The coming week will be unusually rich in economic statistics and various events that will have a significant impact on the markets.

A number of important economic data will be released this week, where the values of production indicators both in Europe, China and the USA will play a significant role. The numbers of indexes of business activity in the manufacturing sectors will have to indicate what impact the processes of raising interest rates have on national economies, of course, here we mean the countries of the so-called West. The decline in indicators will demonstrate a steady trend towards recession in the Western countries with the expected result - continued increase in interest rates by central banks and, as a result, continued pressure on demand in the stock markets and the dollar.

Also, new data on consumer inflation in the euro area will be published today, which, as predicted, will again show its increase in annual terms from 9.9% to 10.2%. If the reports do not disappoint, then the growth of inflation in the euro area will again bring to life the topic of further continuation of the aggressive increase in European Central Bank interest rates, however, which we strongly doubt, since there are noticeable discrepancies between the words of the central bank's representatives and real actions. This allows us to believe that the euro is unlikely to receive significant support in the near future.

Monetary policy meetings of the Reserve Bank of Australia and the Bank of England will be held this week. Interest rates are expected to rise by 0.25% in Australia and by 0.75% in Britain, which, in our opinion, is unlikely to noticeably change the positioning of the Australian dollar and sterling against the US currency if the Federal Reserve, following the meeting on Tuesday, makes it clear that the growth rate rates at 0.75% can be maintained until the start of the new year. Only a softening of the US central bank's position regarding the prospective aggressive continuation of raising rates can significantly change the situation on the markets and lead to a global reversal in the stock markets and a weakening of the dollar.

And the icing on the cake will be the release on Wednesday and Friday of new data from the US labor market. If they show the preservation of a high rate of creation of new jobs, this may allow the Fed to continue actively raising rates, which will become a new basis for the dollar's growth.

What can we expect in the markets today?

We believe that trading in Europe, according to the dynamics of futures for stock indices, will start in the red, but a lot will depend on the positioning of American investors. If trading in the United States starts positive, this may put pressure on the dollar and support its local weakening, as the markets still hope that the Fed at the November meeting may consider reducing the rate growth rate in the near future.

Forecast of the day:

EURUSD

The pair is trading in a very tight range of 0.9925-0.9970. If the eurozone inflation report turns out to be lower than expected or in line with the forecast, the pair may break out of this range and fall to 0.9820, at the same time, if inflation shows more growth, this will cause an expectation of a continuation of the ECB's aggressive rate hike and may cause the pair to rise to 1.0080.

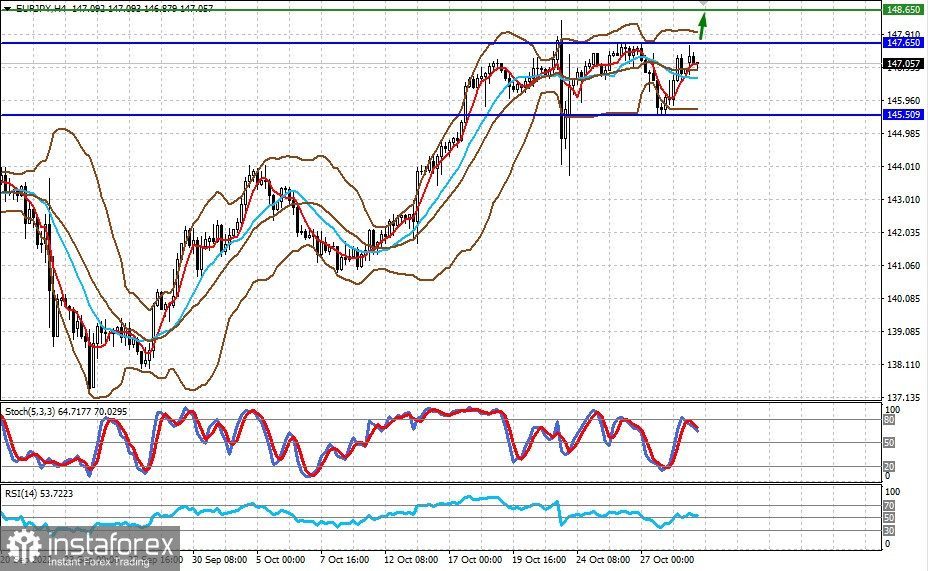

EURJPY

The pair is moving in the range of 14550-147.65. A strong increase in inflation in the euro area may trigger the likelihood of continued aggressive rate hikes by the ECB, which will support the euro against the yen. In this case, a rise above 147.65 could lead to a rise of the pair to 148.65.