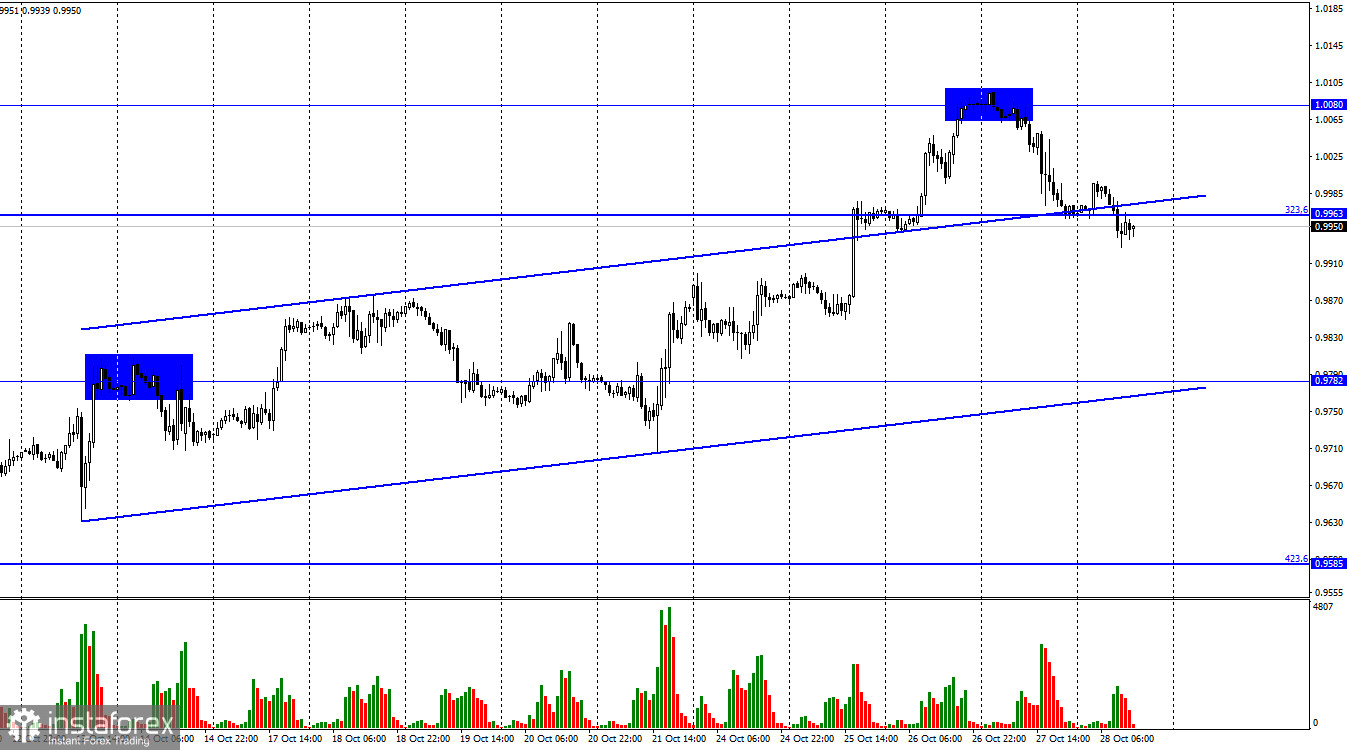

Hi, dear traders! On Thursday, EUR/USD reversed downwards after bouncing off 1,0080 and fell to the retracement level of 323.6% (0.9963). Early on Friday, the pair moved below 0.9963. From there, EUR/USD may slide down towards 0.9872.

Yesterday was a very important day for the European currency. The European Central Bank increased the interest rate by 0.75%, matching market expectations. However, traders started selling EUR instead, as they assumed that the EU currency has already advanced too much. Very likely they have already priced in a hawkish ECB decision, which led to Thursday's drop of EUR/USD. It remains to be seen if the euro can rally amid the new round of monetary tightening by the ECB.

Chart analysis suggests that the euro has some upside potential. We can see an ascending trend channel on the H1 chart. On the H4 chart, the pair closed above the descending channel. Currently, bullish traders predominate in the market. There are hardly any events on the economic calendar today. The Fed policy meeting next week will have an even greater impact on EUR/USD, as traders pay much more attention to the US regulator than to the European one. The Fed could also hike the rate by 0.75%, pushing the US dollar up. This rise may happen on any other day of the week, and not just the day of the meeting. For example, the euro began to rise two days before the ECB's meeting, and the same could happen to the US dollar next week. Within the next couple of days, the US dollar will likely rise, sending the pair downwards.

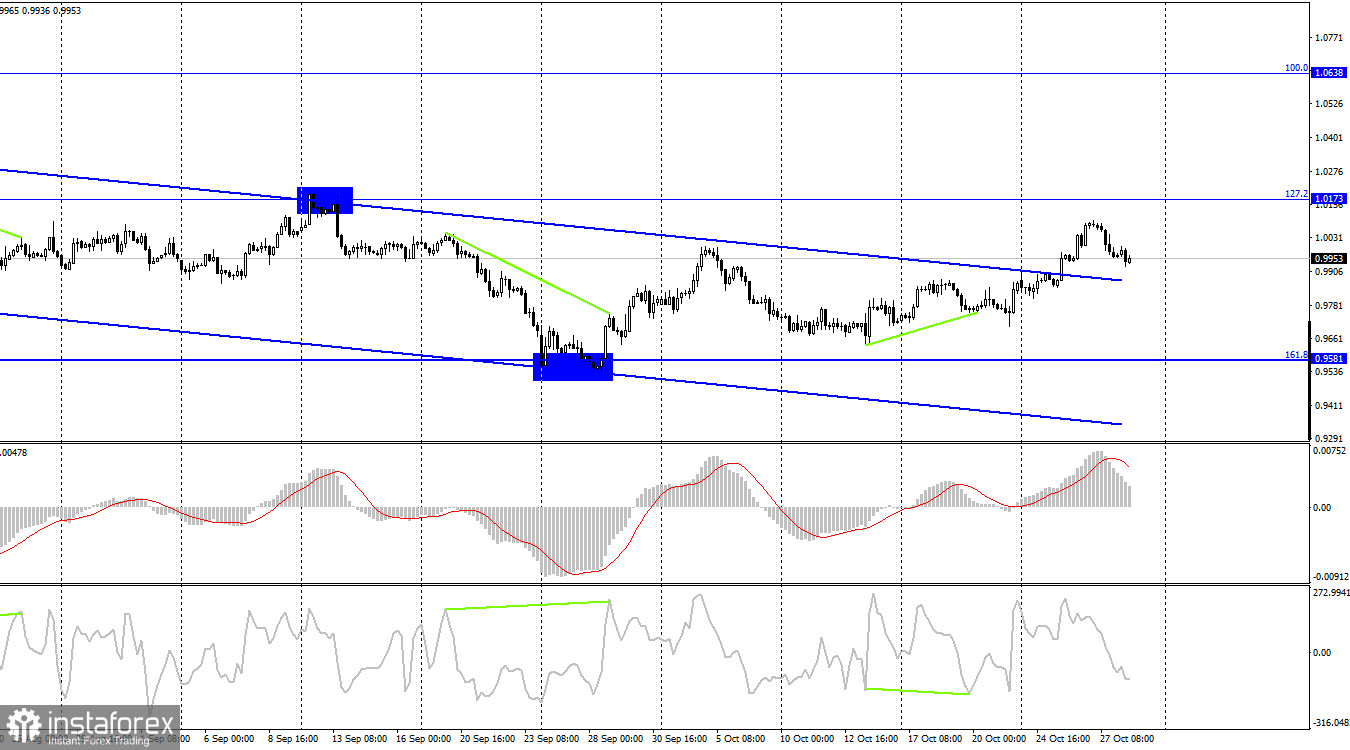

According to the H4 chart, the pair settled above the descending trend channel and could continue to rise towards the retracement level of 127.2% (1.0173). This is a key moment of both this week and this month – the overall trend on the chart is now bullish. At this point, EURs upward movement is not strong enough to put an end to the rising USD. The euro is likely to move up, but ongoing events could jeopardize its advance and return bears into the market.

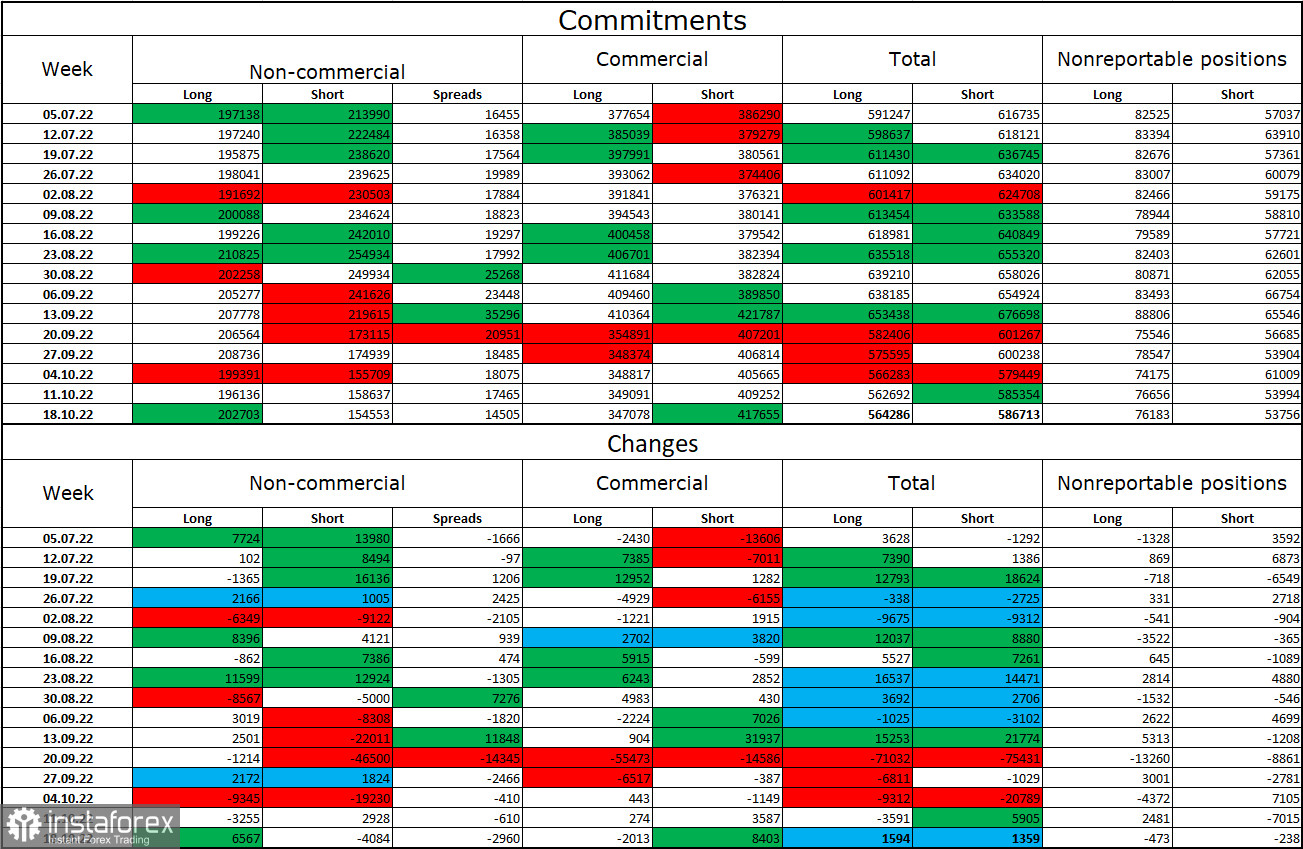

Commitments of Traders (COT) report:

Last week, traders opened 6,567 Long positions and closed 4,084 Short positions, indicating that major players are slightly more bullish than before. Overall, traders are bullish on the euro, unlike the pound sterling. Net long positions now stand at 202,000 against 154,000 net short positions. However, the euro still struggles to advance. Over the past several weeks, EUR's upward movement became more likely, but traders continue to favor USD over the European currency. At this point, the euro could likely fail to close above the key descending channel on the H4 chart. Therefore, a new decline could begin soon. Not even the bullish sentiment of traders can help the European currency increase.

US and EU economic calendar:

US - UoM Consumer Sentiment (14-00 UTC).

There are no important events on the economic calendar on October 28. The few data releases will not have a great effect on traders today.

Outlook for EUR/USD:

Earlier, traders were recommended to open short positions if the pair bounced off 1.0080 with 0.9963 and 0.9782 being targets. Long positions can be opened if the pair bounces off 0.9782 on the H1 chart targeting 0.9963 and 1.0080.