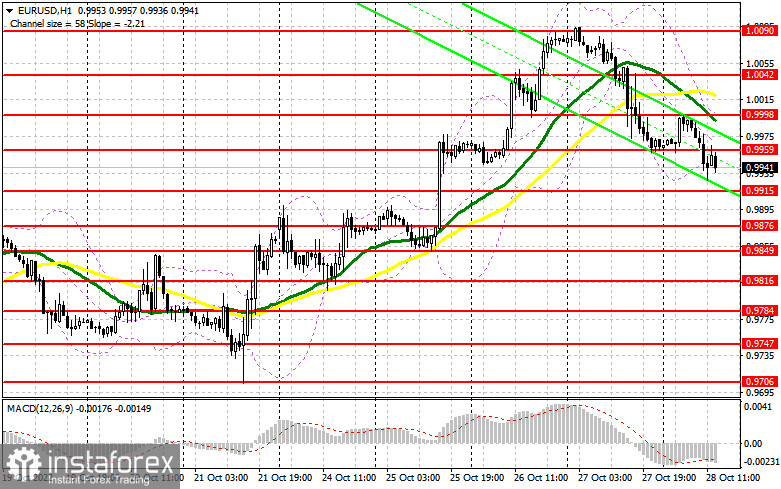

Data on the level of expenditures and incomes of the US population are scheduled for the US session, which may lead to another strengthening of the US dollar against the euro, putting an end to the entire upward trend observed this week. If Americans' spending increases, we can assume that the US economy will also maintain a good growth rate in the 4th quarter. The only thing that can overshadow the life of dollar buyers is data on changes in the volume of pending home sales transactions. A sharp reduction in the indicator will weaken the positions of euro sellers and lead to an upward correction of the pair in the afternoon. The consumer sentiment index from the University of Michigan is of no interest. At the moment, buyers should act after a decline in EUR/USD and the formation of a false breakdown in the area of the nearest support of 0.9915. This will give a signal to open long positions in the expectation of further development of the upward trend and a return to the resistance of 0.9959. A breakthrough and a top-down update of this range against the background of weak US statistics will allow you to get to the maximum, in the area of 1.0000, giving additional hope for a larger upward movement to 1.0042, just below which the moving averages are playing on the sellers' side. The farthest target will be the 1.0090 area, where I recommend fixing the profits. If EUR/USD declines during the US session and there are no buyers at 0.9915, the pressure on the pair will only increase, as the bulls will continue to take profits. In this case, only a false breakdown in the area of the next 0.9876 support will be a reason to buy the euro. I advise you to open long positions on EUR/USD immediately for a rebound only from the support of 0.9849, or even lower – around the minimum of 0.9816 with the aim of an upward correction of 30-35 points within a day.

To open short positions on EURUSD, you need:

Sellers are still in control of the market, but something tells me that after the release of American statistics, they will quickly lose it, and we will see an upward correction of the euro by the close of the week. As long as trading is below 0.9959, the pressure on the pair will remain, which may lead to a larger sell-off of the euro. A good option to sell will be a false breakdown in the area of this resistance of 0.9959, which will indicate the presence of large players in the market, counting on a fall in EUR/USD after the next increase in interest rates by the Federal Reserve next week. An unsuccessful consolidation at 0.9959 after several statistics will lead to the movement of the euro down to the area of 0.9915. A breakdown and consolidation below this range, as well as a reverse test from the bottom up, form an additional sell signal with the demolition of buyers' stop orders and a decline in the euro to 0.9876, where I recommend fixing the profits. We can expect to go beyond this level only after strong statistics on the United States. In the case of an upward movement of EUR/USD during the American session, as well as the absence of bears at 0.9959, it will be possible to see another breakthrough of the pair up to the parity area. In this case, I advise you to postpone sales until 1.0000. The formation of a false breakout there will become a new starting point for entering short positions. You can sell EUR/USD immediately on a rebound from the maximum of 1.0042, or even higher – from 1.0090 with the aim of a downward correction of 30-35 points.

Signals of indicators:

Moving Averages

Trading is below the 30 and 50-day moving averages, which indicates a further fall in the euro.

Note. The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the lower limit of the indicator around 0.9940 will act as support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

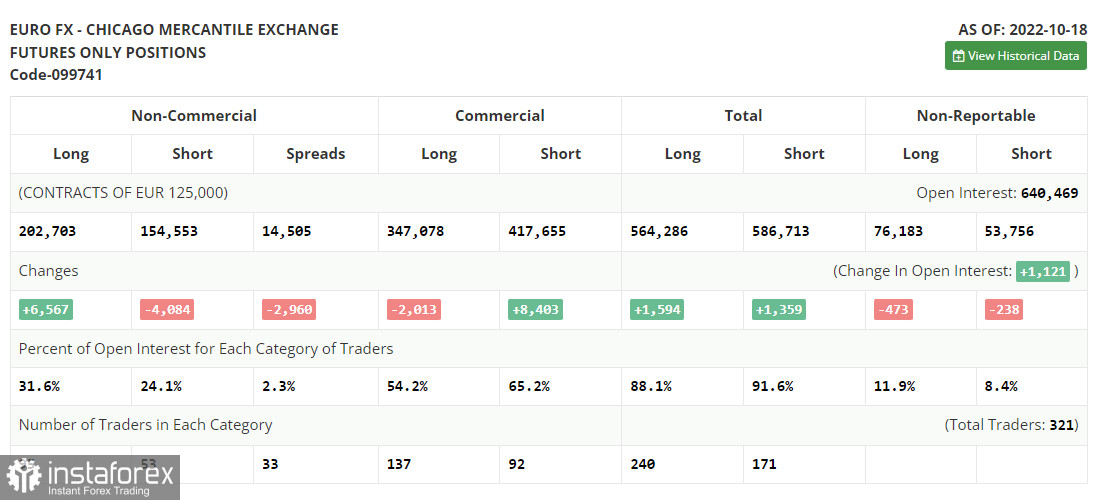

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.