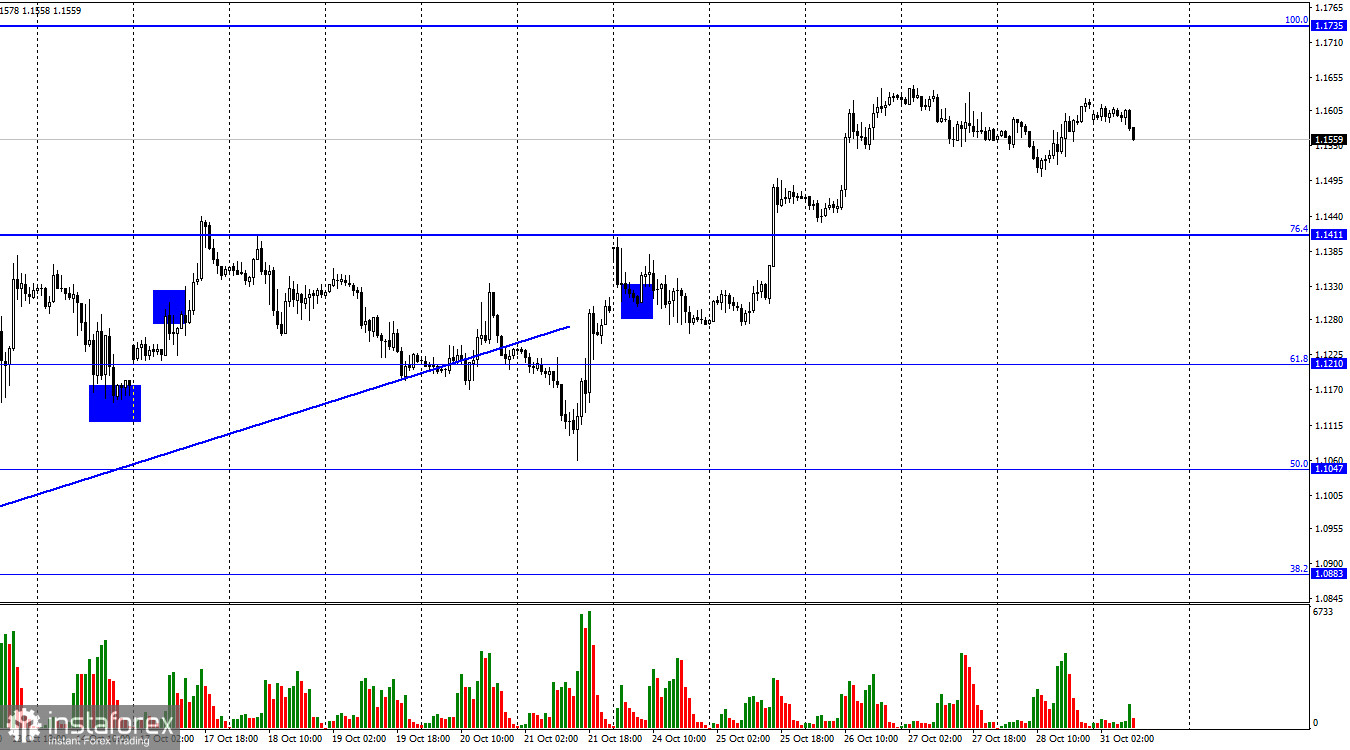

On the hourly chart, the GBP/USD pair was trading within the sideways channel on Friday. On Monday, it is attempting to make a new reversal in favor of the US dollar. The reversal may drag the price to the correctional level of 76.4% - 1.1411. The British pound is showing a very robust rally. While the European currency has been falling for two days in a row, the British currency is avoiding such a scenario.

The markets are expecting the BoE meeting this week. Judging by the trading seen in recent days, investors anticipate hawkish decisions from the British regulator. A 0.75% interest rate hike might already be priced in the pair's quotes. It resembles a situation when the European currency was showing gains in the last few days before the ECB meeting. If that is true, the British currency may decline in the coming days as well. Definitely, the Fed meeting, which could also see a 0.75% rate hike, is also hugely important. However, since the US dollar has not been rising recently, it could start to grow this week.

As noted above, we may see green figures during this week, supporting the greenback. However, if the Bank of England raises its rate not by 0.75% but by 1.00%, it is likely to strengthen GBP. Alternatively, if the Fed unexpectedly raises its rate by 0.50% instead of 0.75%. As we can see, different scenarios are possible. There are no fundamentals for the pound-dollar pair today, so the pair is likely to show calm trading today. Nevertheless, at the beginning of the day, GBP declined slightly. This may be a reaction to the central bank meetings.

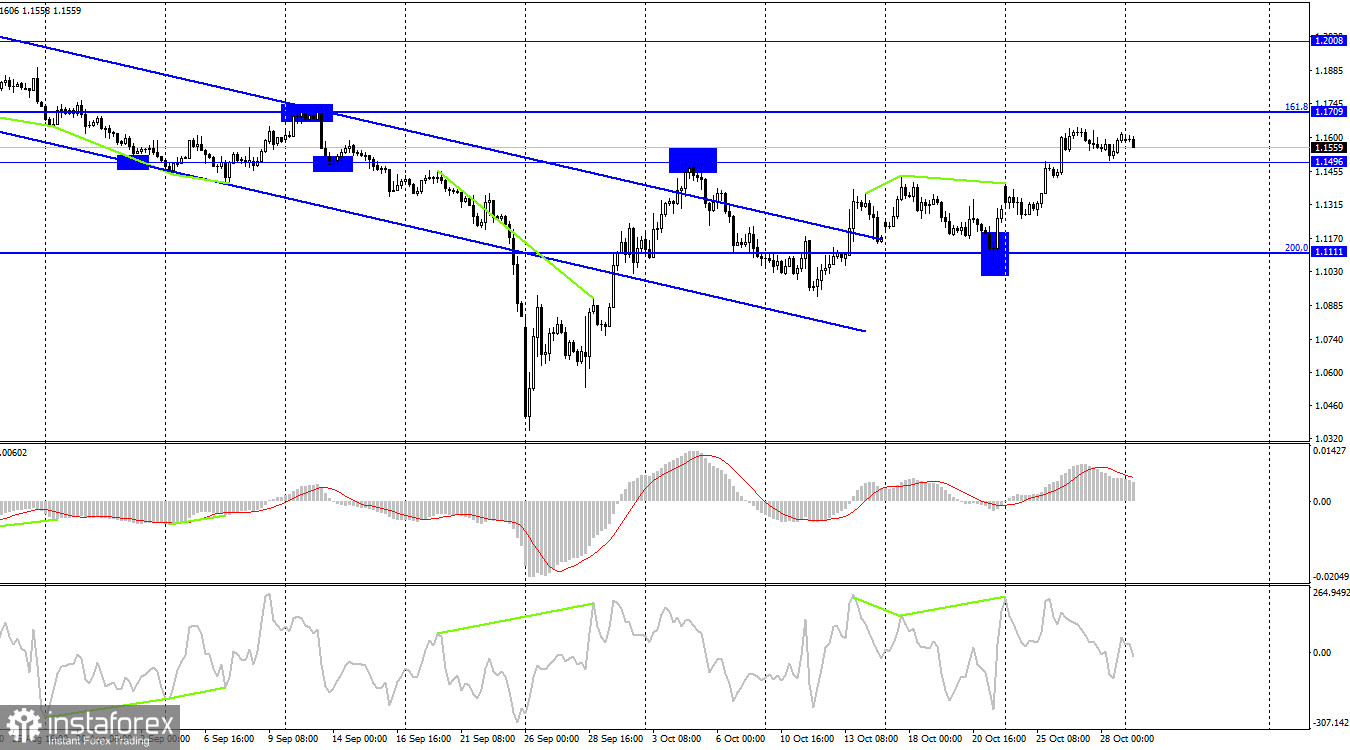

On the 4-hour chart, the pair has fixed above 1.1496. Thus, it may rise to the Fibo level of 161.8% - 1.1709. If the price rebounds from this level, it is likely to strengthen the US dollar and push the pair to the downside. If the pair fixes below 1.1496, it may provide support for the US currency and push the price towards the Fibo level of 200.0% - 1.1111. In addition, there are no emerging divergences today.

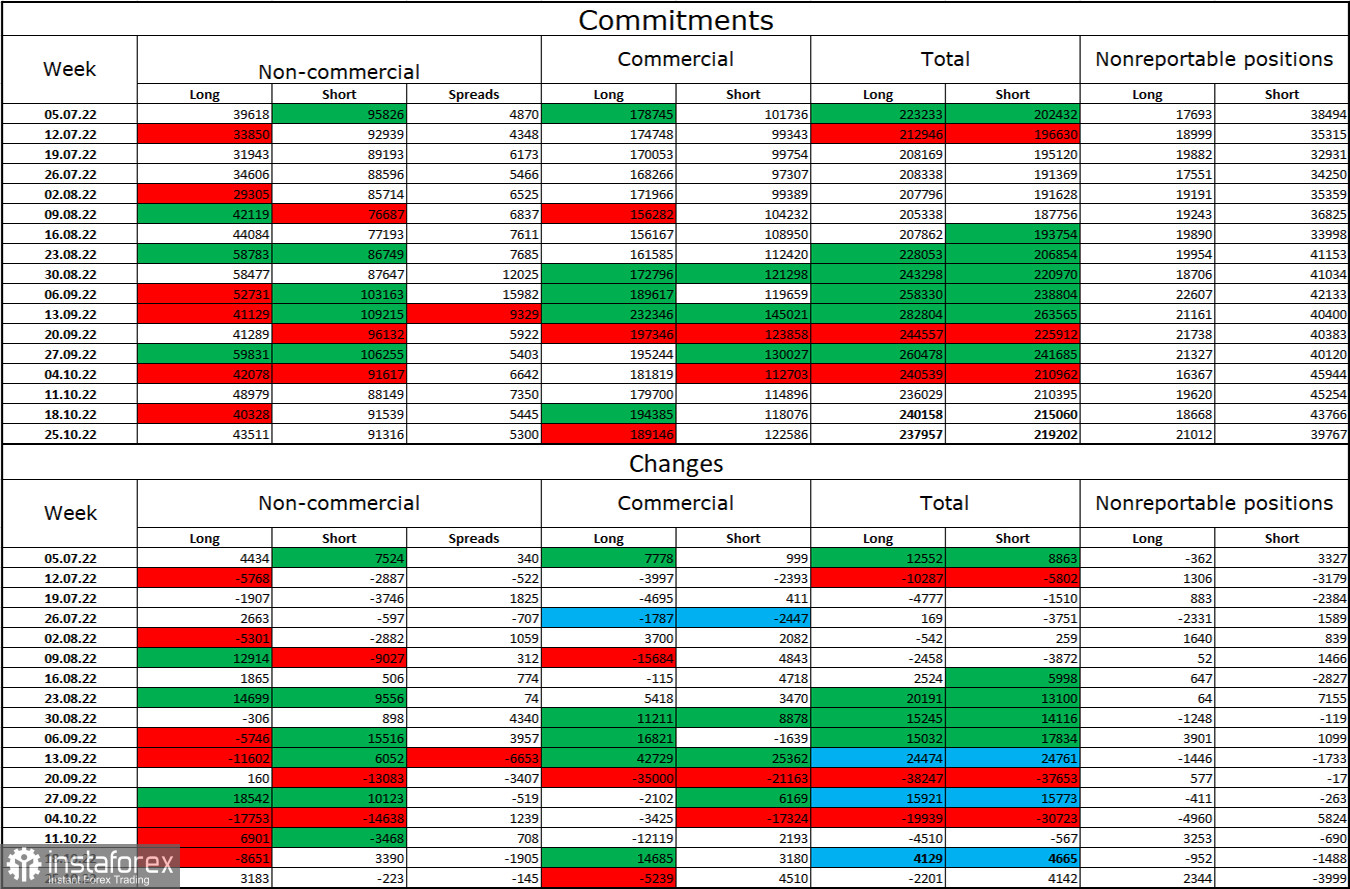

COT report:

The sentiment of non-commercial traders last week was slightly less bearish than the week before. The number of long contracts grew by 3,183, while the number of short contracts decreased by 223. However, the overall sentiment of big players remains bearish, and the number of short contracts is still higher than the number of long ones. Thus, big players continue to sell the British pound and their sentiment has been gradually changing in recent months. Notably, it will take some time to become bullish. The pound can continue to grow only if we see strong fundamental data. Recently, the markets have not received strong fundamentals. At the same time, speculators' sentiment has been bullish for a long time but the European currency is still unappealing to traders. As for the pound, even the COT reports do not give any grounds to buy it.

US and UK economic calendar:

On Monday, the UK and the US economic calendars have no important reports. Market sentiment is unlikely to change today.

GBP/USD forecast:

On the 4-hour chart, it is better to open short positions on the pound from a rebound near 1.1709 with the target at 1.1496. If the pair closes below 1.1496, the target will be located at 1.1111. One may also open longs with the target at 1.1709 if the price rebounds from 1.1496 on the 4-hour chart.