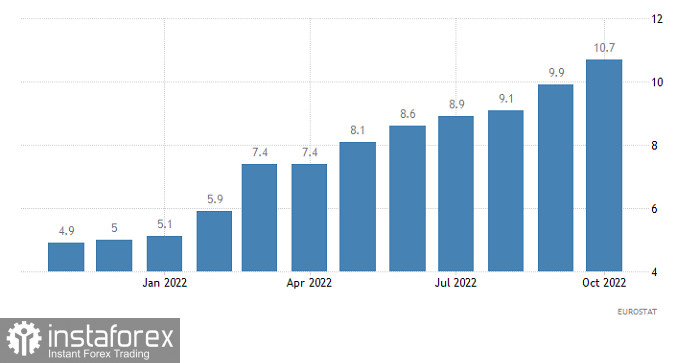

As investors were shocked to see the preliminary estimates of the eurozone inflation, the euro depreciated notably. There were no doubts that inflation would rise but no one expected to see such an increase. Even according to the most pessimistic forecasts, consumer prices were predicted to rise from 9.9% to 10.4%. Yet, the CPI data showed that the indicator accelerated to 10.7%. At first, the market froze. Closer to the start of the North American session, the euro began to decline at a slow pace. Logically, it should have advanced as higher inflation means a possible 100-basis-point rate hike by the ECB in December. It seems that the market has not digested this news yet.

Inflation (Europe):

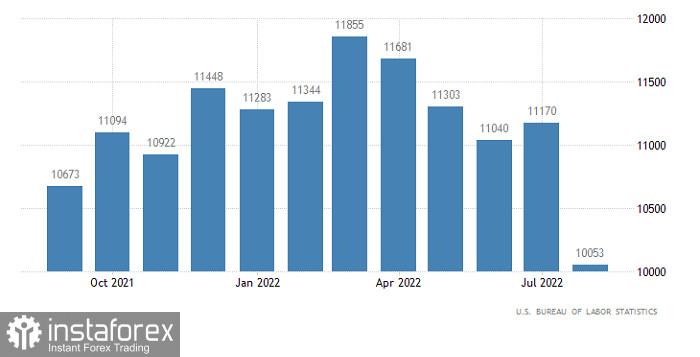

Today, the market may start to recover only closer to the New York session as the European trade will be slow. The fact is, some European countries, such as France and Italy, celebrate a public holiday today. Even some regions in Germany celebrate All Saints Day on November 1. Meanwhile, this day is a normal business day in the US. The only thing that can stop the recovery of the euro is the data on new job openings in the US. The number of new jobs is predicted to increase from 10,053K to 10,200K which will signal an improvement in the US labor market. Yet, this change is so minor that market participants may simply ignore it and focus on the previous data instead.

Job openings (United States):

EUR/USD dropped below 0.9900 against the US dollar after a rapid sell-off. This could be a short-term movement which is confirmed by the reversal of the price at the start of the session. If the upward dynamic remains in place, the pair may recover to the parity level.

GBP/USD followed the downward dynamic of the euro. As a result, the quote declined below the mark of 1.1500. However, buyers still keep their long positions on the pound. The pair has already recovered above the area of 1.1525. Traders will start to add more long positions as soon as the price settles firmly above 1.1650.